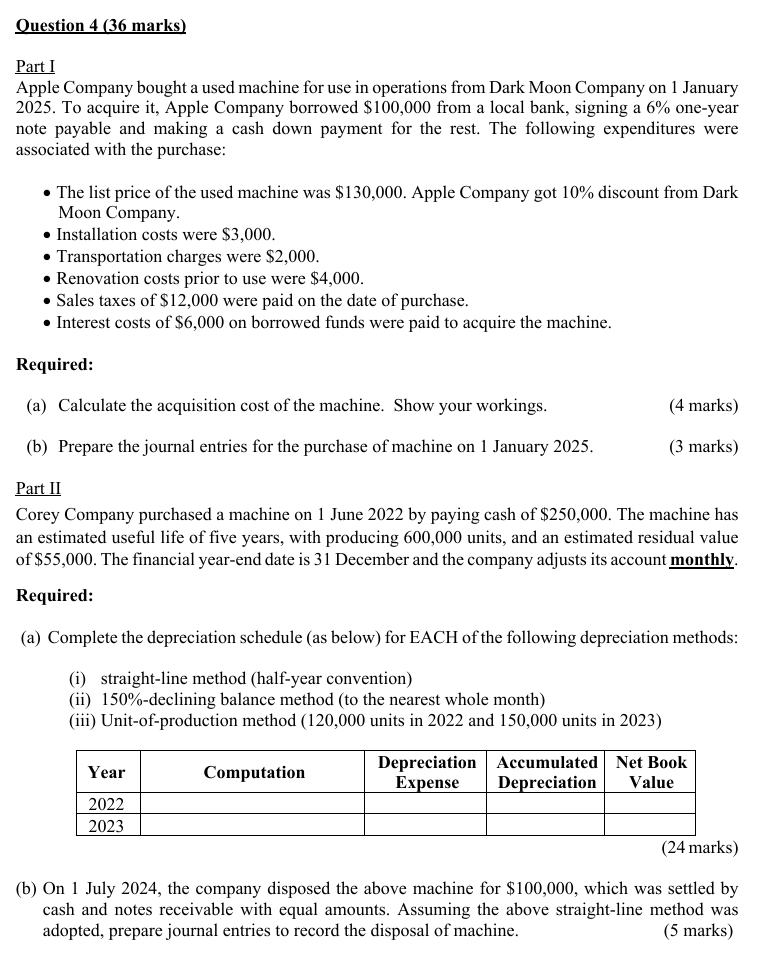

Question: Ouestion 4 ( 3 6 marks ) Part I Apple Company bought a used machine for use in operations from Dark Moon Company on 1

Ouestion marks Part I Apple Company bought a used machine for use in operations from Dark Moon Company on January To acquire it Apple Company borrowed $ from a local bank, signing a oneyear note payable and making a cash down payment for the rest. The following expenditures were associated with the purchase: The list price of the used machine was $ Apple Company got discount from Dark Moon Company. Installation costs were $ Transportation charges were $ Renovation costs prior to use were $ Sales taxes of $ were paid on the date of purchase. Interest costs of $ on borrowed funds were paid to acquire the machine. Required: a Calculate the acquisition cost of the machine. Show your workings. b Prepare the journal entries for the purchase of machine on January Part II Corey Company purchased a machine on June by paying cash of $ The machine has an estimated useful life of five years, with producing units, and an estimated residual value of $ The financial yearend date is December and the company adjusts its account monthly. Required: a Complete the depreciation schedule as below for EACH of the following depreciation methods: i straightline method halfyear conventioniideclining balance method to the nearest whole monthiii Unitofproduction method units in and units in marksb On July the company disposed the above machine for $ which was settled by cash and notes receivable with equal amounts. Assuming the above straightline method was adopted, prepare journal entries to record the disposal of machine.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock