Question: Over-the-Top Technologies (OTT) operates a computer repalr and web consulting business. News Now (NN) publishes a local newspaper. The two companles entered Into the following

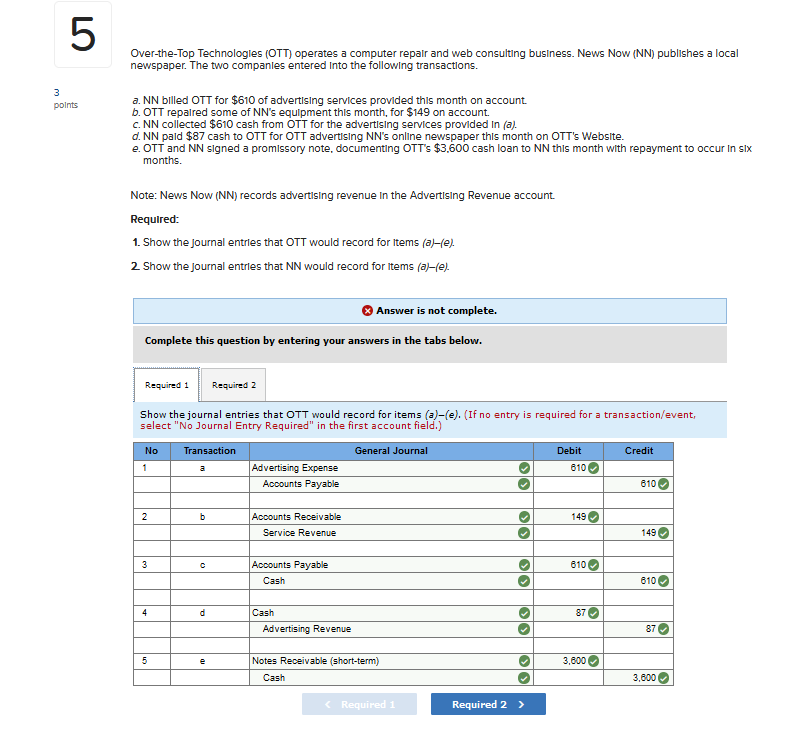

Over-the-Top Technologies (OTT) operates a computer repalr and web consulting business. News Now (NN) publishes a local newspaper. The two companles entered Into the following transactions. a. NN billed OTT for $610 of advertising services provided this month on account. b. OTT repalred some of NN's equlpment this month, for \$149 on account. c. NN collected $610 cash from OTT for the advertising services provided In (a). d. NN pald $87 cash to OTT for OTT advertising NN's online newspaper this month on OTT's Website. e. OTT and NN signed a promissory note, documenting OTT's $3,600 cash loan to NN this month with repayment to occur In six months. Note: News Now (NN) records advertising revenue In the Advertising Revenue account. Required: 1. Show the journal entrles that OTT would record for items (a)-(e). 2 Show the journal entrles that NN would record for items (a)-(e). Answer is not complete. Complete this question by entering your answers in the tabs below. Show the journal entries that OTT would record for items (a)-(e). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. Complete this question by entering your answers in the tabs below. Show the journal entries that NN would record for items (a) -(e). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts