Question: other information (it may support your work, you may not use it: Question 1.5 Recently you have been appointed as the Management Accountant of Quality

other information (it may support your work, you may not use it:

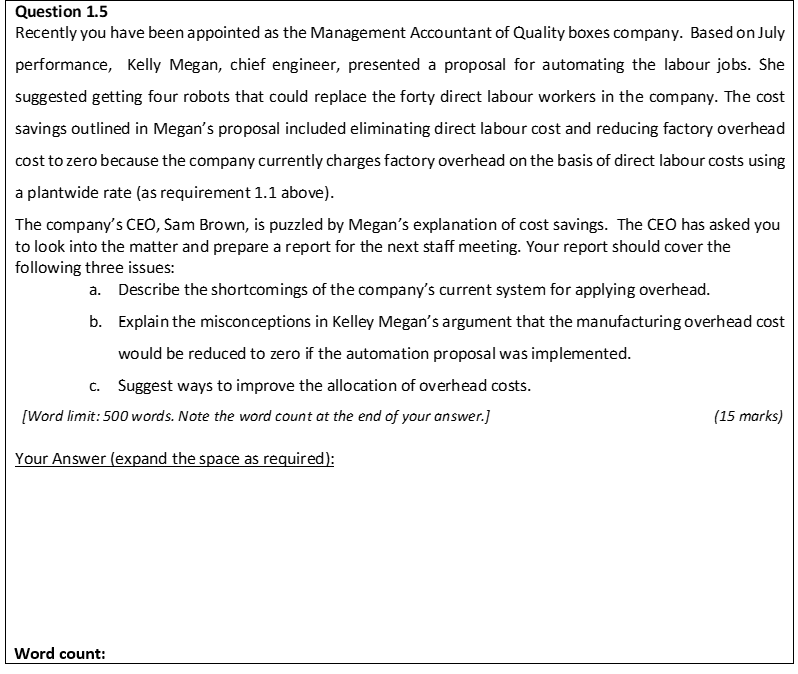

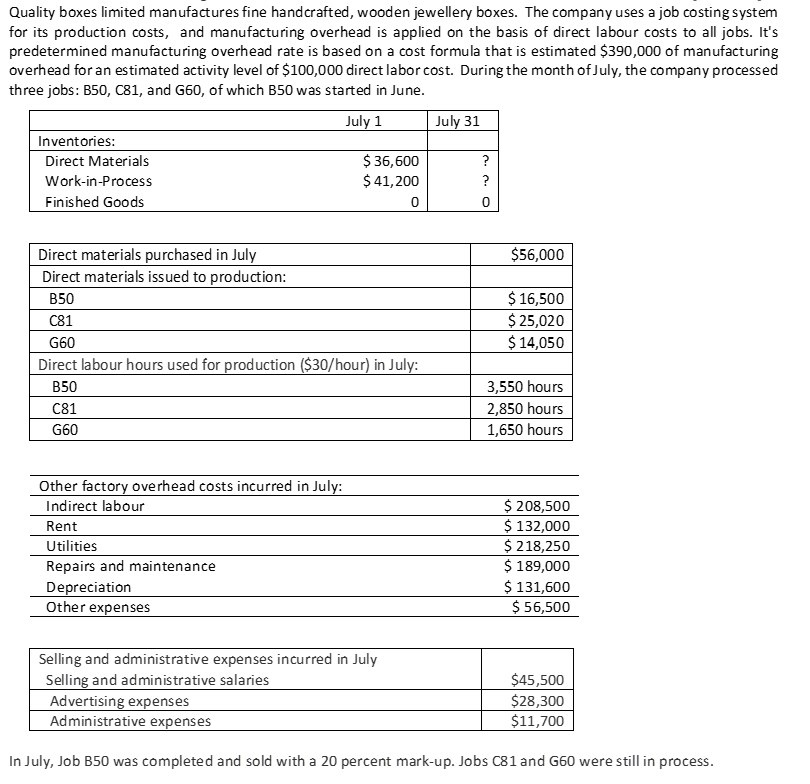

Question 1.5 Recently you have been appointed as the Management Accountant of Quality boxes company. Based on July performance, Kelly Megan, chief engineer, presented a proposal for automating the labour jobs. She suggested getting four robots that could replace the forty direct labour workers in the company. The cost savings outlined in Megan's proposal included eliminating direct labour cost and reducing factory overhead cost to zero because the company currently charges factory overhead on the basis of direct labour costs using a plantwide rate (as requirement 1.1 above). The company's CEO, Sam Brown, is puzzled by Megan's explanation of cost savings. The CEO has asked you to look into the matter and prepare a report for the next staff meeting. Your report should cover the following three issues: a. Describe the shortcomings of the company's current system for applying overhead. b. Explain the misconceptions in Kelley Megan's argument that the manufacturing overhead cost would be reduced to zero if the automation proposal was implemented. C. Suggest ways to improve the allocation of overhead costs. [Word limit: 500 words. Note the word count at the end of your answer.) (15 marks) Your Answer (expand the space as required): Word count: Quality boxes limited manufactures fine handcrafted, wooden jewellery boxes. The company uses a job costing system for its production costs, and manufacturing overhead is applied on the basis of direct labour costs to all jobs. It's predetermined manufacturing overhead rate is based on a cost formula that is estimated $390,000 of manufacturing overhead for an estimated activity level of $100,000 direct labor cost. During the month of July, the company processed three jobs: B50, C81, and G60, of which B50 was started in June. July 1 July 31 Inventories: Direct Materials $36,600 Work-in-Process $ 41,200 Finished Goods ? ? 0 0 $56,000 Direct materials purchased in July Direct materials issued to production: B50 C81 G60 Direct labour hours used for production ($30/hour) in July: B50 C81 G60 $ 16,500 $ 25,020 $ 14,050 3,550 hours 2,850 hours 1,650 hours Other factory overhead costs incurred in July: Indirect labour Rent Utilities Repairs and maintenance Depreciation Other expenses $ 208,500 $ 132,000 $ 218,250 $ 189,000 $ 131,600 $ 56,500 Selling and administrative expenses incurred in July Selling and administrative salaries Advertising expenses Administrative expenses $45,500 $28,300 $11,700 In July, Job B50 was completed and sold with a 20 percent mark-up. Jobs C81 and G60 were still in process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts