Question: Oriole Corporation just purchased computing equipment for ( $ 1 9 , 0 0 0 ) . The equipment will be depreciated

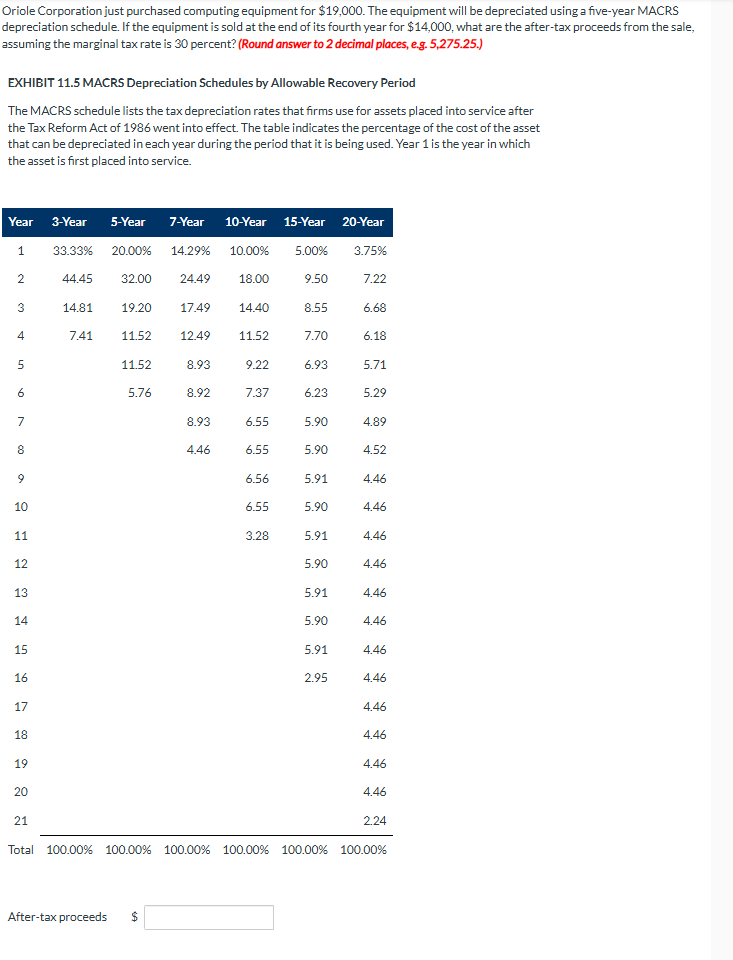

Oriole Corporation just purchased computing equipment for $ The equipment will be depreciated using a fiveyear MACRS depreciation schedule. If the equipment is sold at the end of its fourth year for $ what are the aftertax proceeds from the sale, assuming the marginal tax rate is percent? Round answer to decimal places, eg EXHIBIT MACRS Depreciation Schedules by Allowable Recovery Period The MACRS schedule lists the tax depreciation rates that firms use for assets placed into service after the Tax Reform Act of went into effect. The table indicates the percentage of the cost of the asset that can be depreciated in each year during the period that it is being used. Year is the year in which the asset is first placed into service. Aftertax proceeds $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock