Question: Oriole Limited established a share appreciation rights (SARs) program that entitled its new president, Angela Murfitt, to receive cash for the difference between the Oriole

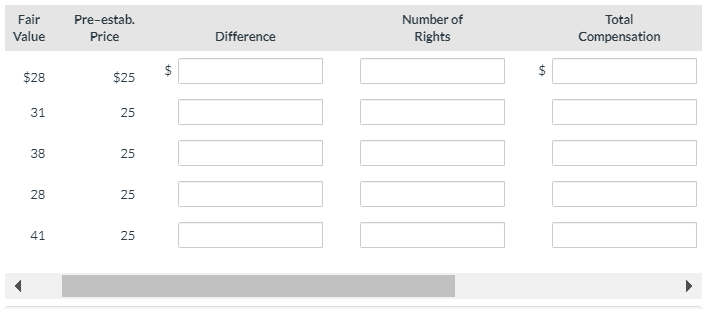

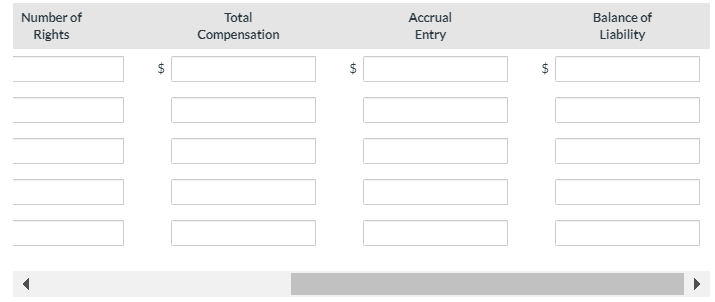

Oriole Limited established a share appreciation rights (SARs) program that entitled its new president, Angela Murfitt, to receive cash for the difference between the Oriole Limited common shares fair value and a pre-established price of $25 (also fair value on December 31, 2019), on 68,100 SARs. The date of grant is December 31, 2019, and the required employment (service) period is four years. The common shares fair value fluctuated as follows: December 31, 2020, $28; December 31, 2021, $31; December 31, 2022, $38; December 31, 2023, $28; and December 31, 2024, $41. Oriole Limited recognizes the SARs in its financial statements. Angela Murfitt exercised half of the SARs on June 1, 2025, when the share price was $39. Assume that Oriole follows ASPE. Prepare a five-year (2020 to 2024) schedule of compensation expense pertaining to the 68,100 SARs granted to Murfitt. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Follow this format please

Follow this format please

Fair Value Pre-estab. Price Number of Rights Total Compensation Difference $ $ $28 $25 31 25 38 25 28 25 41 25 Number of Rights Total Compensation Accrual Entry Balance of Liability $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts