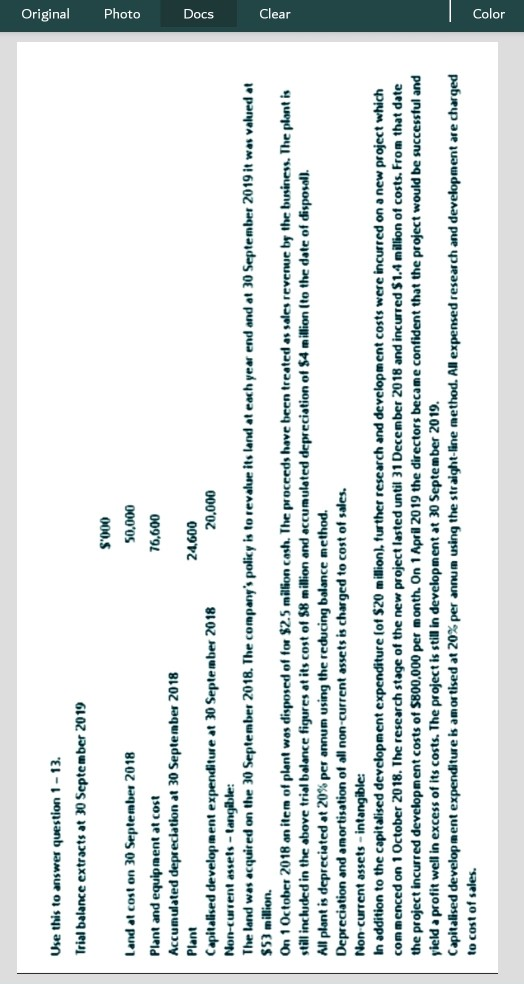

Question: Original Use this to answer question 1 - 13. Trial balance extracts at 30 September 2019 S'000 Photo Docs Clear Land at cost on 30

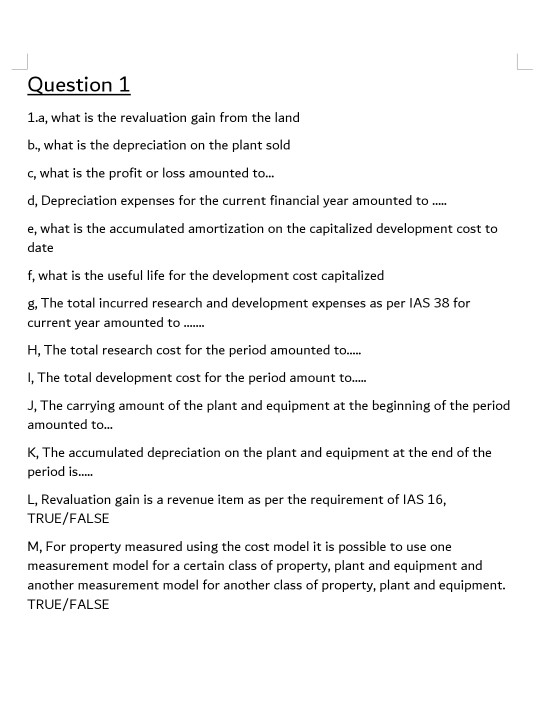

Original Use this to answer question 1 - 13. Trial balance extracts at 30 September 2019 S'000 Photo Docs Clear Land at cost on 30 September 2018 50,000 Plant and equipment at cost 76,600 Accumulated depreciation at 30 September 2018 Plant 24.600 Capitalised development expenditure at 30 September 2018 20,000 Non-current assels - langible: The land was acquired on the 30 September 2018. The company's policy is to revalue its land at each year end and at 30 September 2019 it was valued at $53 million. On 1 October 2018 on item of plant was disposed of for $2.5 million cash. The proceeds have been treated as sales revenue by the business. The plant is still included in the above trial balance figures at its cost of $8 million and accumulated depreciation of $4 million to the date of disposal). All plant is depreciated at 20% per annum using the reducing balance method. Depreciation and amortisation of all non-current assets is charged to cost of sales. Non-current assets - intangible: In addition to the capitalised development expenditure (of $20 million), further research and development costs were incurred on a new project which commenced on 1 October 2018. The research stage of the new project lasted until 31 December 2018 and incurred $1.4 million of costs. From that date the project incurred development costs of $800,000 per month. On 1 April 2019 the directors became confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 30 September 2019. Capitalised development expenditure is amortised at 20% per annum using the straight-line method. All expensed research and development are charged to cost of sales. Color 8. Question 1 1.a, what is the revaluation gain from the land b., what is the depreciation on the plant sold c, what is the profit or loss amounted to... d, Depreciation expenses for the current financial year amounted to ..... e, what is the accumulated amortization on the capitalized development cost to date f, what is the useful life for the development cost capitalized The total incurred research and development expenses as per IAS 38 for current year amounted to ..... H, The total research cost for the period amounted to... I, The total development cost for the period amount to..... J, The carrying amount of the plant and equipment at the beginning of the period amounted to... K. The accumulated depreciation on the plant and equipment at the end of the period is.... L, Revaluation gain is a revenue item as per the requirement of IAS 16, TRUE/FALSE M, For property measured using the cost model it is possible to use one measurement model for a certain class of property, plant and equipment and another measurement model for another class of property, plant and equipment. TRUE/FALSE Original Use this to answer question 1 - 13. Trial balance extracts at 30 September 2019 S'000 Photo Docs Clear Land at cost on 30 September 2018 50,000 Plant and equipment at cost 76,600 Accumulated depreciation at 30 September 2018 Plant 24.600 Capitalised development expenditure at 30 September 2018 20,000 Non-current assels - langible: The land was acquired on the 30 September 2018. The company's policy is to revalue its land at each year end and at 30 September 2019 it was valued at $53 million. On 1 October 2018 on item of plant was disposed of for $2.5 million cash. The proceeds have been treated as sales revenue by the business. The plant is still included in the above trial balance figures at its cost of $8 million and accumulated depreciation of $4 million to the date of disposal). All plant is depreciated at 20% per annum using the reducing balance method. Depreciation and amortisation of all non-current assets is charged to cost of sales. Non-current assets - intangible: In addition to the capitalised development expenditure (of $20 million), further research and development costs were incurred on a new project which commenced on 1 October 2018. The research stage of the new project lasted until 31 December 2018 and incurred $1.4 million of costs. From that date the project incurred development costs of $800,000 per month. On 1 April 2019 the directors became confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 30 September 2019. Capitalised development expenditure is amortised at 20% per annum using the straight-line method. All expensed research and development are charged to cost of sales. Color 8. Question 1 1.a, what is the revaluation gain from the land b., what is the depreciation on the plant sold c, what is the profit or loss amounted to... d, Depreciation expenses for the current financial year amounted to ..... e, what is the accumulated amortization on the capitalized development cost to date f, what is the useful life for the development cost capitalized The total incurred research and development expenses as per IAS 38 for current year amounted to ..... H, The total research cost for the period amounted to... I, The total development cost for the period amount to..... J, The carrying amount of the plant and equipment at the beginning of the period amounted to... K. The accumulated depreciation on the plant and equipment at the end of the period is.... L, Revaluation gain is a revenue item as per the requirement of IAS 16, TRUE/FALSE M, For property measured using the cost model it is possible to use one measurement model for a certain class of property, plant and equipment and another measurement model for another class of property, plant and equipment. TRUE/FALSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts