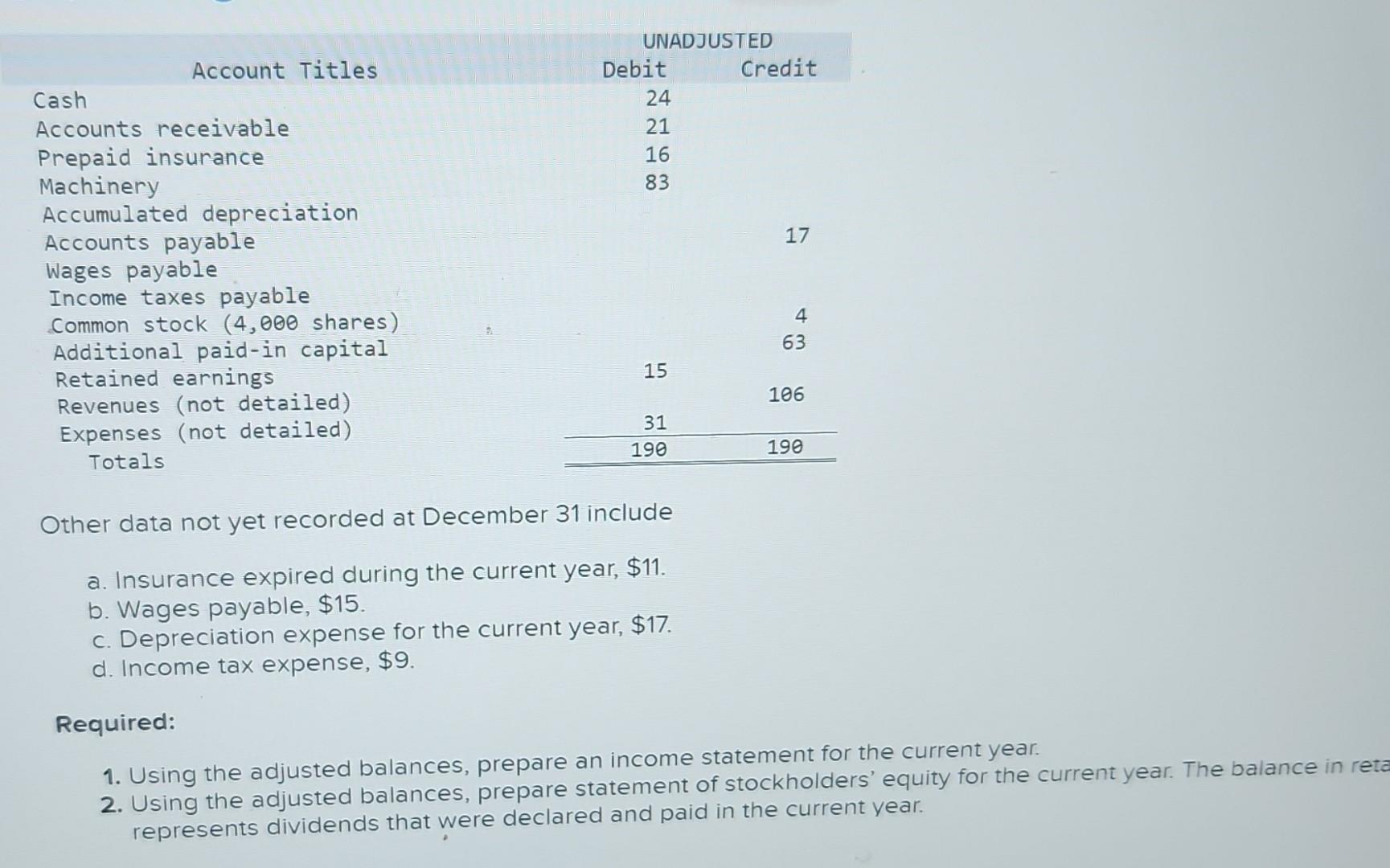

Question: Other data not yet recorded at December 31 include a. Insurance expired during the current year, $11. b. Wages payable, $15. c. Depreciation expense for

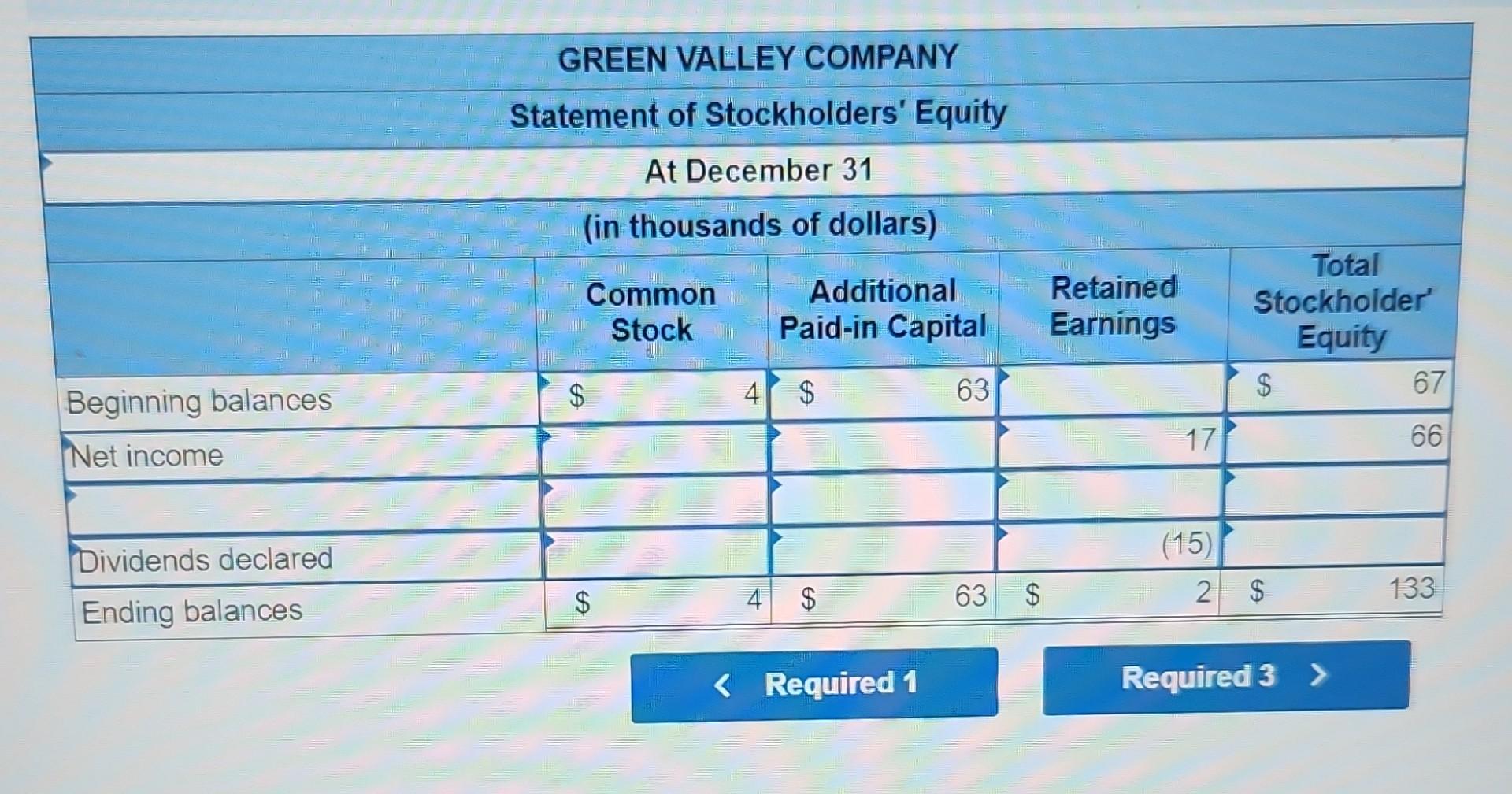

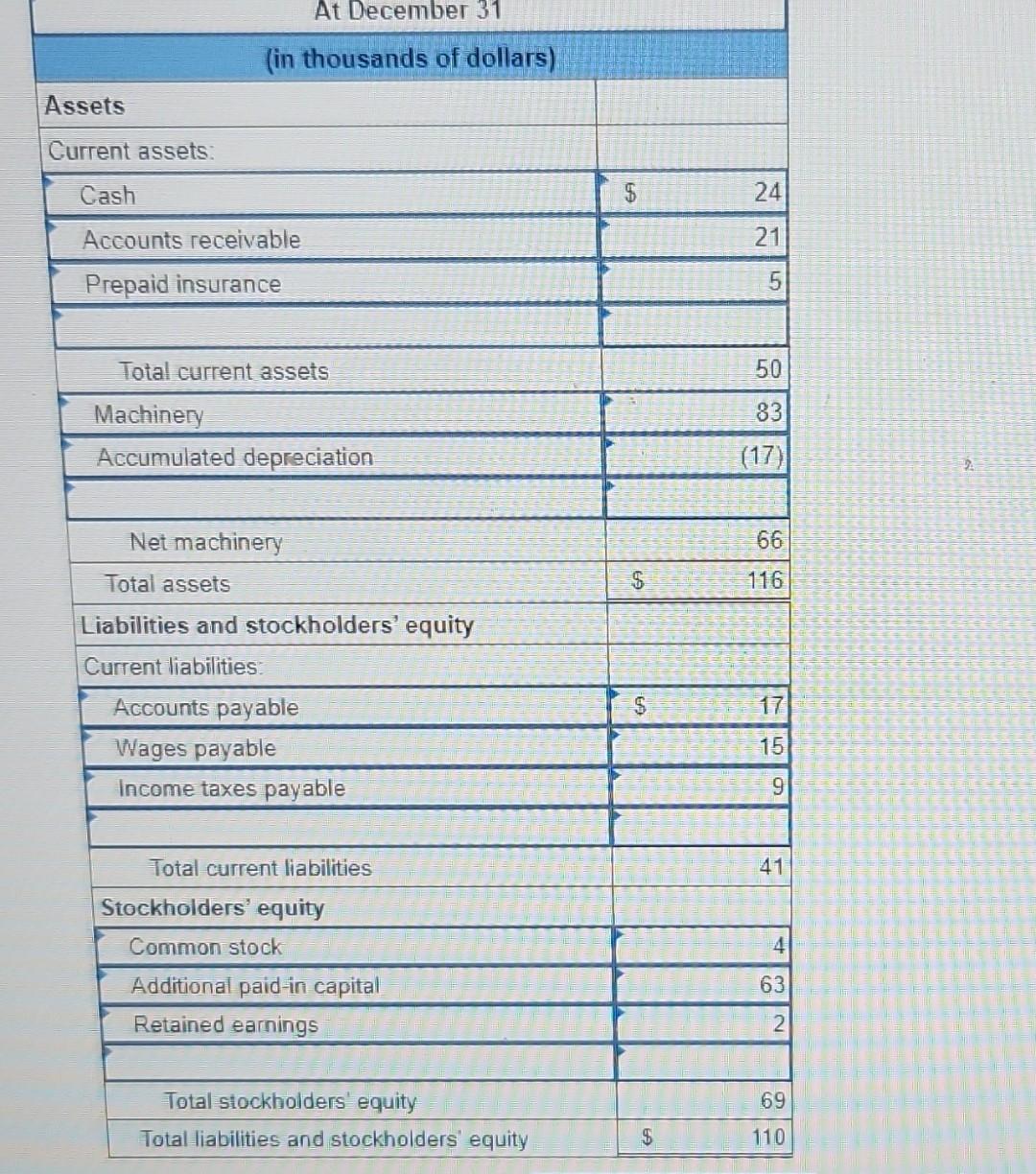

Other data not yet recorded at December 31 include a. Insurance expired during the current year, \$11. b. Wages payable, $15. c. Depreciation expense for the current year, \$17. d. Income tax expense, \$9. Required: 1. Using the adjusted balances, prepare an income statement for the current year. 2. Using the adjusted balances, prepare statement of stockholders' equity for the current year. The balance in ret represents dividends that were declared and paid in the current year. At December 31 \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ (in thousands of dollars) } \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash & $ & 24 \\ \hline Accounts receivable & & 21 \\ \hline Prepaid insurance & & 5 \\ \hline Total current assets & & 50 \\ \hline Machinery & & 83 \\ \hline Accumulated depreciation & & (17) \\ \hline Net machinery & & 66 \\ \hline Total assets & $ & 116 \\ \hline \multicolumn{3}{|l|}{ Liabilities and stockholders' equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $ & 17 \\ \hline Wages payable & & 15 \\ \hline Income taxes payable & & 9 \\ \hline Total current liabilities & & 41 \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity } \\ \hline Common stock & & 4 \\ \hline Additional paid-in capital & & 63 \\ \hline Retained earnings & & 2 \\ \hline Total stockhoiders' equity & & 69 \\ \hline Total liabilities and stockholders' equity & $ & 110 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts