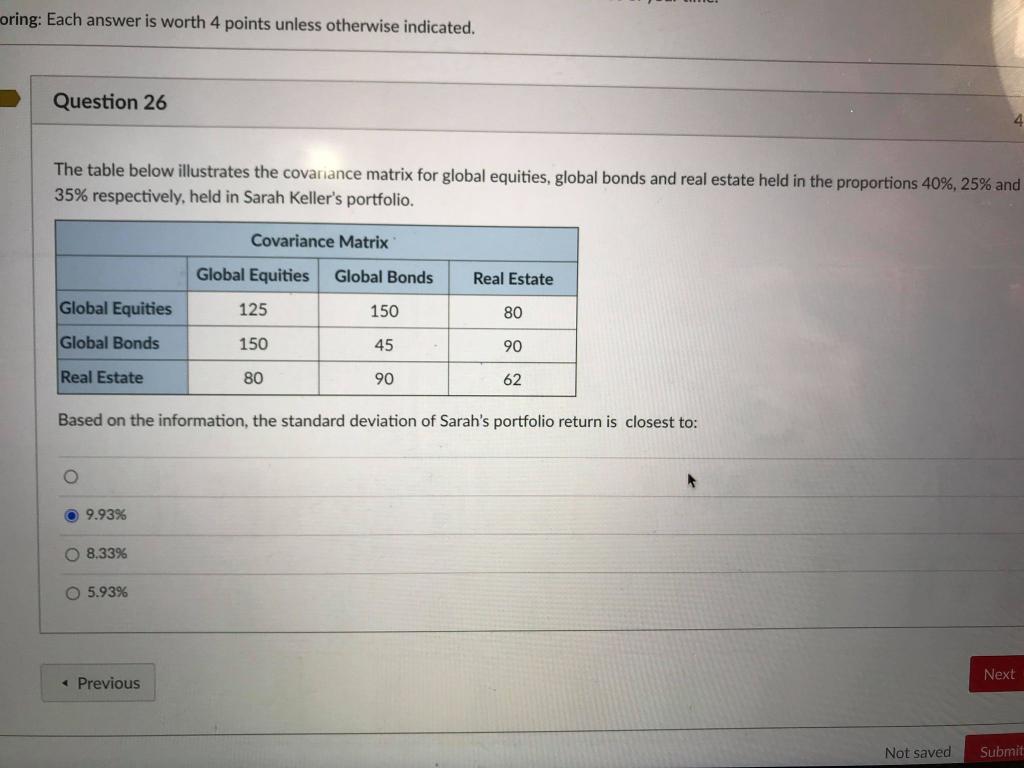

Question: oring: Each answer is worth 4 points unless otherwise indicated. Question 26 4 The table below illustrates the covariance matrix for global equities, global bonds

oring: Each answer is worth 4 points unless otherwise indicated. Question 26 4 The table below illustrates the covariance matrix for global equities, global bonds and real estate held in the proportions 40%, 25% and 35% respectively, held in Sarah Keller's portfolio. Covariance Matrix Global Equities Global Bonds Real Estate Global Equities 125 150 80 Global Bonds 150 45 90 Real Estate 80 90 62 Based on the information, the standard deviation of Sarah's portfolio return is closest to: 9.93% O 8.33% 5.93% Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts