Question: Overview For the final project, you will use the scenario provided below. You will use financial information from your selected company to prepare a financial

Overview

For the final project, you will use the scenario provided below. You will use financial information from your selected company to prepare a financial analysis report. Your analysis should include the background calculations and managerial analysis for each topic: time value of money, stock and bond valuation, and capital budgeting. You will also discuss macroeconomic variables (i.e., interest rates, inflation, unemployment, and so forth) that might impact your selected company's financial decision-making and strategic objectives. These topics will be covered over four milestones to be submitted throughout the course before you submit the final project. While these elements may seem separate and unrelated, they will present a well-rounded view of your selected company's finances.

In this milestone, using the financial information you prepared from the company you selected from the first tab of the Final Project Student Spreadsheet, you will submit a draft of the Macroeconomic Items section of the final project, along with your supporting explanations.

Scenario

In this project, you will step into the role of a financial analyst tasked with conducting a comprehensive financial analysis for a potential corporate investment opportunity. Your goal is to create a detailed financial analysis report that will guide the investment decision-making process for the corporation you select from the Final Project Student Spreadsheet, which is linked in the What to Submit section.

You have been hired by a prominent financial consulting firm known for its expertise in providing data-driven insights to corporations seeking to make informed investment decisions. Your firm has a reputation for delivering accurate financial analyses that aid companies in identifying profitable investment opportunities.

Prompt

Provide an explanation of the impact of external factors on the financial position of your selected company. Use the Interest Rates Implications tab in the Final Project Student Spreadsheet to demonstrate the implications of interest rate changes on at least one of the calculations you performed in Milestone One.

Specifically, the followingcritical elementsmust be addressed:

- Macroeconomic Items: The CEO of your selected company is convinced that financial analysis should hinge only on what is happening internally within the company. Convince the CEO otherwise based on the following:

- Analyze theimplicationsof interest rate changes on any of your calculations. Support your claims.

- Determine how an issue in the overallstock market?negative or positive?might impact the company's stock valuation numbers, other financial variables, or its overall portfolio management. Support your response with evidence through research, references, and citations using proper APA style.

- Analyze the impact of anyexternal factor(i.e., external to the company) discussed throughout the course on the company's financial position. Technological factors, competitive factors, and global factors are examples of external factors. Justify your reasoning through research, references, and citations using proper APA style.

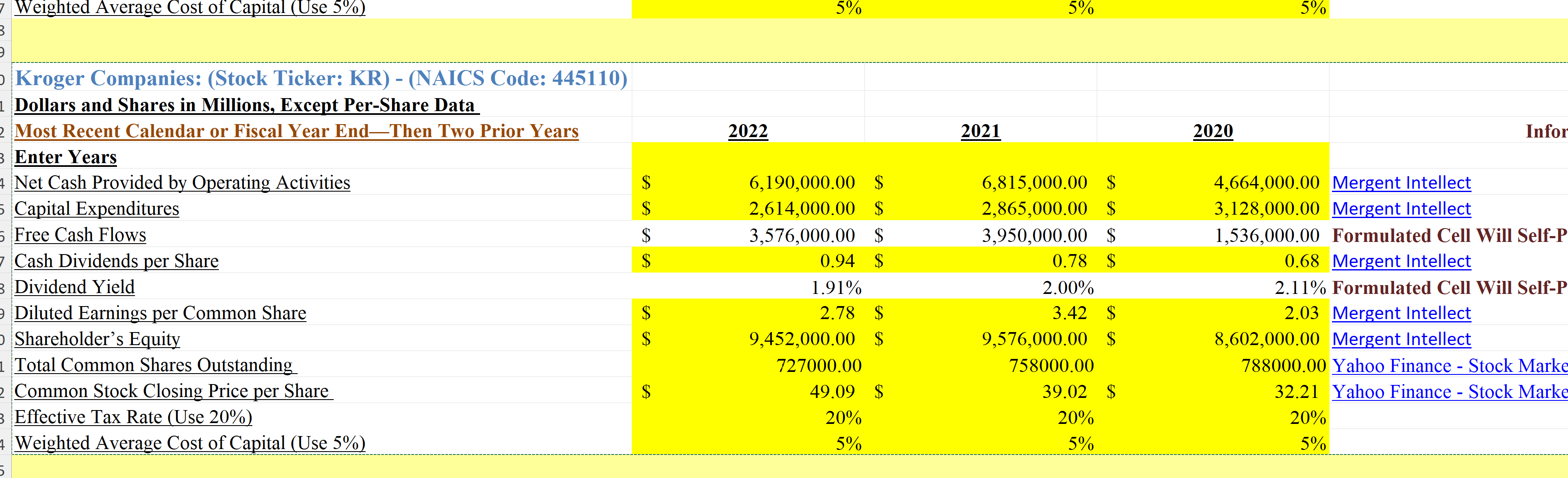

| Milestone One: Time Value of Money (Fill in the yellow cells) | Instructions and Explanations | |||||||||||||

| * Dollar amounts are in millions $ | ||||||||||||||

| Question 1. | Free cash flows (FCF), for this exercise is the difference between cash generated from operating income minus capital expenses at the end of your company's fiscal or calendar year. The present value of free cash flows is one method of determining a company's value to a potential buyer. Note: For Milestone One, please use the free cash flows shown for your selected company on the List of Companies tab of this Excel workbook. Use 5% as the interest rate for these questions. | |||||||||||||

| Interest Rate | 5% | Most Recent Year | ||||||||||||

| FCF - Years | ||||||||||||||

| FCF in dollars* | $ - | $ - | $ - | |||||||||||

| Pv* | $0.00 | $0.00 | $0.00 | |||||||||||

| Total Pv* | $ - | |||||||||||||

| *In millions | ||||||||||||||

| Question 2. | Interest Rate | 5% | Most Recent Year | |||||||||||

| FCF - Years | For the purpose of this exercise, what will happen to the total PV if your selected company's free cash flows for each year reported in Question 1 were reduced by 10%? | |||||||||||||

| FCF in dollars* | $ - | $ - | $ - | |||||||||||

| Pv* | $0.00 | $0.00 | $0.00 | |||||||||||

| Total Pv* | $ - | |||||||||||||

| *In millions | ||||||||||||||

| Question 3. | Interest Rate | 9% | Required Rate of Return for Risk Associated With Projected Future Three Year's Free Cash Flows. | 5% | ||||||||||

| Most Recent Year's Cash Flow fom Queston 1. | ||||||||||||||

| FCF - Years | Your selected company isprojecting that free cash flows for the next three (3) years will increase by 3% annually. Using the Most Recent Year's free cash flows from Question 1 above, increase each of the future free cash flows by 3%(will self-populate in the yellow highlighted cells). As there is a chance that these increases may not occur as projected, a buyer who may be willing to purchase the company before the increases occur, will account for this risk by using a required rate of return of 9%. What price would the potential buyer be willing to pay based upon the known free cash flows and the future projected free cash flows? | |||||||||||||

| FCF in dollars* | $ - | $ - | $ - | $ - | ||||||||||

| Pv* | $ - | $ - | $ - | |||||||||||

| *In millions | ||||||||||||||

| Total Pv* | $ - | This is the Company Value - Selling Price | ||||||||||||

| Milestone Two: Stock Valuation and Bond Issuance (Fill in the yellow cells) | Instructions and Explanations | ||||||||||

| PART I: STOCK VALUATION | PART I: STOCK VALUATION | ||||||||||

| Read the explanations to the right of the calculation cells for specific information on the data. | |||||||||||

| Question 1: Initial Stock Valuation | |||||||||||

| Year | Cash Div/Share ($) | Dividend Yield | Stockholder's Equity (in millions) | Stock Price | Total Shares Outstanding (millions of shares) | Note: Use and enter the fiscal or year-end financial data for yourselected company and enter the appropriate data into each yellow highlighted cell. | |||||

| $ - | 0% | $ - | $ - | 0 | |||||||

| $ - | 0% | $ - | $ - | 0 | |||||||

| $ - | 0% | $ - | $ - | 0 | |||||||

| Question 2. Stock Valuation?The New Dividend Yield if the Company Increased Its Dividend Per Share by 1.75 | |||||||||||

| Use the numbers from Question 1 as your basis to calculate these questions. | |||||||||||

| Year | Cash Div/Share ($) +1.75 | Dividend Yield | Stockholder's Equity (in millions) | Stock Price | Total Shares Outstanding (millions of shares) | Note: Stock price for your selected company is found in your selected company's spreadsheet. | |||||

| $ - | #DIV/0! | 0 | $ - | 0 | |||||||

| $ - | #DIV/0! | 0 | $ - | 0 | |||||||

| $ - | #DIV/0! | 0 | $ - | 0 | |||||||

| Question 3. The Dividend Yield, Cash Dividend Per Share, Stock Price, and Total Shares Outstanding After the Stock Split Occurs | |||||||||||

| Use the numbers from Question 1 to calculate these questions. | |||||||||||

| Year | Cash Div/Share ($) | Dividend Yield | Stockholder's Equity (in millions) | Stock Price | Total Shares Outstanding (millions of shares) | Stockholder's Equity = Assets - Liabilities. This represents the ownership of a corporations. Owners are called "stockholders" because they hold stocks or shares of the company. The main goal of every corporate manager is to generate shareholder value. Shareholder Equity is also known as Stockholder Equity and can be found for your selected company in the List of Companies tab in this spreadsheet. | |||||

| $ - | 0.00% | 0 | $ - | 0 | |||||||

| $ - | 0.00% | 0 | $ - | 0 | |||||||

| $ - | 0.00% | 0 | $ - | 0 | |||||||

| Return on Investment (ROI) : Using the formula: ROI = ((Dividend ) + (New Price - Old Price) / Old Price)) | |||||||||||

| Question 4. The Rate of Return on Investment Based on the Cash Div/Share ($) and Stock Price You Used in Question 1 | |||||||||||

| Use the numbers from Question 1 to calculate these questions. | |||||||||||

| Year | Cash Div/Share ($) | Stock Price | Return on Investment | ||||||||

| $ - | $ - | CALCULATE ROI | |||||||||

| $ - | $ - | #DIV/0! | ROI cell is formulated | ||||||||

| $ - | $ - | #DIV/0! | ROI cell is formulated | ||||||||

| PART II: BOND ISSUANCE | PART II: BOND ISSUANCE | ||||||||||

| Newly issued 10-year bond. | Calculate the present value in the four scenarios below. | Bonds are a long-term debt for corporations. By buying a bond, the bond-purchaser lends money to the corporation. The borrower promises to pay a specified interest rate during the bond's lifetime and at maturity, payback the entire future value of the bond. In case of bankruptcy, bondholders have priority over stockholders for any payment distributions. | |||||||||

| 1. The present value of the bond at issuance | For purposes of this exercise, assume that your selected company issued a new 10-year bond for $300,000 on October 1, 2023. The bond will mature on October 1, 2033. The future value of this bond is $300,000. The bond was issued at the latest market rate of 5.0% fixed for 10 years, with interest payments made semi-annually. What is the present value of this bond using the four scenarios in Part II: Bond Issuance? | ||||||||||

| Present Value | PV | $ - | |||||||||

| Periods | N | 0 | Number of semi-annual payments made over 10 years = | (10 X 2) | |||||||

| Interest | I | % | Annual interest rate at issuance paid semi-annually (Annual Interest Rate / 2) | ||||||||

| Payments | PMT | $ - | This bond makes regular semi-annual payments of interest (in dollars). Annual Interest Payment / 2). | ||||||||

| Future Value | FV | $ - | Future value in 10 years?enter as a positive number (Always the Future or Face Value of the Bond) | Bonds = Debt....................Bondholders = Lenders | |||||||

| 2. The present value of the bond if overall rates in the market increased by 2% annually | NOTE: A simple rule to follow: When market rates change, nothing in the original bond's terms change, except you will enter the new market interest rate in place of the interest rate stated at the bond's issuance date. In other words, the future value remains the same, payments remain the same, periods remain the same. When you change the interest rate to reflect the new market rate, the present value of the bond will either increase or decrease. | ||||||||||

| Present Value | PV | $ - | For the purposes of this exercise, assume that the new market rates occur one (1) day after the initial bond is issued. | ||||||||

| Periods | N | 0 | Number of semi-annual payments made over 10 years = | (10 X 2) | |||||||

| Interest | I | % | New annual market interest rate paid semi-annually = (New Annual Rate divided by 2) | ||||||||

| Payments | PMT | $ - | This bond makes regular semi-annual payments of interest (in dollars) = (Dollars Paid Annually divided by 2) | You can either use Excel formulas or the web-based financial calculator provided at the link below. | |||||||

| Future Value | FV | $ - | Future value in 10 years?enter as a positive number = (Always the Future or Face Value of the Bond and Never Changes) | ||||||||

| Arachnoid Finance Calculator | |||||||||||

| 3. The present value of the bond if overall rates in the market decreased by 2% annually | |||||||||||

| Present Value | PV | $ - | Once you have completed these calculations, proceed to write your written analysis | ||||||||

| Periods | N | 0 | Number of semi-annual payments made over 10 years = | (10 X 2) | on your Word Document | ||||||

| Interest | I | % | New annual market interest rate paid semi-annually = (New Annual Rate divided by 2) | ||||||||

| Payments | PMT | $ - | This bond makes regular semi-annual payments of interest (in dollars) = (Dollars Paid Annually divided by 2 and Never Changes) | ||||||||

| Future Value | FV | $ - | Future value in 10 years?enter as a positive number = ( Always the Future or Face Value of the Bond and Never Changes) | ||||||||

| 4. The present value of the bond if overall rates in the market remained the same as at issuance | |||||||||||

| Present Value | PV | $ - | |||||||||

| Periods | N | 0 | Number of semi-annual payments made over 10 years | (10 X 2) | |||||||

| Interest | I | % | Annual market interest rate remains the same as Question 1, paid semi-annually (Annual Rate divided by 2) | ||||||||

| Payments | PMT | $ - | This bond makes regular semi-annual payments of interest (in dollars) (Dollars Paid Annually divided by 2 and Never Changes) | ||||||||

| Future Value | FV | $ - | Future value in 10 years?enter as a positive number (Always the Future or Face Value of the Bond and Never Changes) | ||||||||

| Milestone Three: Capital Budgeting Data (Fill in yellow cells) | Instructions and Explanations | ||||||||||||||

| WACC | For this milestone, you will assume that your selected company is | ||||||||||||||

| As Shown in the Description | considering a potential capital investment for new equipment. | ||||||||||||||

| description under Instructions and Explanations | Choose oneof the three investment options listed below and solve. You will eitherACCEPT orREJECT the proposal. | ||||||||||||||

| Initial Outlay | CF1 | CF2 | CF3 | CF4 | CF5 | ||||||||||

| $0 | 1. Capital Budgeting Example Setup | 2. Capital Budgeting Example Setup | 3. Capital Budgeting Example Setup | ||||||||||||

| Cash Flows (Sales) | $ - | $ - | $ - | $ - | $ - | Initial investment $17,000,000 | Initial investment $65,000,000 | Initial investment $85,000,000 | |||||||

| - Operating Costs (excluding Depreciation) | $ - | $ - | $ - | $ - | $ - | Straight-line depreciation of 20% | Straight-line depreciation of 20% | Straight-line depreciation of 20% | |||||||

| - Depreciation Rate of 20% (5-Years) | $ - | $ - | $ - | $ - | $ - | Income tax rate = 20% | Income tax rate = 20% | Income tax rate = 20% | |||||||

| Operating Income (EBIT) | $ - | $ - | $ - | $ - | $ - | WACC: use 5% | WACC: use 9% | WACC: use 9% | |||||||

| - Income Tax (use 20%) | $ - | $ - | $ - | $ - | $ - | Cash Flows (sales revenue based upon this | Cash Flows (sales revenue based upon this | Cash Flows (sales revenue based upon this | |||||||

| After-Tax EBIT | $ - | $ - | $ - | $ - | $ - | purchase of new equipment, are projected | purchase of new equipment, are projected | purchase of new equipment, are projected | |||||||

| + Depreciation | $ - | $ - | $ - | $ - | $ - | to be as follows): | to be as follows): | to be as follows): | |||||||

| Cash Flows | $0 | $ - | $ - | $ - | $ - | $ - | CF1: $4,390,000 | CF1: $15,000,000 | CF1: $50,000,000 | ||||||

| CF2: $4,200,000 | CF2: $17,000,000 | CF2: $45,000,000 | |||||||||||||

| Select from drop-down: | CF3: $4,500,000 | CF3: $18,000,000 | CF3: $35,000,000 | ||||||||||||

| NPV | $0 | CF4: $5,000,000 | CF4: $19,000,000 | CF4: $40,000,000 | |||||||||||

| CF5: $4,700,000 | CF5: $18,000,000 | CF5: $35,000,000 | |||||||||||||

| IRR | #NUM! | Operating Costs | Operating Costs | Operating Costs | |||||||||||

| CF1: $700,000 | CF1: $500,000 | CF1: $15,000,000 | |||||||||||||

| CF2: $700,000 | CF2: $500,000 | CF2: $12,000,000 | |||||||||||||

| CF3: $225,000 | CF3: $600,000 | CF3: $11,000,000 | |||||||||||||

| CF4: $350,000 | CF4: $500,000 | CF4: $13,000,000 | |||||||||||||

| CF5: $400,000 | CF5: $500,000 | CF5: $13,000,000 | |||||||||||||

| Initial Investment?always entered as a negative number. Companies have to invest money ("payout" funds) in order to gain the future benefit. | |||||||||||||||

| WACC?why do we use WACC rate for new projects? If the project's IRR doesn't earn a return equal to or higher than WACC, the corporation should abandon the project and invest money elsewhere. | |||||||||||||||

| Once you have completed these calculations, proceed to write your written analysis. | |||||||||||||||

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts