Question: overvalued or undervalued for the 4th question too A stock trading at a price below its intrinsic value is considered to be undervalued. A stock

overvalued or undervalued for the 4th question too

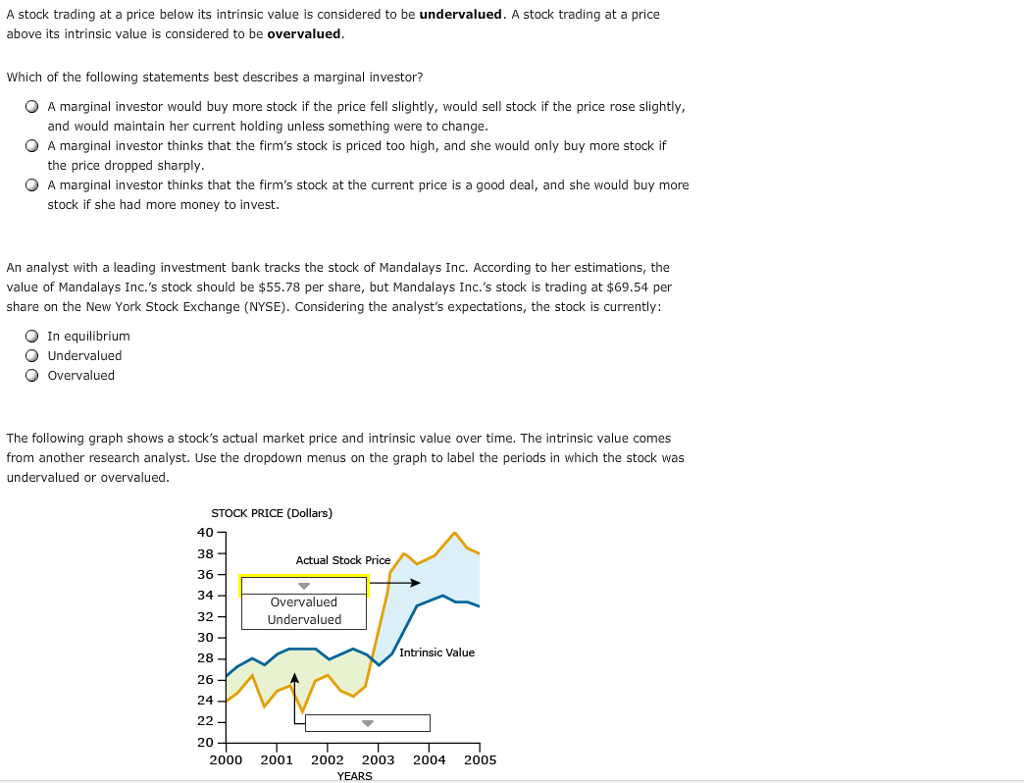

A stock trading at a price below its intrinsic value is considered to be undervalued. A stock trading at a price above its intrinsic value is considered to be overvalued. Which of the following statements best describes a marginal investor? O A marginal investor would buy more stock if the price fell slightly, would sell stock if the price rose slightly, and would maintain her current holding unless something were to change. O A marginal investor thinks that the firm's stock is priced too high, and she would only buy more stock if the price dropped sharply Q A marginal investor thinks that the firm's stock at the current price is a good deal, and she would buy more stock if she had more money to invest. An analyst with a leading investment bank tracks the stock of Mandalays Inc. According to her estimations, the value of Mandalays Inc.'s stock should be $55.78 per share, but Mandalays Inc.'s stock is trading at $69.54 per share on the New York Stock Exchange (NYSE). Considering the analyst's expectations, the stock is currently: O In equilibrium O Undervalued O Overvalued The following graph shows a stock's actual market price and intrinsic value over time. The intrinsic value comes from another research analyst. Use the dropd menus on the graph to label the periods in which the stock was own undervalued or overvalued. STOCK PRICE (Dollars 40 38 Actual Stock Price 36 34 Overvalued 32 Undervalued 30 Intrinsic Value 28 26 24 20 2000 2001 2002 2003 2004 2005 YEARS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts