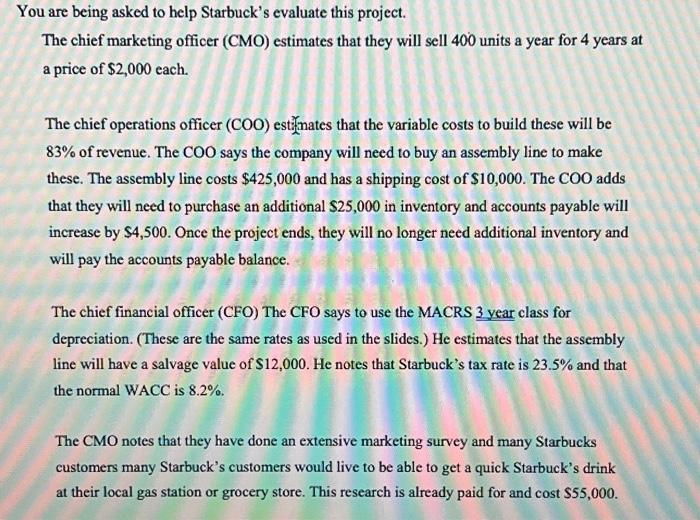

Question: 'ou are being asked to help Starbuck's evaluate this project. The chief marketing officer (CMO) estimates that they will sell 400 units a year for

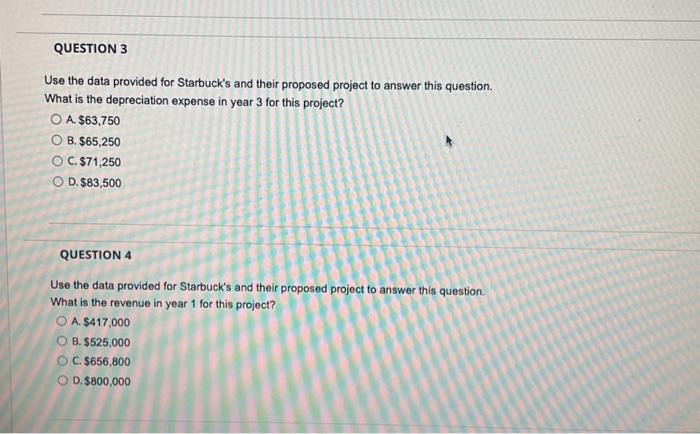

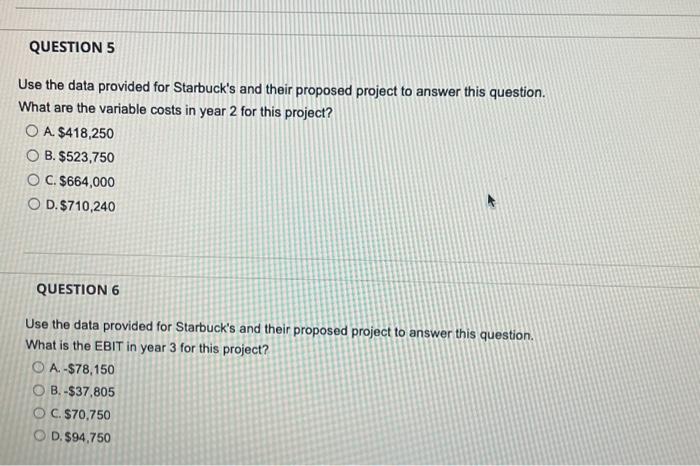

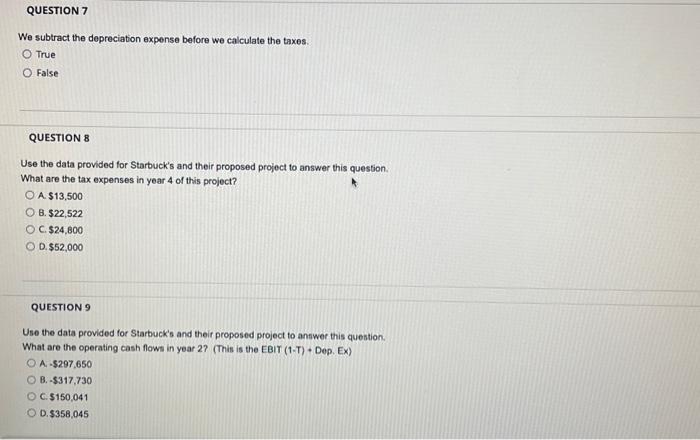

'ou are being asked to help Starbuck's evaluate this project. The chief marketing officer (CMO) estimates that they will sell 400 units a year for 4 years at a price of $2,000 each. The chief operations officer ( COO) estifnates that the variable costs to build these will be 83% of revenue. The COO says the company will need to buy an assembly line to make these. The assembly line costs $425,000 and has a shipping cost of $10,000. The COO adds that they will need to purchase an additional $25,000 in inventory and accounts payable will increase by $4,500. Once the project ends, they will no longer need additional inventory and will pay the accounts payable balance. The chief financial officer (CFO) The CFO says to use the MACRS 3 year class for depreciation. (These are the same rates as used in the slides.) He estimates that the assembly line will have a salvage value of $12,000. He notes that Starbuck's tax rate is 23.5% and that the normal WACC is 8.2%. The CMO notes that they have done an extensive marketing survey and many Starbucks customers many Starbuck's customers would live to be able to get a quick Starbuck's drink at their local gas station or grocery store. This research is already paid for and cost $55,000. Use the data provided for Starbuck's and their proposed project to answer this question. What is the depreciation expense in year 3 for this project? A. $63,750 B. $65,250 C. $71,250 D. $83,500 QUESTION 4 Use the data provided for Starbuck's and their proposed project to answer this question. What is the revenue in year 1 for this project? A. $417,000 B. $525,000 C. $656,800 D. $800,000 Use the data provided for Starbuck's and their proposed project to answer this question. What are the variable costs in year 2 for this project? A. $418,250 B. $523,750 C. $664,000 D. $710,240 QUESTION 6 Use the data provided for Starbuck's and their proposed project to answer this question. What is the EBIT in year 3 for this project? A. $78,150 B. $37,805 C. 570,750 D. $94,750 We subtract the depreciation expense before we calculate the taxes. True False QUESTION 8 Use the data provided for Starbuck's and their proposed project to answer this question. What are the tax expenses in year 4 of this project? A. $13.500 B. $22,522 C. $24,600 D. $52,000 QUESTION 9 Use the data provided for Starbuck's and their propesed project to answer this question. What are the operating cash flows in year 2? (This is the EBIT (1-T) + Dep. EX) A. $297.650 B. $317,730 C. $150,041 D. $358.045

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts