Question: orkdaycdn.com / scorm / static / f / hYMr / c / C 3 7 4 E 4 3 7 7 A 4 0 DF

orkdaycdn.comscormstaticfhYMrcCEADFhzfAtjBabTkYJmnOAsOuAHBmSWeextractedindexIms.html

Assessment

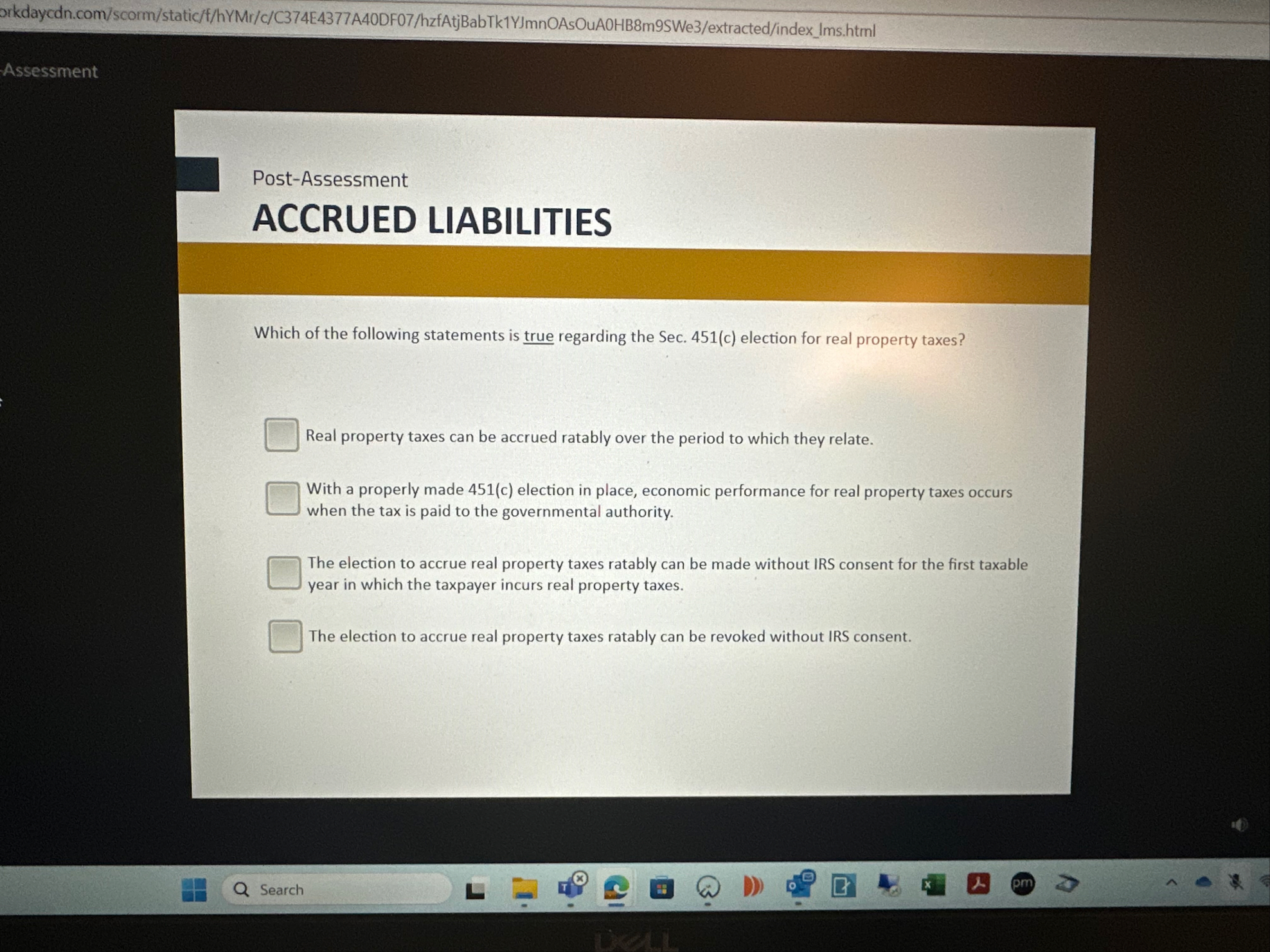

PostAssessment ACCRUED LIABILITIES

Which of the following statements is true regarding the Sec. c election for real property taxes?

Real property taxes can be accrued ratably over the period to which they relate.

With a properly made c election in place, economic performance for real property taxes occurs when the tax is paid to the governmental authority.

The election to accrue real property taxes ratably can be made without IRS consent for the first taxable year in which the taxpayer incurs real property taxes.

The election to accrue real property taxes ratably can be revoked without IRS consent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock