Question: Organics Plus is considering which bad debt estimation method works best for its company. It is deciding between the income statement method, balance sheet

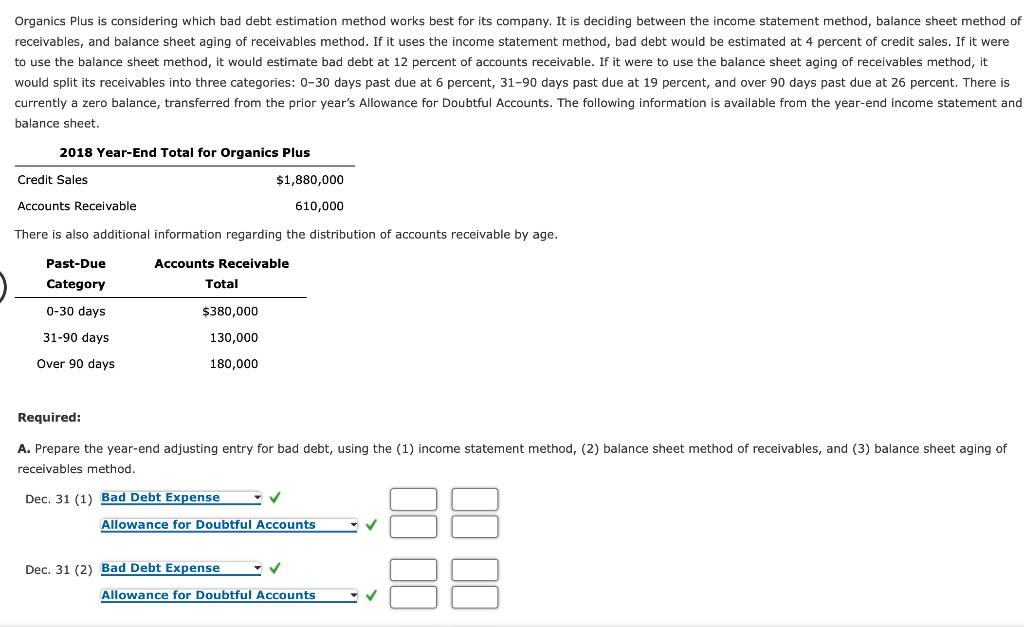

Organics Plus is considering which bad debt estimation method works best for its company. It is deciding between the income statement method, balance sheet method of receivables, and balance sheet aging of receivables method. If it uses the income statement method, bad debt would be estimated at 4 percent of credit sales. If it were to use the balance sheet method, it would estimate bad debt at 12 percent of accounts receivable. If it were to use the balance sheet aging of receivables method, it would split its receivables into three categories: 0-30 days past due at 6 percent, 31-90 days past due at 19 percent, and over 90 days past due at 26 percent. There is currently a zero balance, transferred from the prior year's Allowance for Doubtful Accounts. The following information is available from the year-end income statement and balance sheet. 2018 Year-End Total for Organics Plus Credit Sales Accounts Receivable There is also additional information regarding the distribution of accounts receivable by age. Accounts Receivable Past-Due Category 0-30 days 31-90 days Over 90 days Total $380,000 130,000 180,000 $1,880,000 610,000 Required: A. Prepare the year-end adjusting entry for bad debt, using the (1) income statement method, (2) balance sheet method of receivables, and (3) balance sheet aging of receivables method. Dec. 31 (1) Bad Debt Expense Allowance for Doubtful Accounts Dec. 31 (2) Bad Debt Expense Allowance for Doubtful Accounts 00 00 Organics Plus is considering which bad debt estimation method works best for its company. It is deciding between the income statement method, balance sheet method of receivables, and balance sheet aging of receivables method. If it uses the income statement method, bad debt would be estimated at 4 percent of credit sales. If it were to use the balance sheet method, it would estimate bad debt at 12 percent of accounts receivable. If it were to use the balance sheet aging of receivables method, it would split its receivables into three categories: 0-30 days past due at 6 percent, 31-90 days past due at 19 percent, and over 90 days past due at 26 percent. There is currently a zero balance, transferred from the prior year's Allowance for Doubtful Accounts. The following information is available from the year-end income statement and balance sheet. 2018 Year-End Total for Organics Plus Credit Sales Accounts Receivable There is also additional information regarding the distribution of accounts receivable by age. Accounts Receivable Past-Due Category 0-30 days 31-90 days Over 90 days Total $380,000 130,000 180,000 $1,880,000 610,000 Required: A. Prepare the year-end adjusting entry for bad debt, using the (1) income statement method, (2) balance sheet method of receivables, and (3) balance sheet aging of receivables method. Dec. 31 (1) Bad Debt Expense Allowance for Doubtful Accounts Dec. 31 (2) Bad Debt Expense Allowance for Doubtful Accounts 00 00

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Date Account Titles Debit Credit a Dec ... View full answer

Get step-by-step solutions from verified subject matter experts