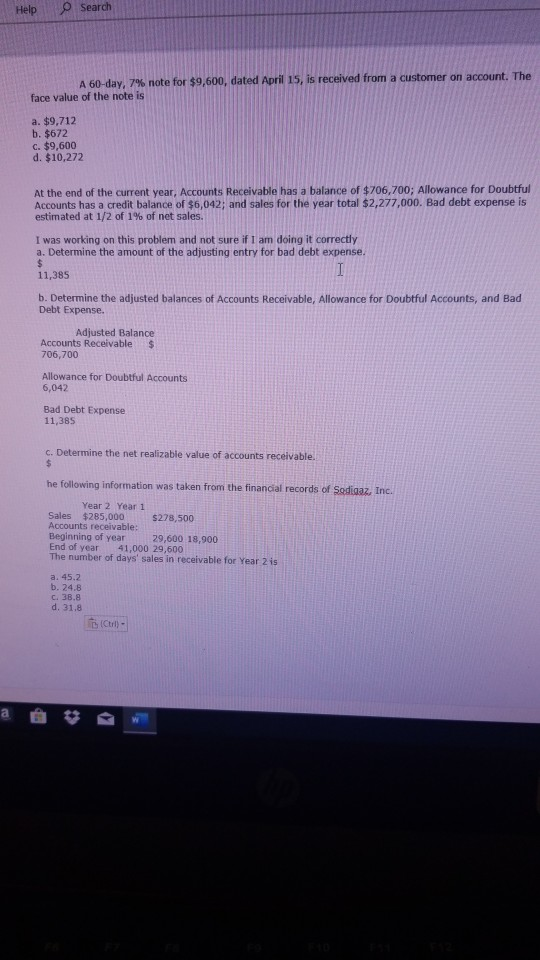

Question: OSearch Help A 60-day, 7% note for $9,600, dated April 15, is received from a customer on account. The face value of the note is

OSearch Help A 60-day, 7% note for $9,600, dated April 15, is received from a customer on account. The face value of the note is a. $9,712 b. $672 c. $9,600 d. $10,272 At the end of the current year, Accounts Receivable has a balance of $706,700; Allowance for Doubtful Accounts has a credit balance of $6,042; and sales for the year total $2,277,000. Bad debt expense is estimated at 1/2 of 1 % of net sales. I was working on this problem and not sure if I am doing it correctly a. Determine the amount of the adjusting entry for bad debt expense. $ 11,385 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Accounts Receivable 706,700 Allowance for Doubtful Accounts 6,042 Bad Debt Expense 11,385 c. Determine the net realizable value of accounts receivable. $ he following information was taken from the financial records of Sodigaz, Inc. Year 2 Year 1 Sales Accounts receivable: Beginning of year End of year The number of days' sales in receivable for Year 2 is $285,000 $278,500 29.600 18.900 41,000 29,600 a. 45.2 b. 24.8 c. 38.8 d. 31.8 (Ctrl)- a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts