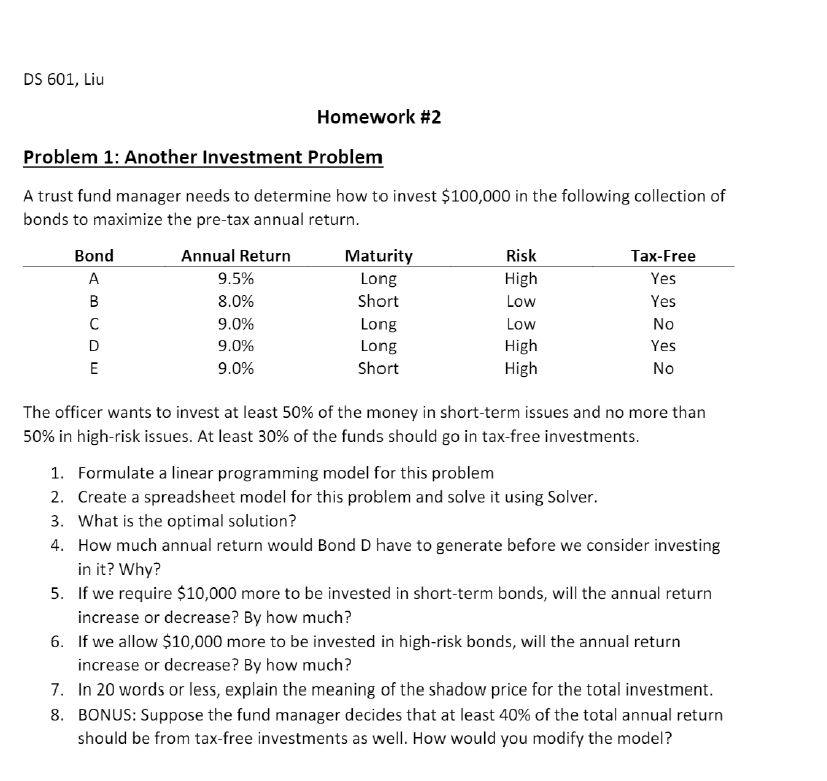

Question: os sol, Liu Homework #2 Problem 1: Another Investment Problem A trust fund manager needs to determine how to invest $100,000 in the following collection

os sol, Liu Homework #2 Problem 1: Another Investment Problem A trust fund manager needs to determine how to invest $100,000 in the following collection of bonds to maximize the oretax annual return. Bond Annual Return Maturity Risk Tart-Free A 95% Long High \"res B 3.0% Short Low Yes C 90% Long LOW No D 90% Long High Yes E 9.0% Short High No The officer wants to invest at least 50% of the monevr in shortterm issues and no more than 50% in highrisk issues. At least 30% of the funds should go in taxfree investments. Formulate a linear programming model for this problem Create a spreadsheet model for this problem and solve it using Solver. What is the optimal solution? How much annual return would Bond 0 have to generate before we consider investing in it? Whv? S. If we require $10,000 more to be invested in short-term bonds, will the annual return increase or decrease? Elv how much? 6. If we allow $10,000 more to be invested in high-risk bonds, 1will the annual return increase or decrease? Eiv how much?I T. In 20 words or less, explain the meaning of the shadow price for the total investment. 8. BONUS: Suppose the fund manager decides that at least 40% of the total annual return should be from taxfree investments as well. How would you modifvr the model? PINE\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts