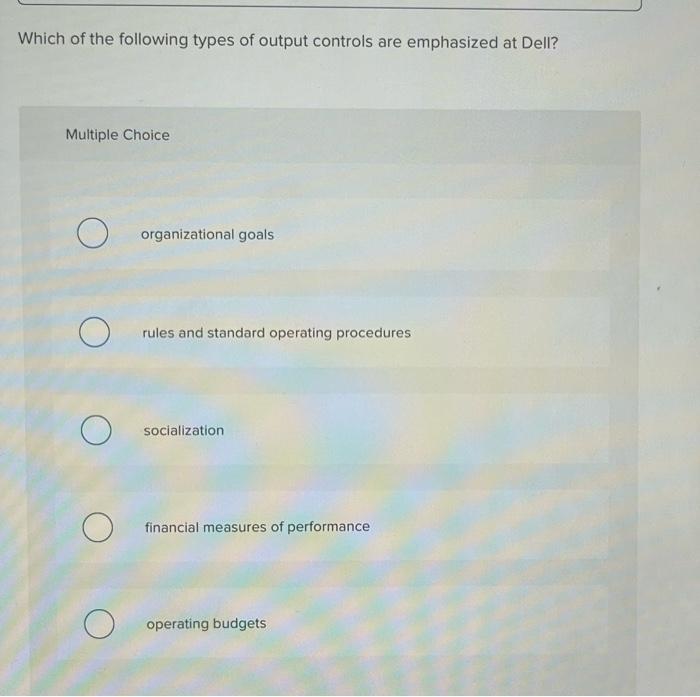

Question: Output Controls All managers develop a system of output control for their organizations. First, they choose the goals, output performance standards, or targets that they

Output Controls

All managers develop a system of output control for their organizations. First, they choose the goals, output performance standards, or targets that they think will best result in efficiency, quality, innovation, and responsiveness to customers. Then, they measure to see whether the performance goals and standards are being achieved at the corporate, divisional, functional, and individual employee levels. Top managers are most concerned with the organizations overall performance and use various financial measures to evaluate it. The most common financial measures are profit ratios, liquidity ratios, leverage ratios, and activity ratios.

The following case involving Dell will demonstrate the importance of financial controls. You will see how a knowledge of a company's finances is important not only for top management but for all workers in a company. This case shows the positive outcomes that can result from ensuring that workers understand how their actions affect the company's bottom line.

Read the case below and answer the questions that follow.

You might think financial control is the province of top managers, that employees lower in the organization don't need to worry about the numbers or about how their specific activities affect those numbers. However, some top managers make a point of showing employees exactly how their activities affect financial measures, and they do so because employees' activities directly affect a company's costs and its sales revenues. One of those managers is Michael Dell.

Dell, the founder and CEO of Dell Inc., goes to enormous lengths to convince employees that they need to watch every dime spent in making, selling, and servicing the PCs that have made his company so prosperous. Dell believes all his managers need to have at their fingertips detailed information about Dell's cost structure, including assembly costs, selling costs, and after-sales costs, in order to maximize efficiency. Another good reason for disseminating financial information throughout the company is that Dell puts a heavy emphasis on the operating margin financial ratio in measuring his company's performance. Dell doesn't care about how much profits or sales are growing individually; he cares about how these two figures work together because only if profits are growing faster than sales is the company increasing its long-run profitability by operating more efficiently and effectively.

He insists that his managers search for every way possible to reduce costs. Managers also must focus on customer satisfaction and then help employees learn how to achieve these goals. At Dell's boot camp for new employees in Austin, Texas, he has been known to bring financial charts that show employees how each minute spent on performing some job activity, or how each mistake made in assembling or packing a PC, affects the bottom-line. Dell's repeated efforts to reduce costs and build customer loyalty boosted his company's efficiency and operating margins. As the level of competition in Dells industry continues to grow, Dells competitors have adopted the practice of helping employees to understand how their specific behaviors affect their companies financial performance.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts