Question: Outline 3 different comparisons an analyst may include when evaluating the performance of a company. (Not asking for specific ratios) You have been asked

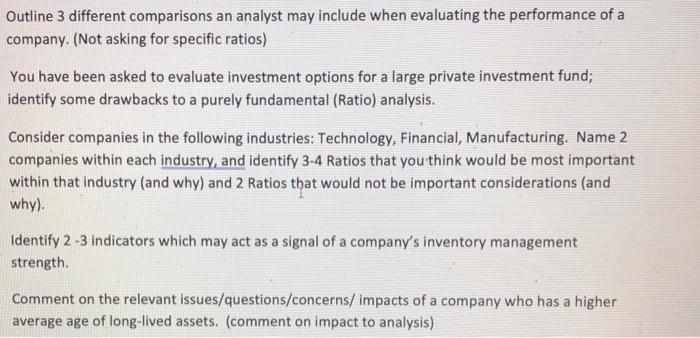

Outline 3 different comparisons an analyst may include when evaluating the performance of a company. (Not asking for specific ratios) You have been asked to evaluate investment options for a large private investment fund; identify some drawbacks to a purely fundamental (Ratio) analysis. Consider companies in the following industries: Technology, Financial, Manufacturing. Name 2 companies within each industry, and identify 3-4 Ratios that you think would be most important within that industry (and why) and 2 Ratios that would not be important considerations (and why). Identify 2 -3 indicators which may act as a signal of a company's inventory management strength. Comment on the relevant issues/questions/concerns/ impacts of a company who has a higher average age of long-lived assets. (comment on impact to analysis)

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

1 Ans Three differrent comparisions an analyst may include when evaluating the performance of a company are a Comparision through ratios using ratio analysis can be a great way to evaluate the way a c... View full answer

Get step-by-step solutions from verified subject matter experts