Question: other guy that helped me got it wrong Question 1 of 1 16.16/45 E On August 1, 2016. Stephanie Ram, a sole proprietor started a

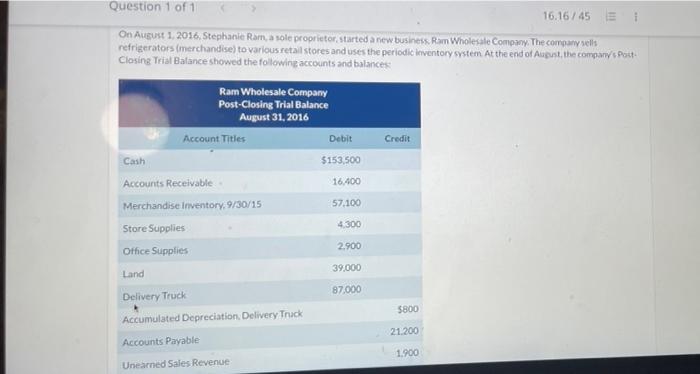

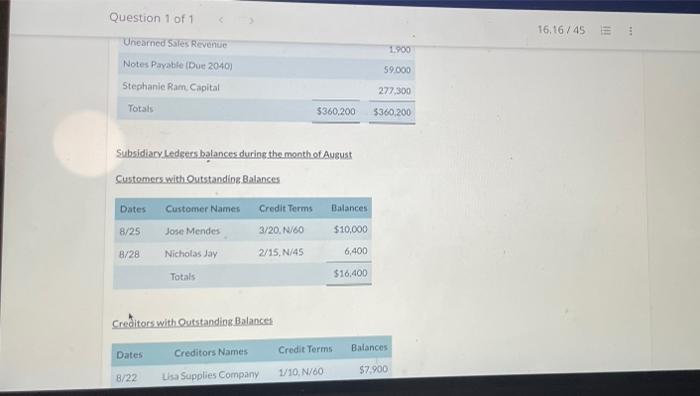

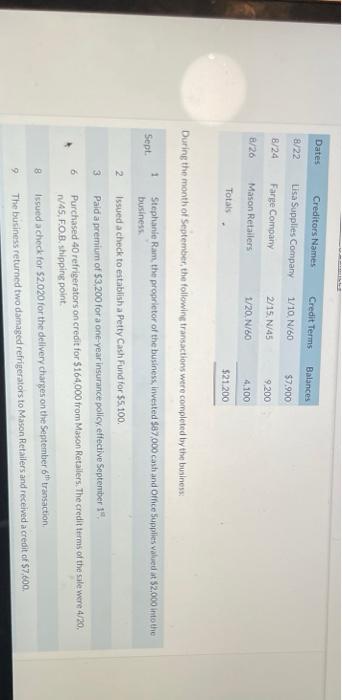

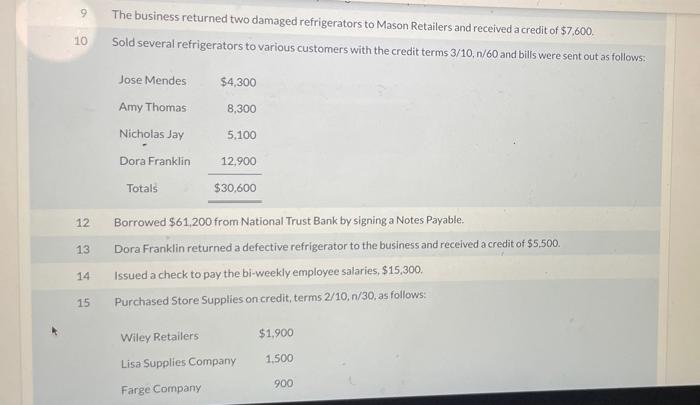

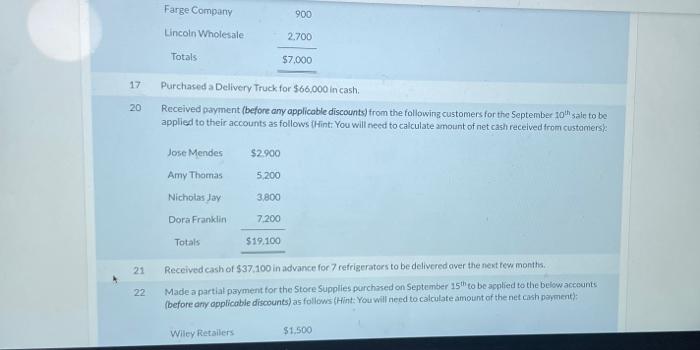

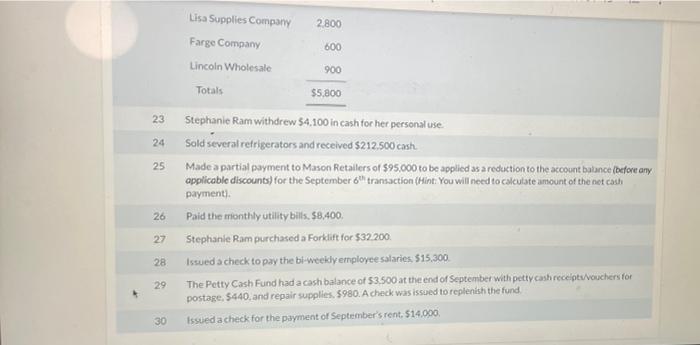

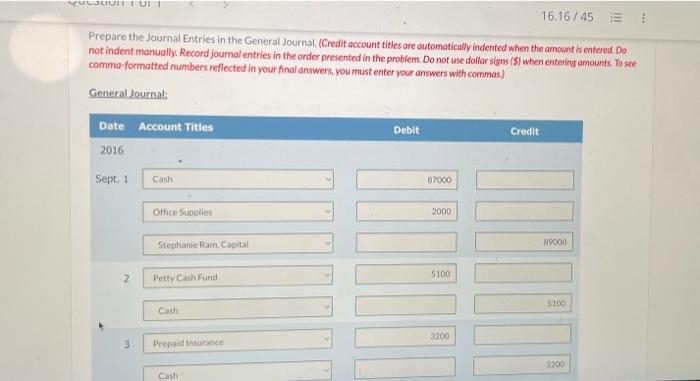

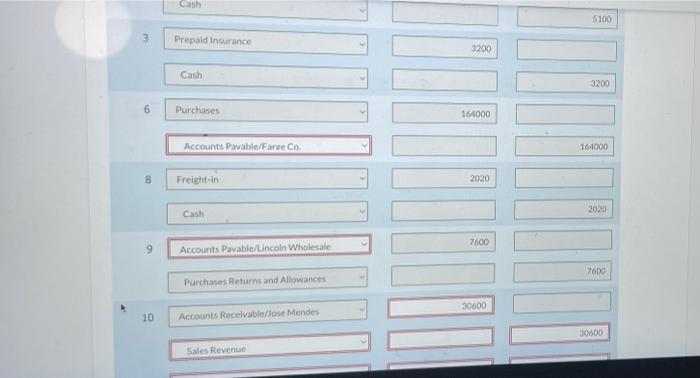

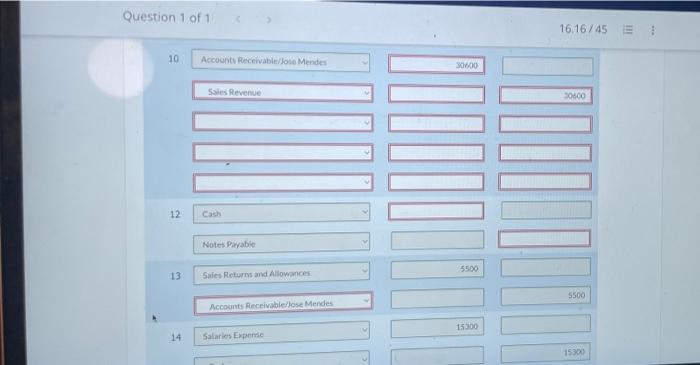

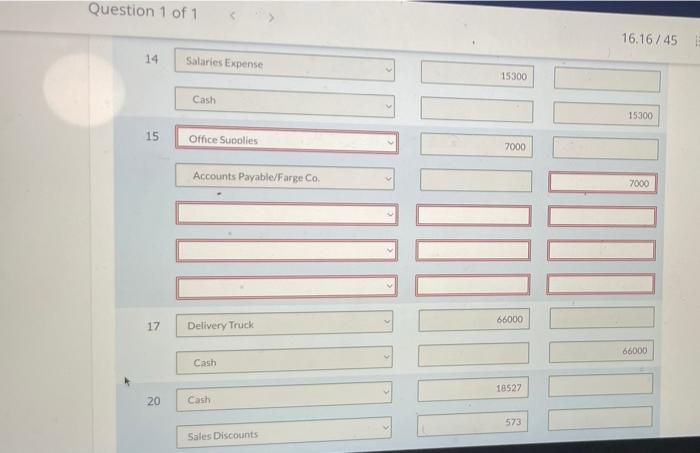

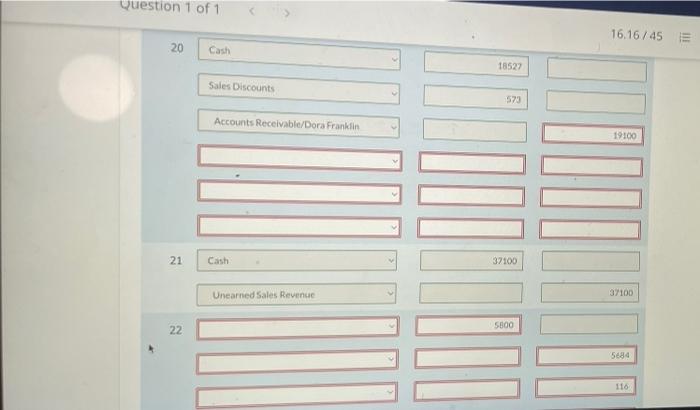

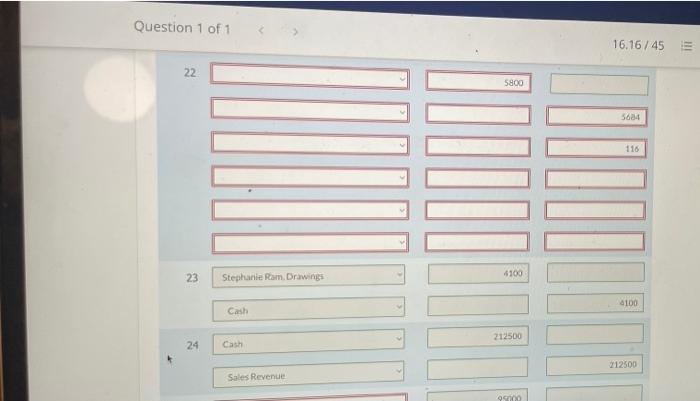

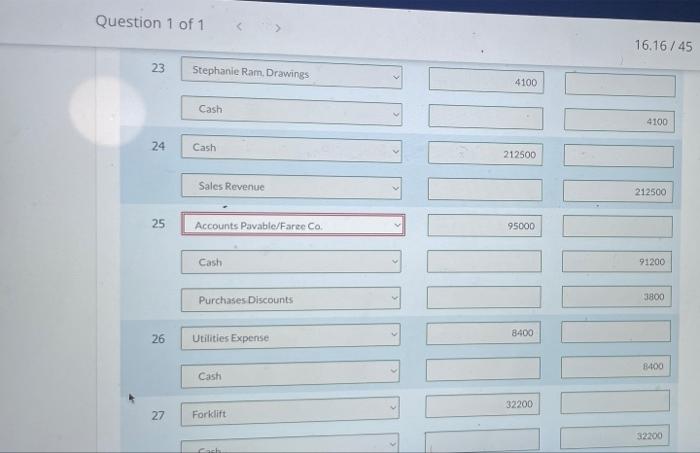

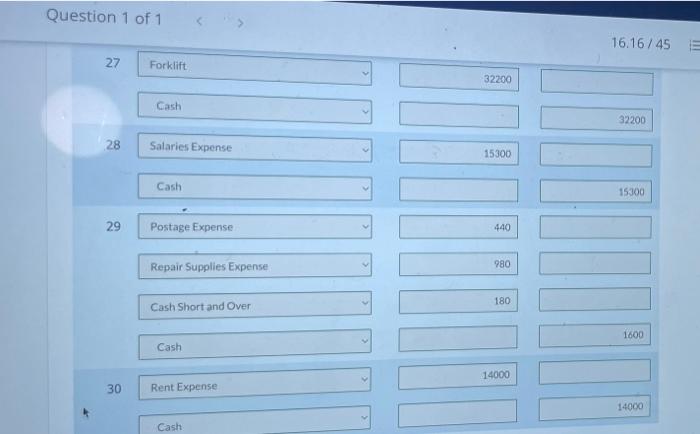

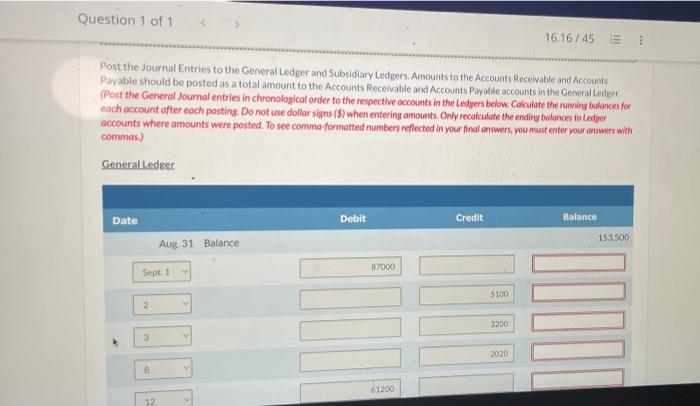

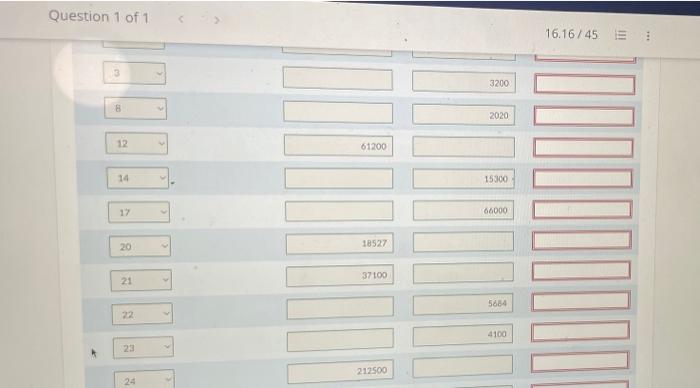

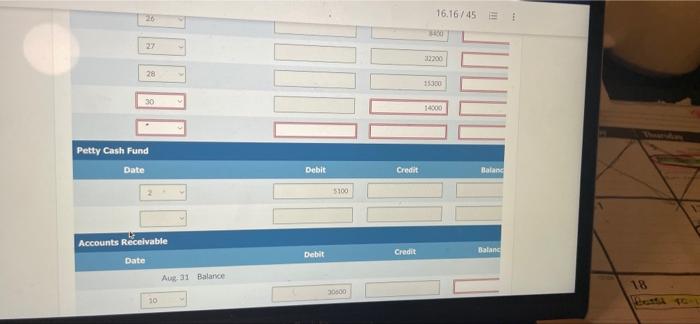

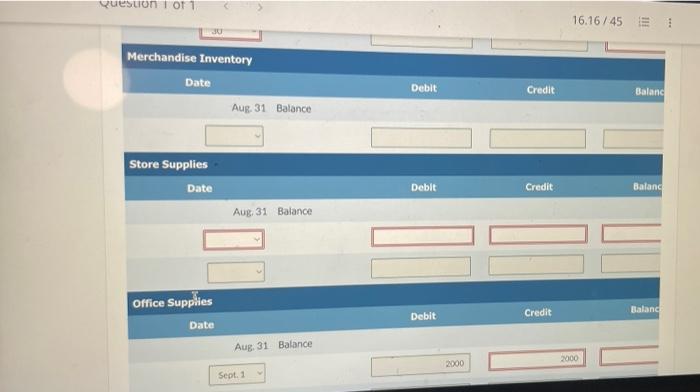

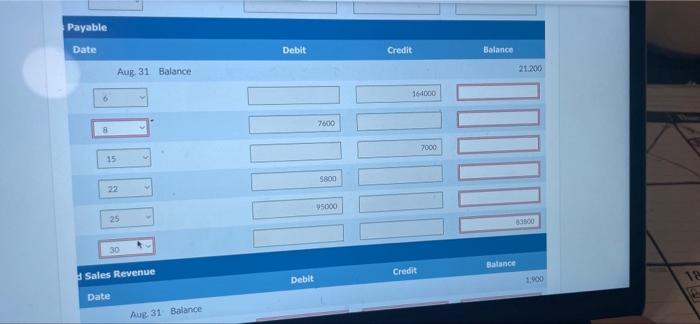

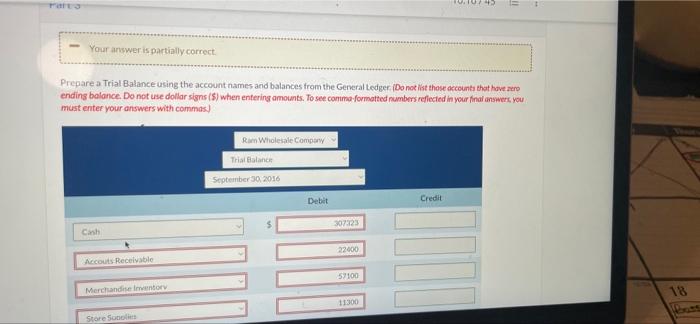

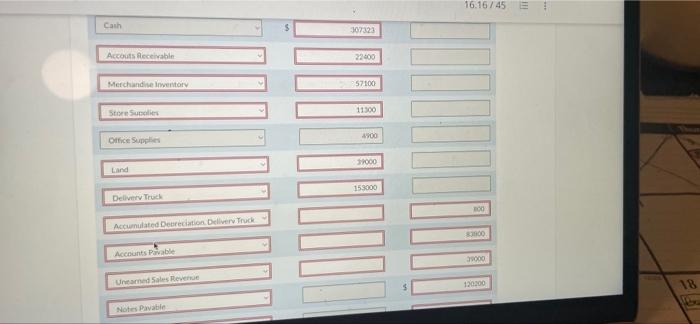

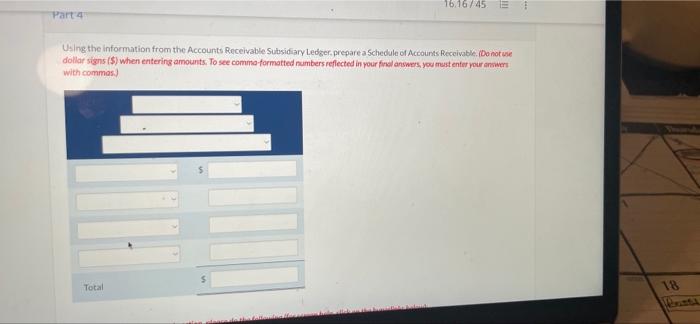

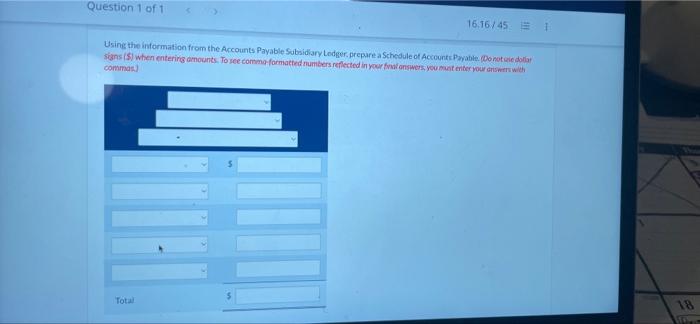

Question 1 of 1 16.16/45 E On August 1, 2016. Stephanie Ram, a sole proprietor started a new business. Ram Wholesale Company. The company sells refrigerators (merchandise) to various retail stores and uses the periodic Inventory system At the end of August, the company's Pout Closing Trial Balance showed the following accounts and balances Ram Wholesale Company Post-Closing Trial Balance August 31, 2016 Account Titles Debit Credit $153.500 16.400 Cash Accounts Receivable Merchandise Inventory, 9/30/15 Store Supplies Office Supplies 57.100 4.300 2.900 39.000 Land 87.000 Delivery Truck Accumulated Depreciation, Delivery Truck $800 21.200 Accounts Payable 1.900 Unearned Sales Revenue Question 1 of 1 16,16/45 TH 3 Unearned Sales Revenue 1.900 59.000 Notes Payable (Due 20401 Stephanie Ram Capital Totats 277.300 $360,200 3360 200 Subsidiary Ledeers balances during the month of August Customers with Outstandine Balances Dates Customer Names Credit Terms Balances 8/25 Jose Mendes 3/20 N/60 $10,000 8/28 Nicholas Jay 2/15, N/45 6,400 Totals $10,400 Creditors with Outstandios Balances Balances Credit Terms Dates Creditors Names 8/22 $7.900 1/10. N/60 Lisa Supplies Company Dates Creditors Names Credit Terms Balances 8/22 Lisa Supplies Company 1/10 N/60 $7.900 B/24 Fare Company 2/15. N/45 9 200 8/26 Mason Retailers 1/20 N/60 4.100 Total $21.200 During the month of September, the following transactions were completed by the business 1 Sept 2 3 Stephanie Ram the proprietor of the business, invested $87,000 cash and Office Supplies valued at $2.000 into the business Issued a check to establish a Petty Cash Fund for 55.100. Paid a premium of $3,200 for a one-year insurance policy, effective September 19 Purchased 40 refrigerators on credit for $164,000 from Mason Retailers. The credit terms of the sale were 4/20, 1/45, F.O.B. shipping point Issued a check for $2.020 for the delivery charges on the September 6th transaction, The business returned two damaged refrigerators to Mason Retailers and received a credit of $7.600, 6 8 ON 9 The business returned two damaged refrigerators to Mason Retailers and received a credit of $7,600 Sold several refrigerators to various customers with the credit terms 3/10, n/60 and bills were sent out as follows: 10 $4,300 Jose Mendes Amy Thomas 8,300 Nicholas Jay 5.100 Dora Franklin 12.900 Totals $30,600 12 13 a Borrowed $61,200 from National Trust Bank by signing a Notes Payable. Dora Franklin returned a defective refrigerator to the business and received a credit of $5,500. Issued a check to pay the bi-weekly employee salaries, $15,300. Purchased Store Supplies on credit, terms 2/10, 1/30, as follows: 14 15 $1,900 Wiley Retailers Lisa Supplies Company Farge Company 1,500 900 Farge Company 900 Lincoln Wholesale 2.700 Totals $7,000 17 20 Purchased a Delivery Truck for $66.000 in cash. Received payment (before any applicable discounts) from the following customers for the September 10th sale to be applied to their accounts as follows (Hint: You will need to calculate amount of net cash received from customers): $2.900 Jose Mendes Amy Thomas 5.200 Nicholas Jay 3,800 Dora Franklin 7.200 Totals $19.100 21 Received cash of $37.100 in advance for 7 refrigerators to be delivered over the next few months. 22 Made a partial payment for the Store Supplies purchased on September 15th to be applied to the below accounts (before any applicable discounts) as follows (Hint: You will need to calculate amount of the net cash payment); Wiley Retailers $1,500 Lisa Supplies Company Farge Company 2800 600 Lincoln Wholesale 900 Totals $5,800 23 24 25 26 Stephanie Ram withdrew 54,100 in cash for her personal use. Sold several refrigerators and received $212.500 cash. Made a partial payment to Mason Retailers of 595,000 to be applied as a reduction to the account balance before any applicable discounts) for the September 6'h transaction (Hint: You will need to calculate amount of the net cash payment). Paid the monthly utility bills. $8,400, Stephanie Ram purchased a Forklift for $32 200 Issued a check to pay the bi-weekly employee salaries 515,300 The Petty Cash Fund had a cash balance of 53.500 at the end of September with petty cash receipts/vouchers for postage: 5440, and repair supplies. $980. A check was issued to replenish the fund Issued a check for the payment of September's rent. $14.000 27 28 29 30 ULUUN 011 16.16/45 Prepare the Journal Entries in the General Journal. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Do not use dollar signs (5) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas) General Journal Date Account Titles 2016 Debit Credit Sept. 1 Cash 87000 Othce Supplies 2000 Stephanie Ram. Capital 89000 2 Petty Cash Fund 5100 5100 Cash 3200 3 Prepaid insurance 21200 Cash Cash 5100 3 Prepaid Insurance 3200 Cash 3200 6 Purchases 164000 Accounts Pavable/Fare Co. 164000 8 Freight-in 2020 2020 Cash 7600 9 Accounts Pavable/Lincoln Wholesale 7600 Purchases Returns and Allowances 30000 10 Accounts Receivable/lose Mendes 30600 Sales Revenue Question 1 of 1 16.16/45 10 Accounts Receivable/Jose Mendes 0600 Sales Revenue 50600 JUNIO 12 Notes Payable 5500 13 Sales Returns and Allowances 5500 Accounts Receivable/lose Mendes 15300 14 Salaries Expert 15300 Question 1 of 1 16.16/45 14 Salaries Expense 15300 Cash 15300 15 Office Supplies 7000 Accounts Payable/Farge Co. 7000 66000 17 Delivery Truck 66000 Cash 18527 20 Cash 573 Sales Discounts Question 1 of 1 16.16/45 = 20 Cash 18527 Sales Discounts 573 Accounts Receivable/Dora Franklin 19100 21 Cash 37100 Unearned Sales Revenue 37100 5800 22 5684 116 Question 1 of 1 16.16/45 22 5800 AME 5684 116 6100 23 Stephanie Ram.Drawings 4100 Cash 212500 24 Cash 212500 Sales Revenue 9910 Question 1 of 1 16.16 745 23 Stephanie Ram.Drawings 4100 Cash 4100 24 Cash 212500 Sales Revenue 212500 25 Accounts Pavable/Faree Co. 95000 Cash 93200 Purchases Discounts 3800 8400 26 Utilities Expense 8400 Cash 32200 27 Forklift 32200 Question 1 of 1 16.16/45 27 Forklift 32200 Cash 32200 28 Salaries Expense 15300 Cash 15300 29 Postage Expense 440 Repair Supplies Expense 980 180 Cash Short and Over 1600 Cash 14000 30 Rent Expense 14000 Cash Question 1 of 1 16.16/45 Post the Journal Entries to the General Ledger and Subsidiary Ledgers. Amounts to the Accounts Receivable and Accounts Payable should be posted as a total amount to the Accounts Receivable and Accounts Payable accounts in the General Ledger (Post the General Journal entries in chronological order to the respective accounts in the Ledgers below. Calculate the running balances for each account after each posting Do not use dollar signs (S) when entering amounts Only recalculate the ending balances to Ledger accounts where amounts were posted. To see commo-formatted numbers reflected in your final answers, you must enter your answers with commes.) General Ledger Date Debit Credit Balance Aug 31 Balance 153.500 87000 Sept. 1 3100 2 3200 3 2020 8 61200 12 Question 1 of 1 16.16/45 3200 8 2020 12 61200 14 15300 17 66000 20 18527 37100 21 5664 22 4100 23 212500 24 16.16/45 20 27 312200 28 15300 30 14000 Petty Cash Fund Date Debit Credit Baland 5100 Accounts Receivable Debit Credit Balanc Date A-31 Balance 18 30000 10 Question 1 of 1 16.16/45 Merchandise Inventory Date Debit Credit Balanc Aug 31 Balance Store Supplies Date Debit Credit Balanc Aug 31 Balance Office Supplies Debit Credit Baland Date Aug 31 Balance 2000 2000 Sept. 1 Payable Date Debit Credit Balance 21.200 Aug 31 Balance 6 164000 7600 8 7000 15 5800 22 95000 25 3D Balance Sales Revenue Credit Debit 12 Date NE Aug 31 Balance = Your answer is partially correct Prepare a Trial Balance using the account names and balances from the General Ledger (Do not list those accounts that have zero ending balance. Do not use dollar signs (5) when entering amounts. To set comma formatted numbers reflected in your final answers, you must enter your answers with commas) Run Wholesale Company Trial Balance September 30, 2016 Debit Credit 307323 Cash 22000 Accouts Receivable IMA 57100 Merchandise Intory 18 11300 Store Sco 16.16 / 45 Cach -307323 Accouts Receivable 22600 Merchandise Inventory 57100 11300 Store Subles Office Supplies 4900 2000 Land 153000 Delivery Accumulated Derection Dellver Truck 300 Accounts Payable 3000 Unearned Sales Revenue 10300 18 Notes Pavable 16.16/45 E Parta Using the information from the Accounts Receivable Subsidiary Ledger, prepare a Schedule of Accounts Receivable. (Do not use doller signs (S) when entering amounts. To see commo-formatted numbers reflected in your firal answers, you must enter your answers with commes.) $ Total 13 Question 1 of 1 16.16/45 Using the information from the Accounts PayableSubsidiary Ledger prepare a Schedule of Accounts Payabi. Do not editar signs (5) when entering amounts. To see como formatted numbers reflected in your final swers, you must enter your own with commas) Total 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts