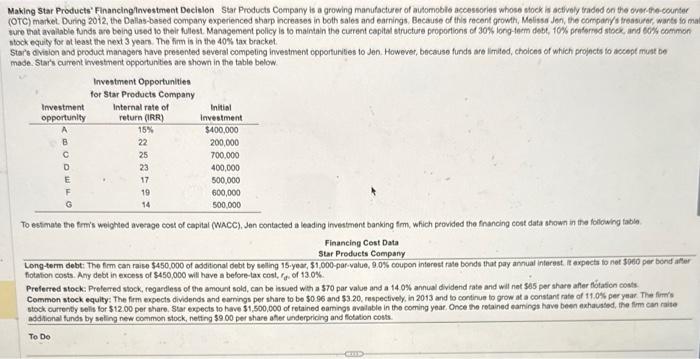

Question: (OTC) markeL During 2012, the Dallas-based company experienced sharp increases in both sales and earnings. Because of this recent growit, Molissa Jen, the company/s treasurer,

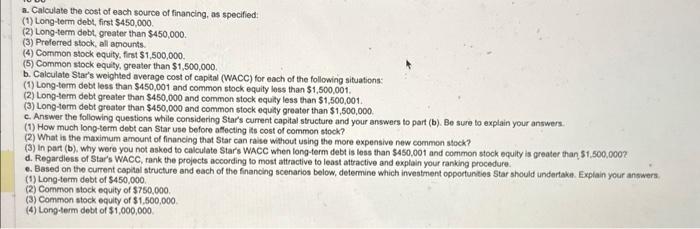

(OTC) markeL During 2012, the Dallas-based company experienced sharp increases in both sales and earnings. Because of this recent growit, Molissa Jen, the company/s treasurer, warts fo me stock equily for at least the next 3 yearn. The firm is in the 40% tax bracket Star's ovision and product managers have presented several competing investment coporturities to Jen. Howerer, becbuse funds are limited, choices of which projncts to accopt must be made. Star's current investhent oppotunbes are shown in the table below To estmate the trm's woighted average cost of capitar (WACC), Jen oontacted a leading investment banking fmm, which provided the fnancing cost data shown in the folowing table Financing Cost Data Star Products Company fotation costs. Amy debt in excoss of $450,000 will have a belore-tax cost, ri of 13.0% Prelerred stock: Preferred wock, regardless of the amount sold, can be issued whth a $70 par value and a 140% annual dividend rate and will net $35 per ahare afler thotafion conts Common stock equity: The firm expects dividends and earnings per share to bo $0.96 and $3.20, respectively, in 2013 and to continue to grow at a constant rate of 11.07 peryear. The fimmit. stock ourrently sels lor $12.00 per thare. Star expects to heve $1,500,000 of retained eamings avalable in the coming year Once the retained eamings have been axhausiod, the flem can raite addifinal funds by seling new common stock, neting $9.00 per share athor underpricing and fotation costs. a. Calculate the cost of each source of financing, as specified: (1) Long-term debt, first $450,000. (2) Long-term debt, greater than $450,000. (3) Preferred stock, all amounts. (4) Common stock equity, first $1,500,000. (5) Common stock equity, greater than $1,500,000. b. Calculate \$tar's woighted overage cost of captal (WACC) for each of the following situations: (1) Long-torm debt less than $450,001 and common stock equily loss than $1,500,001. (2) Long-term debt greater than $450,000 and common stock equity less than $1,500,001. (3) Long-term debt greater than $450,000 and common stock equity greater than $1,500,000. c. Answer the following questions while considering Star's current capital structure and your answers to part (b). Be sure to explain your answers. (1) How much long-term debt can Star use before aflecting iss cost of common stock? (2) What is the maximum amount of financing that Star can raise without using the more expensive new commen stock? (3) In part (b). why wore you not asked to calculate Star's WACC when long-term debt is less than $450,001 and common stock equity is greater than S1, S00,000? d. Regardless of Star's WACC. rank the projects according lo most attractive to least attractive and explain your ranking procedure. e. Based on the current copital structure and each of the financing scenarios below, determine which investment opportunties Star should undertake. Explain your answers. (1) Long-term debt of $450,000. (2) Common stock equity of $750,000. (3) Comman stock equity of $1,500,000. (4) Longterm debt of $1,000,000. (OTC) markeL During 2012, the Dallas-based company experienced sharp increases in both sales and earnings. Because of this recent growit, Molissa Jen, the company/s treasurer, warts fo me stock equily for at least the next 3 yearn. The firm is in the 40% tax bracket Star's ovision and product managers have presented several competing investment coporturities to Jen. Howerer, becbuse funds are limited, choices of which projncts to accopt must be made. Star's current investhent oppotunbes are shown in the table below To estmate the trm's woighted average cost of capitar (WACC), Jen oontacted a leading investment banking fmm, which provided the fnancing cost data shown in the folowing table Financing Cost Data Star Products Company fotation costs. Amy debt in excoss of $450,000 will have a belore-tax cost, ri of 13.0% Prelerred stock: Preferred wock, regardless of the amount sold, can be issued whth a $70 par value and a 140% annual dividend rate and will net $35 per ahare afler thotafion conts Common stock equity: The firm expects dividends and earnings per share to bo $0.96 and $3.20, respectively, in 2013 and to continue to grow at a constant rate of 11.07 peryear. The fimmit. stock ourrently sels lor $12.00 per thare. Star expects to heve $1,500,000 of retained eamings avalable in the coming year Once the retained eamings have been axhausiod, the flem can raite addifinal funds by seling new common stock, neting $9.00 per share athor underpricing and fotation costs. a. Calculate the cost of each source of financing, as specified: (1) Long-term debt, first $450,000. (2) Long-term debt, greater than $450,000. (3) Preferred stock, all amounts. (4) Common stock equity, first $1,500,000. (5) Common stock equity, greater than $1,500,000. b. Calculate \$tar's woighted overage cost of captal (WACC) for each of the following situations: (1) Long-torm debt less than $450,001 and common stock equily loss than $1,500,001. (2) Long-term debt greater than $450,000 and common stock equity less than $1,500,001. (3) Long-term debt greater than $450,000 and common stock equity greater than $1,500,000. c. Answer the following questions while considering Star's current capital structure and your answers to part (b). Be sure to explain your answers. (1) How much long-term debt can Star use before aflecting iss cost of common stock? (2) What is the maximum amount of financing that Star can raise without using the more expensive new commen stock? (3) In part (b). why wore you not asked to calculate Star's WACC when long-term debt is less than $450,001 and common stock equity is greater than S1, S00,000? d. Regardless of Star's WACC. rank the projects according lo most attractive to least attractive and explain your ranking procedure. e. Based on the current copital structure and each of the financing scenarios below, determine which investment opportunties Star should undertake. Explain your answers. (1) Long-term debt of $450,000. (2) Common stock equity of $750,000. (3) Comman stock equity of $1,500,000. (4) Longterm debt of $1,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts