Question: ournalizing payroll transactions M Master Problem Payroll Inc completed payroll transactions during the period January 1 to February 15 of the current otal tax rates

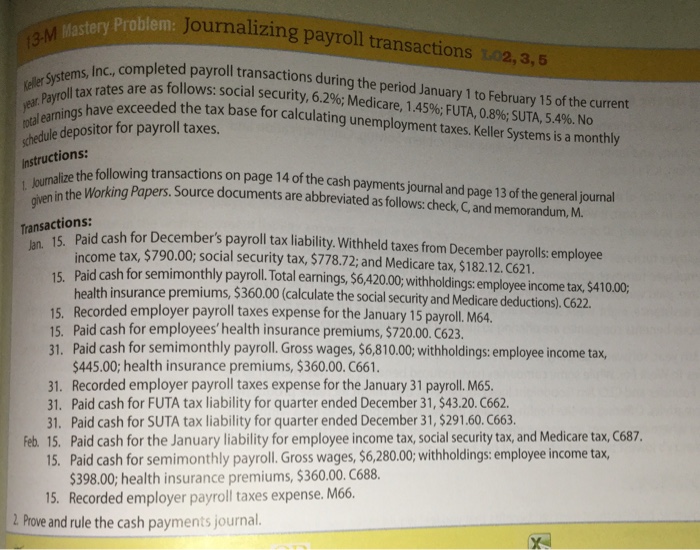

ournalizing payroll transactions M Master Problem Payroll Inc completed payroll transactions during the period January 1 to February 15 of the current otal tax rates are as follow social security, Medicare, FUTA, 08%; No earnings have exceeded the tax base for calculating SUTA, unemployment taxes. Keller systems is a monthly structions: the following transactions on page 14 of the cash payments journal and page 13 journal Working papers. Source documents are abbreviated memorandum, M Transactions 15. Paid cash for Decembers payroll tax liability.Withheld taxes from December payrolls: employee income tax, social security Medicare tax, $182.12.C621 15. Paid cash for semimonthly payroll Total earnings, $6,420.00, withholdings employee income tax,$410.00. 15. health insurance premiums, $360.00 (calculate the social security Medicare deductions). C622. Recorded employer and payroll taxes expense for the January 15 15. for employees' health insurance premiums, $720.00. C623. 31. paid cash for semimonthly payroll. Gross wages, $6,810.00, withholdings employee income tax, $445.00; health insurance premiums, $360.00. C661. 31. Recorded employer payroll taxes expense for the January 31 payroll. M65. 31. Paid cash for FUTA tax liability for quarter ended December 31, $43.20. C662. 31. Paid cash for SUTA tax liability for quarter ended December 31, $291.60.C663 Feb. 15. Paid cash for the January liability for employee income tax, social security tax, and Medicare tax,C687 15. Paid cash for semimonthly payroll. Gross wages, $6,280.00; withholdings: employee income tax, $398.00, health insurance premiums, $360.00. C688 5. Recorded employer payroll taxes expense. M66. Prove and rule the cash payments journal ournalizing payroll transactions M Master Problem Payroll Inc completed payroll transactions during the period January 1 to February 15 of the current otal tax rates are as follow social security, Medicare, FUTA, 08%; No earnings have exceeded the tax base for calculating SUTA, unemployment taxes. Keller systems is a monthly structions: the following transactions on page 14 of the cash payments journal and page 13 journal Working papers. Source documents are abbreviated memorandum, M Transactions 15. Paid cash for Decembers payroll tax liability.Withheld taxes from December payrolls: employee income tax, social security Medicare tax, $182.12.C621 15. Paid cash for semimonthly payroll Total earnings, $6,420.00, withholdings employee income tax,$410.00. 15. health insurance premiums, $360.00 (calculate the social security Medicare deductions). C622. Recorded employer and payroll taxes expense for the January 15 15. for employees' health insurance premiums, $720.00. C623. 31. paid cash for semimonthly payroll. Gross wages, $6,810.00, withholdings employee income tax, $445.00; health insurance premiums, $360.00. C661. 31. Recorded employer payroll taxes expense for the January 31 payroll. M65. 31. Paid cash for FUTA tax liability for quarter ended December 31, $43.20. C662. 31. Paid cash for SUTA tax liability for quarter ended December 31, $291.60.C663 Feb. 15. Paid cash for the January liability for employee income tax, social security tax, and Medicare tax,C687 15. Paid cash for semimonthly payroll. Gross wages, $6,280.00; withholdings: employee income tax, $398.00, health insurance premiums, $360.00. C688 5. Recorded employer payroll taxes expense. M66. Prove and rule the cash payments journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts