Question: Other information In June 2 0 2 3 , the Massachusetts Department of Revenue audited Cecile's state income tax returns for 2 0 2 1

Other information

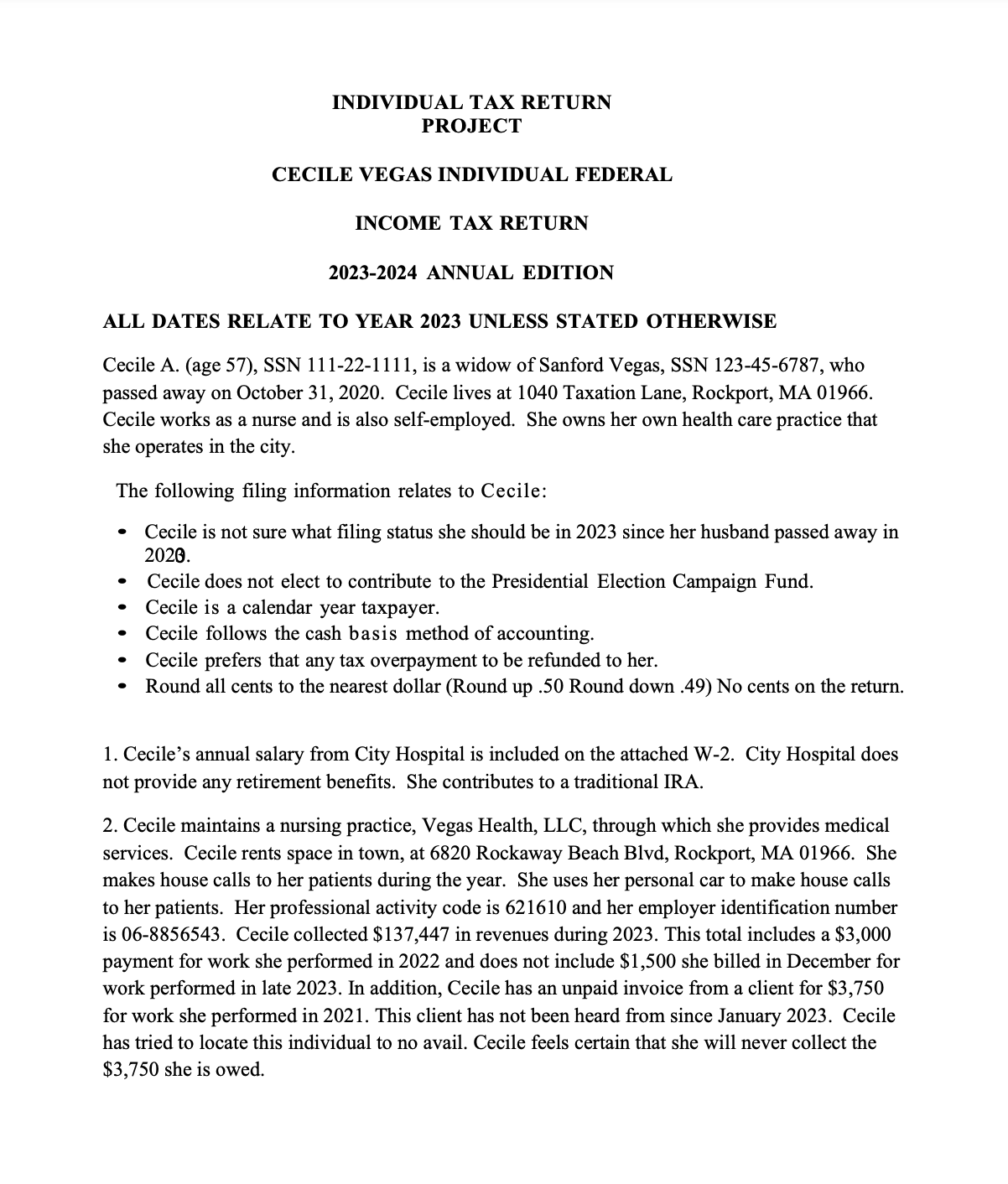

In June the Massachusetts Department of Revenue audited Cecile's state income tax returns for She was assessed additional state income tax of $ for that year. Surprisingly, no interest was included in the assessment. Cecile paid the back taxes promptly. Ceciles second home on Ocean Drive, Sunset Beach, NC was destroyed by a hurricane on February The area was declared a Federally Declared Disaster area FEMA declaration number DR on February th Cecile purchased the home on for $ The fair market value of the home before the hurricane was $ The insurance company reimbursed her for $ to cover the damage. Cecile did not reinvest the insurance proceeds.

Company : Ordinary dividend

Qualified Dividend

Total capital gain disturb.

Company :Ordinary dividend

Qualified Dividend

FOrm

Morgage Interest recieved from payerborrower:

Outstanding Mortgage principle:

can you help fill out form first page and other forms that connect to it I need help to find the exact way to find total income, AGI and taxable income. Pls provide steps. Thank you! Here are some check figures from Form so you know if you are on the right track:

Line total income:

Line AGI:

Line taxable income:

Line tax:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock