Question: ose the best answer for the question. Question 25 3 pts A two-year project has sales of $582.960, cash costs of $411,015, and depreciation expense

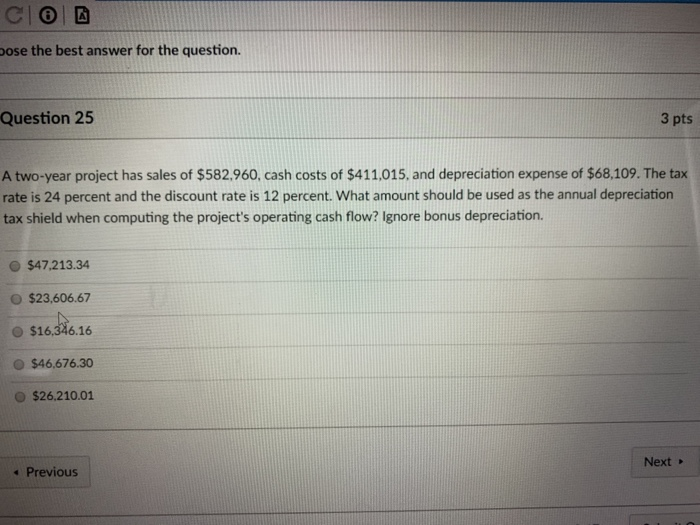

ose the best answer for the question. Question 25 3 pts A two-year project has sales of $582.960, cash costs of $411,015, and depreciation expense of $68,109. The tax rate is 24 percent and the discount rate is 12 percent. What amount should be used as the annual depreciation tax shield when computing the project's operating cash flow? Ignore bonus depreciation. $47,213.34 O$23,606.67 O $16,346.16 $46.676.30 O $26.210.01 Next . Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts