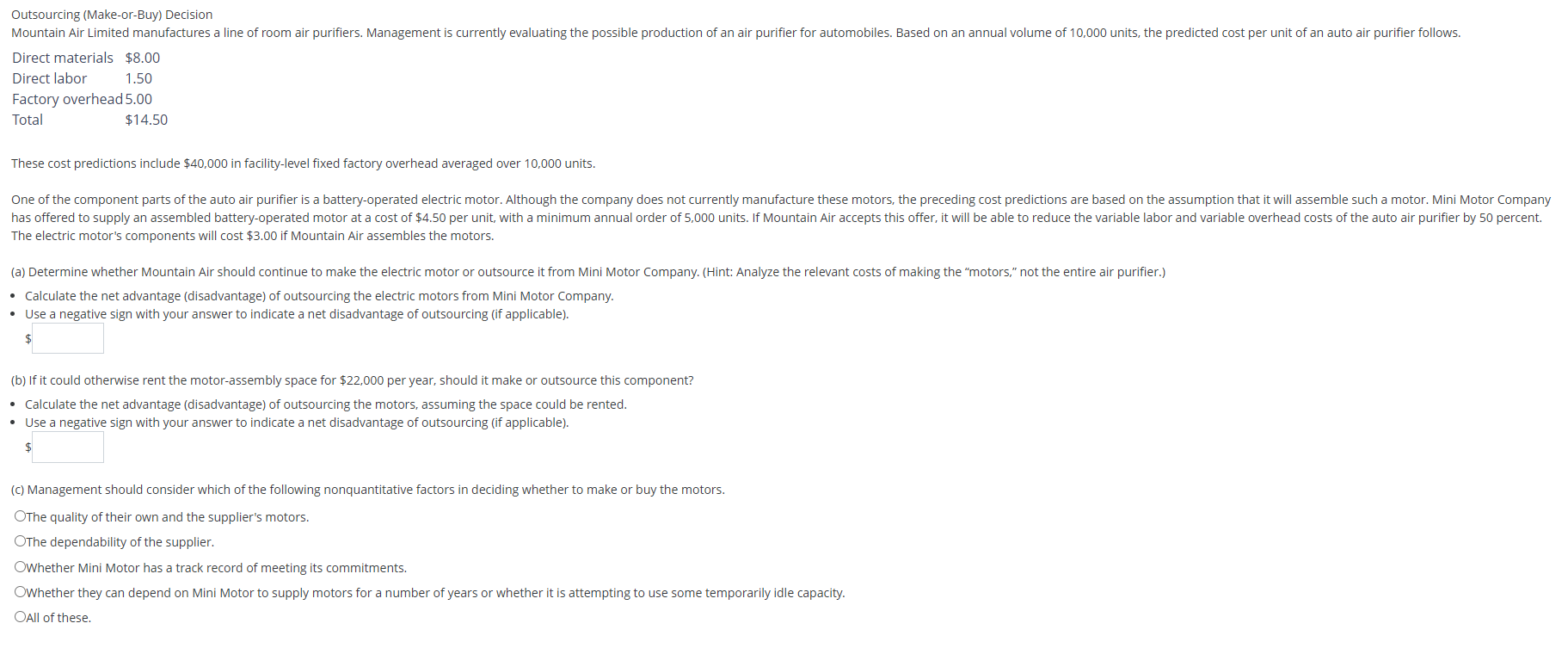

Question: Outsourcing ( Make - or - Buy ) Decision Direct materials $ 8 . 0 0 Direct labor , 1 . 5 0 Factory overhead

Outsourcing MakeorBuy Decision

Direct materials $

Direct labor

Factory overhead

Total $

These cost predictions include $ in facilitylevel fixed factory overhead averaged over units.

The electric motor's components will cost $ if Mountain Air assembles the motors.

Calculate the net advantage disadvantage of outsourcing the electric motors from Mini Motor Company.

Use a negative sign with your answer to indicate a net disadvantage of outsourcing if applicable

b If it could otherwise rent the motorassembly space for $ per year, should it make or outsource this component?

Calculate the net advantage disadvantage of outsourcing the motors, assuming the space could be rented.

Use a negative sign with your answer to indicate a net disadvantage of outsourcing if applicable

$

c Management should consider which of the following nonquantitative factors in deciding whether to make or buy the motors.

he quality of their own and the supplier's motors.

he dependability of the supplier.

OWhether Mini Motor has a track record of meeting its commitments.

Whether they can depend on Mini Motor to supply motors for a number of years or whether it is attempting to use some temporarily idle capacity.

All of these.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock