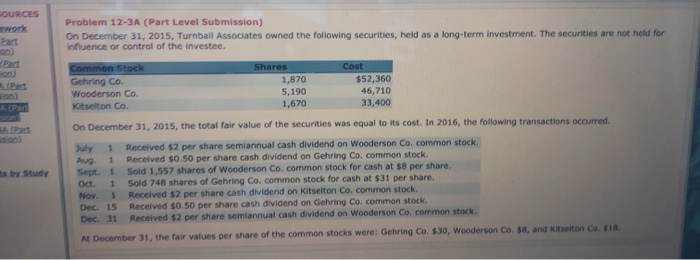

Question: OURCES Problem 12-3A (Part Level Submission) On December 31, 2015, Turnball Associates owned the following securities, held as a long-term investment. The securities are not

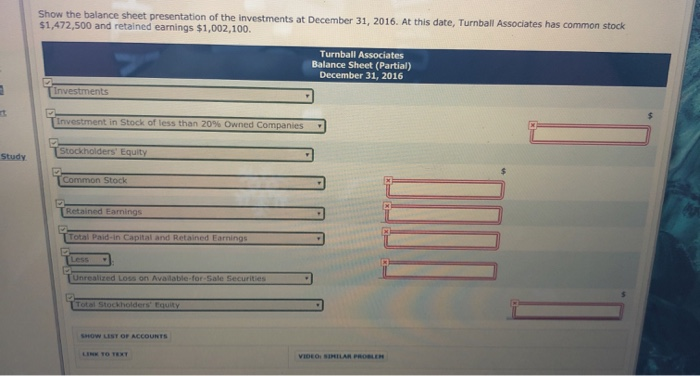

OURCES Problem 12-3A (Part Level Submission) On December 31, 2015, Turnball Associates owned the following securities, held as a long-term investment. The securities are not held to influence or control of the investee. Shares 1.870 Common Stock Gehring Co. Wooderson Co. Kitselton Co. Cost $52,360 46,710 33.400 5,190 1,670 On December 31, 2015, the total fair value of the securities was equal to its cost. In 2016, the following transactions occurred July 1 Received $2 per share semiannual cash dividend on Wooderson Co. common stock Aug 1 Received 50.50 per share cash dividend on Gehring Co. common stock. Sept. 1 Sold 1,557 shares of Wooderson Co. common stock for cash at 58 per share. Oct. 1 Sold 748 shares of Gehring Co. common stock for cash at $31 per share. Nov. 1 Received $2 per share cash dividend on kitselton Co. common stock. Dec. 15 Received $0.50 per share cash dividend on Gehring Co. common stock Dec. 31 Received $2 per share semiannual cash dividend on Wooderson Co. common stock. A December 31, the raw values per share of the common stocks were Gehring Co. $30, Wooderson Co. and Show the balance sheet presentation of the investments at December 31, 2016. At this date, Turnball Associates has common stock $1,472,500 and retained earnings $1,002,100. Turnball Associates Balance Sheet (Partial) December 31, 2016 Investments Investment in Stock of less than 20% Owned Companies Stockholders' Equity Study Common Stock TRetained Eamings TTotal Paid in Capital and retained Earnings TUnrealized Loss on Available for Sale Securities TTotal Stockholders' Equity SHOW LIST OF ACCOUNTS VIDEO SIMILAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts