Question: orect one code de eck my work mode : This shows what is correct or incorrect for the work you have completed so far. It

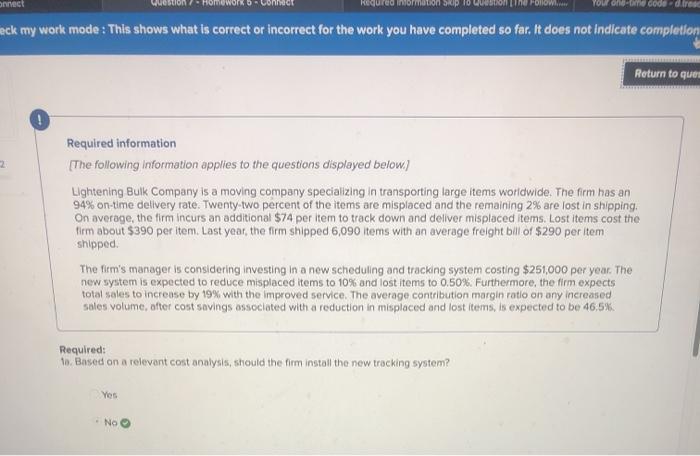

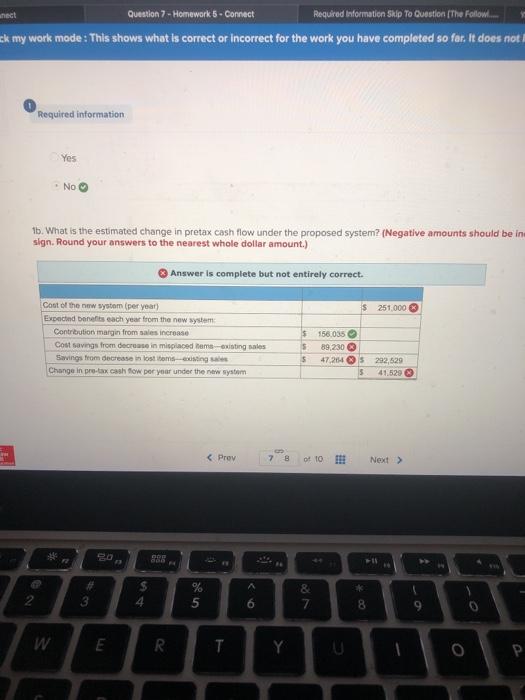

orect one code de eck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to ques 2 Required information The following Information applies to the questions displayed below) Lightening Bulk Company is a moving company specializing in transporting large items worldwide. The firm has an 94% on-time delivery rate. Twenty-two percent of the items are misplaced and the remaining 2% are lost in shipping. On average, the firm incurs an additional $74 per item to track down and deliver misplaced tems. Lost items cost the firm about $390 per item. Last year, the firm shipped 6,090 items with an average freight bill of $290 per Item shipped. The firm's manager is considering investing in a new scheduling and tracking system costing $251,000 per year. The new system is expected to reduce misplaced items to 10% and lost items to 0.50%. Furthermore, the firm expects total sales to increase by 19% with the improved service. The average contribution margin ratio on any increased sales volume, after cost savings associated with a reduction in misplaced and lost items, is expected to be 46,5%. Required: Io. Based on a relevant cost analysis, should the firm install the new tracking system? Yes - NO anect Question 7 - Homework 5 - Connect Required Information Skip To Question (The Follow... ck my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not Required information Yes No 16. What is the estimated change in pretax cash flow under the proposed system? (Negative amounts should be in sign. Round your answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. $ 251.000 Cost of the new system (per year) Expecond benefits each year from the new system Contribution margin from sales increase Cost savings from decrease in misplaced home-existing sales Savings from decrease in lost homsetinga Change in pre-tax cash flow per year under the new system $156,035 $ 89,230 $ 47.264 5 292,529 41.529 5 as 2 16 $ % 5 & 7 6 8 E R. T Y U orect one code de eck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to ques 2 Required information The following Information applies to the questions displayed below) Lightening Bulk Company is a moving company specializing in transporting large items worldwide. The firm has an 94% on-time delivery rate. Twenty-two percent of the items are misplaced and the remaining 2% are lost in shipping. On average, the firm incurs an additional $74 per item to track down and deliver misplaced tems. Lost items cost the firm about $390 per item. Last year, the firm shipped 6,090 items with an average freight bill of $290 per Item shipped. The firm's manager is considering investing in a new scheduling and tracking system costing $251,000 per year. The new system is expected to reduce misplaced items to 10% and lost items to 0.50%. Furthermore, the firm expects total sales to increase by 19% with the improved service. The average contribution margin ratio on any increased sales volume, after cost savings associated with a reduction in misplaced and lost items, is expected to be 46,5%. Required: Io. Based on a relevant cost analysis, should the firm install the new tracking system? Yes - NO anect Question 7 - Homework 5 - Connect Required Information Skip To Question (The Follow... ck my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not Required information Yes No 16. What is the estimated change in pretax cash flow under the proposed system? (Negative amounts should be in sign. Round your answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. $ 251.000 Cost of the new system (per year) Expecond benefits each year from the new system Contribution margin from sales increase Cost savings from decrease in misplaced home-existing sales Savings from decrease in lost homsetinga Change in pre-tax cash flow per year under the new system $156,035 $ 89,230 $ 47.264 5 292,529 41.529 5 as 2 16 $ % 5 & 7 6 8 E R. T Y U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts