Question: Ordered two Ceiling Boom Wash Systems from Ultimate Washer; each includes a Ceiling Boom, Wand, and Accessories; wrote check number 10029 for $3,300. Equipment has

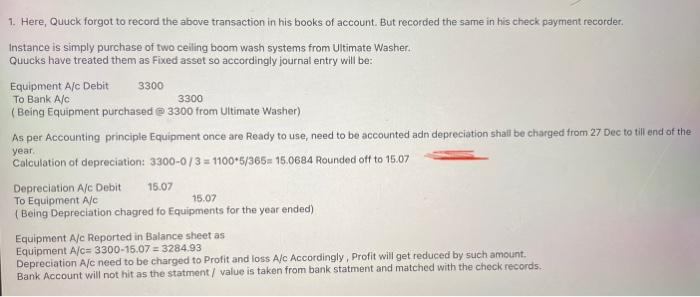

1. Here, Quuck forgot to record the above transaction in his books of account. But recorded the same in his check payment recorder. Instance is simply purchase of two ceiling boom wash systems from Ultimate Washer. Quucks have treated them as Fixed asset so accordingly journal entry will be: Equipment A/c Debit 3300 To Bank A/c 3300 (Being Equipment purchased ( 3300 from Uttimate Washer) As per Accounting principle Equipment once are Ready to use, need to be accounted adn depreciation shail be charged from 27 Dec to till end of the year. Calculation of depreciation: 33000/3=1100+5/365=15.0684 Rounded off to 15.07 Depreciation A/c Debit 15.07 To Equipment A/c 15.97 (Being Depreciation chagred fo Equipments for the year ended) Equipment A/c Reported in Balance sheet as Equipment A/C=330015,07=3284,93 Depreciation A/c need to be charged to Protit and loss A/c. Accordingly, Profit will get reduced by 5uch amount. Bank Account will not hit as the statment/ value is taken from bank statment and matched with the checkrecords

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts