Question: = Original Machine Sinitial cost = 256068 SAnnual depreciation = 33565 SPurchased 5 years ago SBook Value = 126733 $Salvage today = 148853 $Salvage in

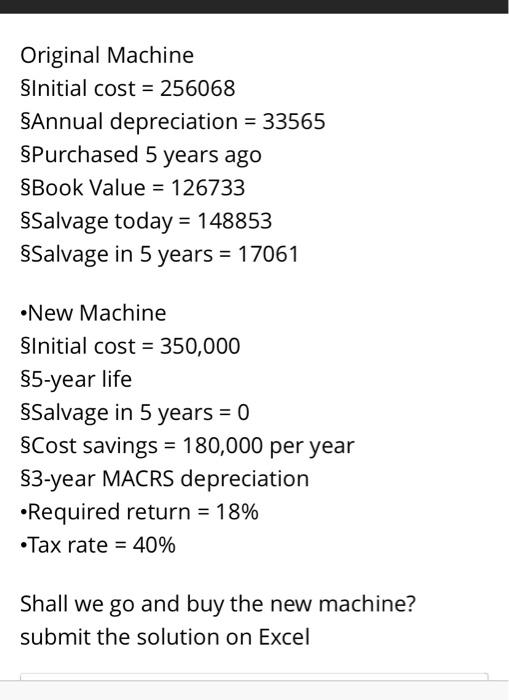

= Original Machine Sinitial cost = 256068 SAnnual depreciation = 33565 SPurchased 5 years ago SBook Value = 126733 $Salvage today = 148853 $Salvage in 5 years = 17061 New Machine Sinitial cost = 350,000 $5-year life $Salvage in 5 years = 0 Cost savings = 180,000 per year $3-year MACRS depreciation Required return = 18% Tax rate = 40% Shall we go and buy the new machine? submit the solution on Excel = Original Machine Sinitial cost = 256068 SAnnual depreciation = 33565 SPurchased 5 years ago SBook Value = 126733 $Salvage today = 148853 $Salvage in 5 years = 17061 New Machine Sinitial cost = 350,000 $5-year life $Salvage in 5 years = 0 Cost savings = 180,000 per year $3-year MACRS depreciation Required return = 18% Tax rate = 40% Shall we go and buy the new machine? submit the solution on Excel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts