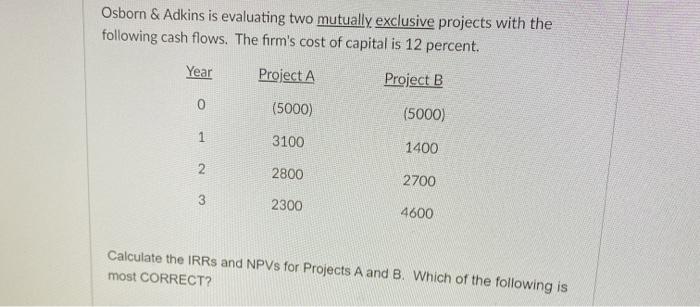

Question: Osborn & Adkins is evaluating two mutually exclusive projects with the following cash flows. The firm's cost of capital is 12 percent. Year Project A

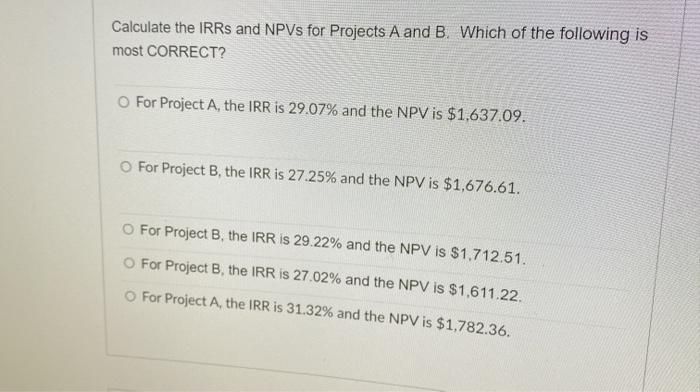

Osborn & Adkins is evaluating two mutually exclusive projects with the following cash flows. The firm's cost of capital is 12 percent. Year Project A Project B 0 (5000) (5000) 1 3100 1400 2 2800 2700 3 2300 4600 Calculate the IRRs and NPVs for Projects A and B. Which of the following is most CORRECT? Calculate the IRRs and NPVs for Projects A and B. Which of the following is most CORRECT? O For Project A, the IRR is 29.07% and the NPV is $1.637.09. For Project B, the IRR is 27.25% and the NPV is $1,676.61. O For Project B, the IRR is 29.22% and the NPV is $1.712.51. For Project B. the IRR is 27.02% and the NPV is $1.611.22. For Project A, the IRR is 31.32% and the NPV is $1,782.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts