Question: other wind instruments. Its current value of operations, which is also its value of debt plus equity, is estimated to be $200 million. Higgs

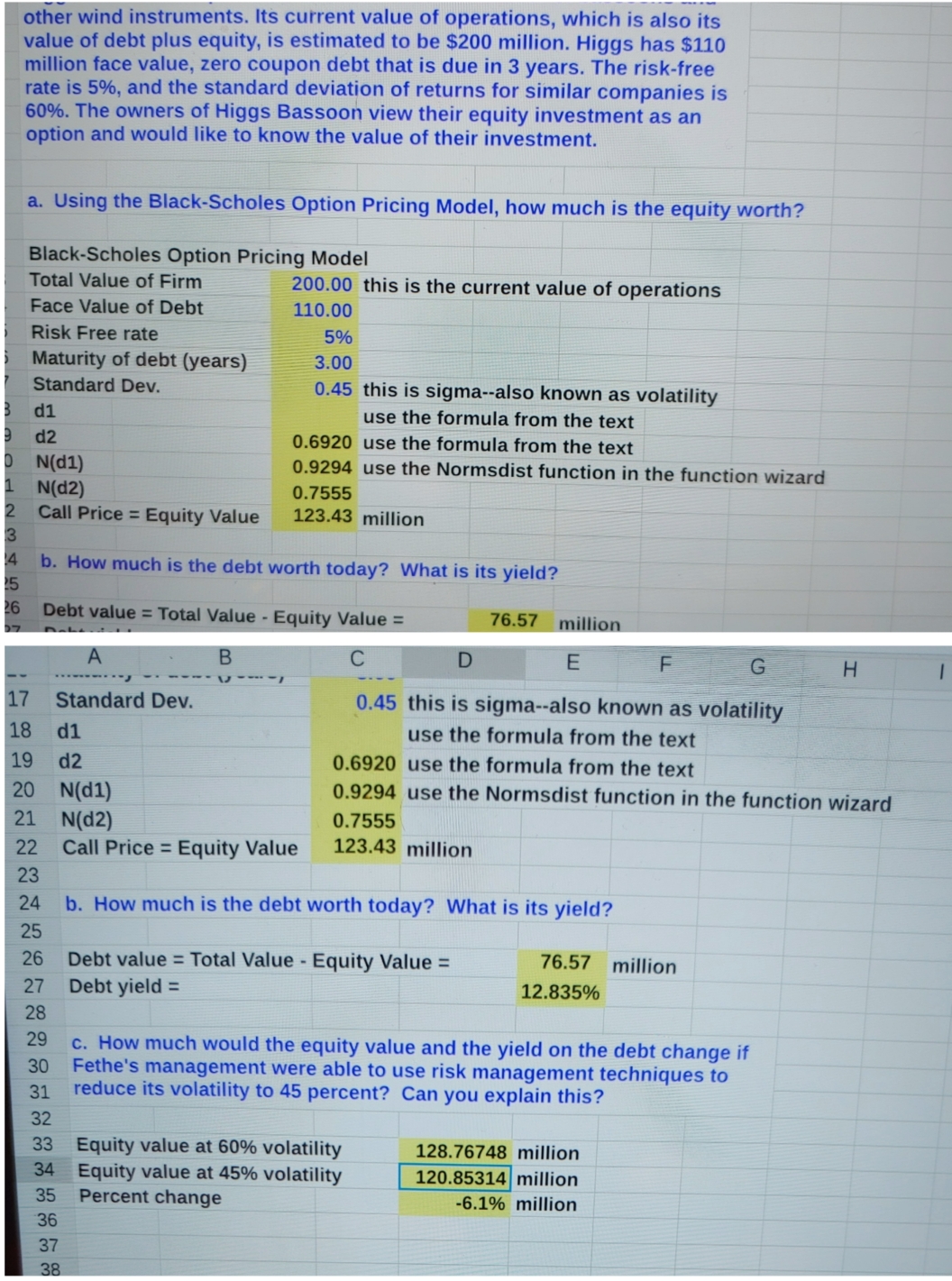

other wind instruments. Its current value of operations, which is also its value of debt plus equity, is estimated to be $200 million. Higgs has $110 million face value, zero coupon debt that is due in 3 years. The risk-free rate is 5%, and the standard deviation of returns for similar companies is 60%. The owners of Higgs Bassoon view their equity investment as an option and would like to know the value of their investment. a. Using the Black-Scholes Option Pricing Model, how much is the equity worth? Black-Scholes Option Pricing Model Total Value of Firm Face Value of Debt Risk Free rate 200.00 this is the current value of operations 110.00 5% Maturity of debt (years) Standard Dev. d1 9 d2 D N(d1) N(d2) 3.00 0.45 this is sigma--also known as volatility use the formula from the text 0.6920 use the formula from the text 0.9294 use the Normsdist function in the function wizard 0.7555 2 Call Price = Equity Value 123.43 million 3 4 5 26 b. How much is the debt worth today? What is its yield? Debt value = Total Value - Equity Value = C 76.57 million D E F A B 17 Standard Dev. 18 d1 19 d2 H 0.45 this is sigma--also known as volatility use the formula from the text 0.6920 use the formula from the text 0.9294 use the Normsdist function in the function wizard 0.7555 20 N(d1) 21 N(d2) Call Price = Equity Value 123.43 million 26 2222222222223333 b. How much is the debt worth today? What is its yield? Debt value = Total Value - Equity Value = Debt yield = 76.57 million 12.835% c. How much would the equity value and the yield on the debt change if Fethe's management were able to use risk management techniques to reduce its volatility to 45 percent? Can you explain this? 33 Equity value at 60% volatility 34 Equity value at 45% volatility Percent change 128.76748 million 120.85314 million -6.1% million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts