Question: . Overcollateralization refers to practice with mortgage backed security pools whereby additional mortgages are pledged to the pool, above and beyond the stated principal amount

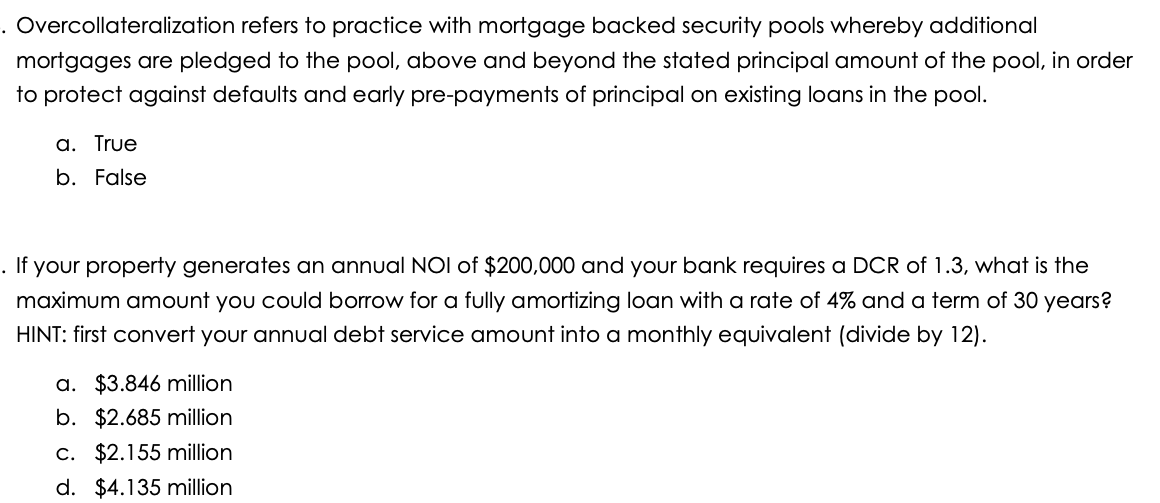

. Overcollateralization refers to practice with mortgage backed security pools whereby additional mortgages are pledged to the pool, above and beyond the stated principal amount of the pool, in order to protect against defaults and early pre-payments of principal on existing loans in the pool. a. True b. False . If your property generates an annual NOI of $200,000 and your bank requires a DCR of 1.3, what is the maximum amount you could borrow for a fully amortizing loan with a rate of 4% and a term of 30 years? HINT: first convert your annual debt service amount into a monthly equivalent (divide by 12). a. $3.846 million b. $2.685 million c. $2.155 million d. $4.135 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts