Question: oruary 22 Assignment Saved Help Save & Exit Subm Check my work mode: This shows what is correct or incorrect for the work you have

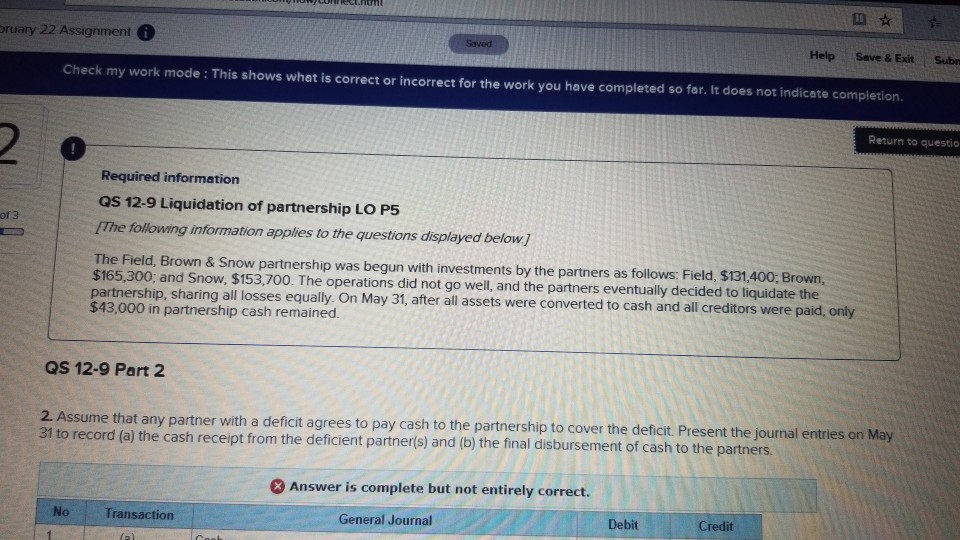

oruary 22 Assignment Saved Help Save & Exit Subm Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to questio 2 Required information QS 12-9 Liquidation of partnership LO P5 of 3 [The following information applies to the questions displayed below] The Field, Brown & Snow partnership $165,300; and Snow, $153,700. The operations did not go well, and the partners eventually decided to liquidate the partnership, sharing all losses equally. On May 31, after all assets were converted to cash and all creditors were paid, only $43,000 in partnership cash remained. begun with investments by the partners as follows: Field, $131,400; Brown, was QS 12-9 Part 2 2 Assume that any partner with a deficit agrees to pay cash to the partnership to cover the deficit. Present the journal entries on May 31 to record (a) the cash receipt from the deficient partner(s) and (b) the final disbursement of cash to the partners. Answer is complete but not entirely correct. Credit Transaction General Journal Debit No (a) Coeh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts