Question: overhead sing onal costing and ABC 3 AP E17.10 Kragan Clothing Company manufactures its own designed and labeled athletic wear and sells its products through

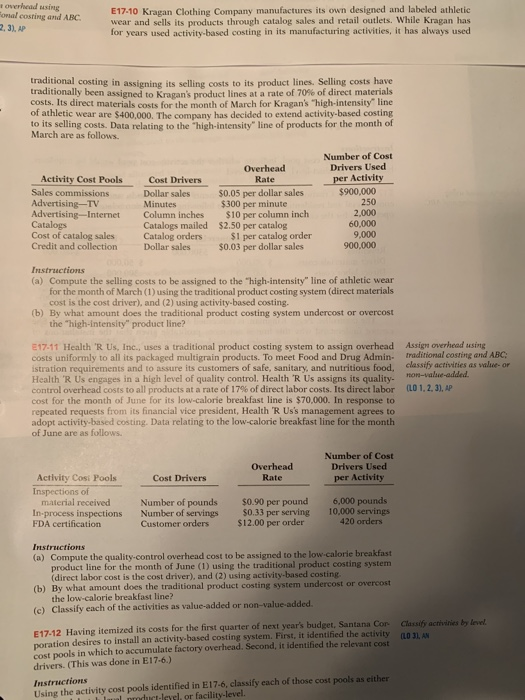

overhead sing onal costing and ABC 3 AP E17.10 Kragan Clothing Company manufactures its own designed and labeled athletic wear and sells its products through catalog sales and retail outlets. While Kragan has for years used activity-based costing in its manufacturing activities, it has always used traditional costing in assigning its selline costs to its product lines. Selling costs have traditionally been assigned to Kragan's product lines at a rate of 70% of direct materials costs. Its direct materials costs for the month of March for Kragan's "high-intensity" line of athletic wear are $400.000. The company has decided to extend activity-based costing to its selling costs. Data relating to the "high-intensity line of products for the month of March are as follows. Activity Cost Pools Sales commissions Advertising-TV Advertising --Internet Catalogs Cost of catalog sales Credit and collection Cost Drivers Dollar sales Minutes Column inches Catalogs mailed Catalog orders Dollar sales Overhead Rate $0.05 per dollar sales $300 per minute $10 per column inch $2.50 per catalog S1 per catalog order $0.03 per dollar sales Number of Cost Drivers Used per Activity $900,000 250 2.000 60,000 9,000 900,000 Instructions (a) Compute the selling costs to be assigned to the "high-intensity" line of athletic wear for the month of March (1) using the traditional product costing system (direct materials cost is the cost driver), and (2) using activity-based costing. (b) By what amount does the traditional product costing system undercost or overcost the "high-Intensity product line? E17.11 Health 'R Us, Inc., uses a traditional product costing system to assign overhead costs uniformly to all its packaged multigrain products. To meet Food and Drug Admin. istration requirements and to assure its customers of safe, sanitary and nutritious food, Health 'R Us engages in a high level of quality control. Health 'R Us assigns its quality. control overhead costs to all products at a rate of 17% of direct labor costs. Its direct labor cost for the month of June for its low-calorie breakfast line is $70,000. In response to repeated requests from its financial vice president, Health R Us's management agrees to adopt activity based costing. Data relating to the low-calorie breakfast line for the month of June are as follows Assign overhead sing Traditional costing and ABC) classily activities as w e or Ron-value-added. (LO 1,2,3), AP Overhead Rate Number of Cost Drivers Used per Activity Cost Drivers Activity Cosi Pools Inspections of material received In-process inspections FDA certification Number of pounds Number of servings Customer orders $0.90 per pound $0.33 per serving $12.00 per order 6,000 pounds 10.000 servings 420 orders Instructions (a) Compute the quality control overhead cost to be assigned to the low-calorie breakfast product line for the month of June (1) using the traditional product costing system (direct labor cost is the cost driver), and (2) using activity-based costine (b) By what amount does the traditional product costing system undercost or overcost the low calorie breakfast line? (c) Classify each of the activities as value-added or non-value-added E 17.12 Having itemized its costs for the first quarter of next year's budget, Santana Corclay paration desires to install an activity-based costing system. First, it identified the activity cost pools in which to accumulate factory overhead. Second, it identified the relevant cost drivers. (This was done in E17-6.) Instructions Using the activity cost pools identified in E17-6, classify each of those cost pools as the melor facility-level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts