Question: ork mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to

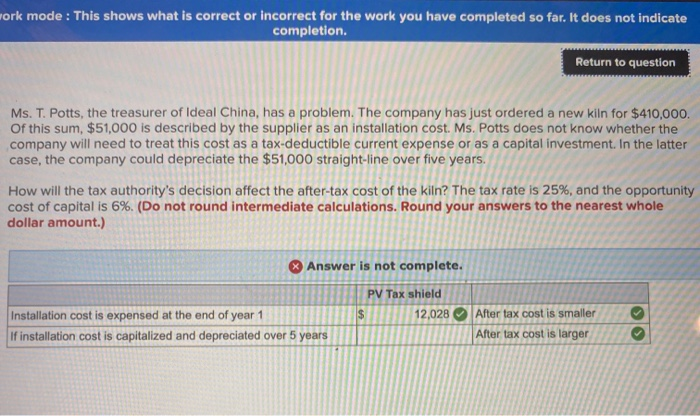

ork mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln for $410,000. of this sum, $51,000 is described by the supplier as an installation cost. Ms. Potts does not know whether the company will need to treat this cost as a tax-deductible current expense or as a capital investment. In the latter case, the company could depreciate the $51,000 straight-line over five years. How will the tax authority's decision affect the after-tax cost of the kiln? The tax rate is 25%, and the opportunity cost of capital is 6%. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) line over they Answer is not complete. PV Tax shield $ 12,028 Installation cost is expensed at the end of year 1 if installation cost is capitalized and depreciated over 5 years After tax cost is smaller After tax cost is larger

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts