Question: orrect Question 1 0 0 1 pts A fund manager has a portfolio worth $ 5 0 million with a beta of 0 . 8

orrect

Question

pts

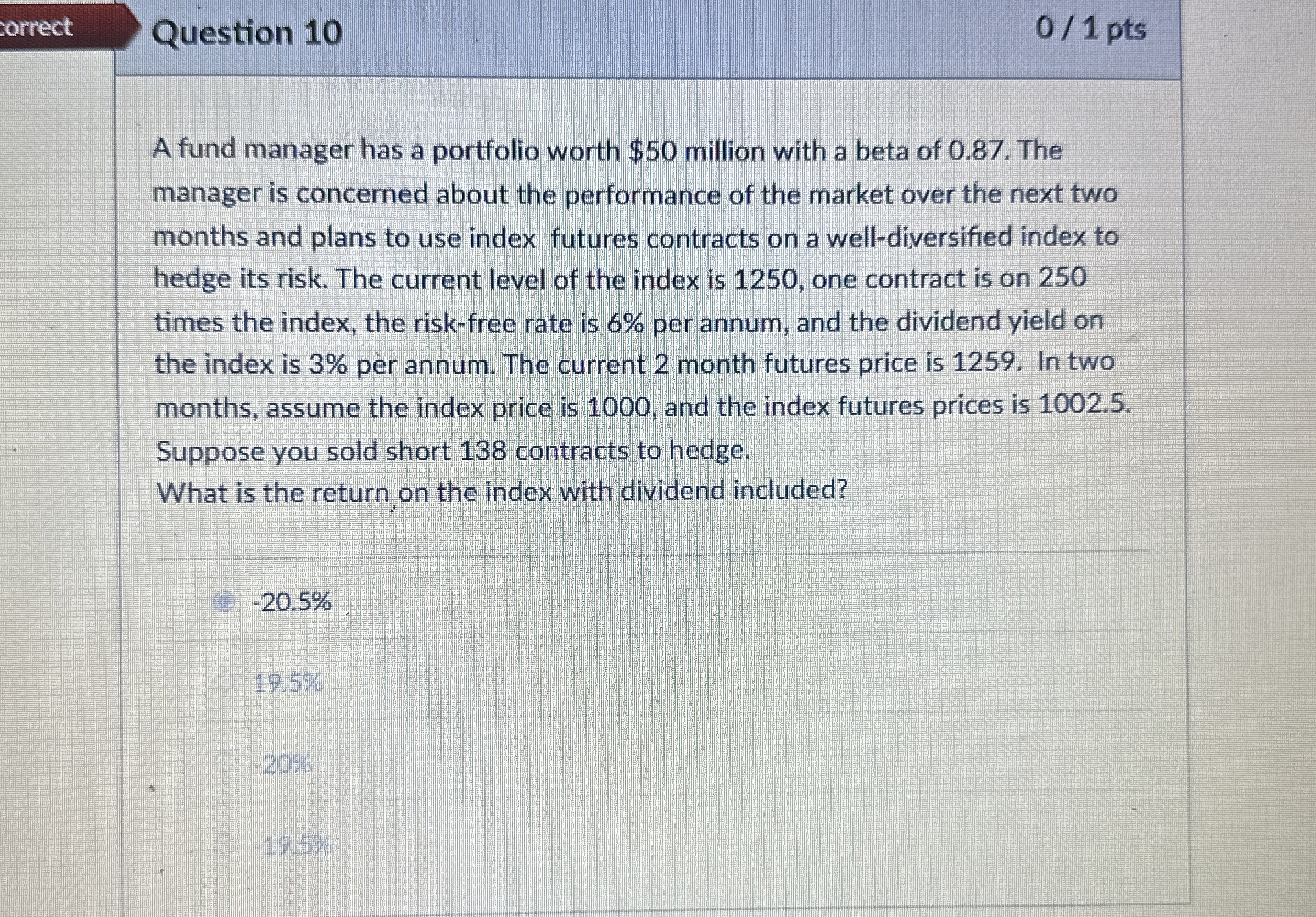

A fund manager has a portfolio worth $ million with a beta of The manager is concerned about the performance of the market over the next two months and plans to use index futures contracts on a welldiversified index to hedge its risk. The current level of the index is one contract is on times the index, the riskfree rate is per annum, and the dividend yield on the index is per annum. The current month futures price is In two months, assume the index price is and the index futures prices is Suppose you sold short contracts to hedge.

What is the return on the index with dividend included?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock