Question: Overview For this assignment you will be working with one of your colleagues (2 in total). Each student will submit their own response using the

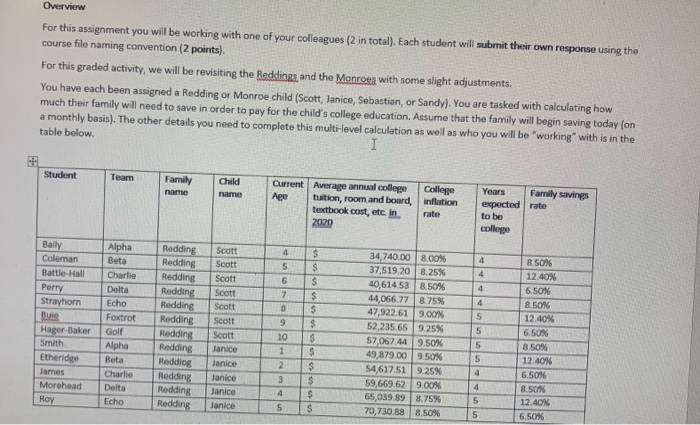

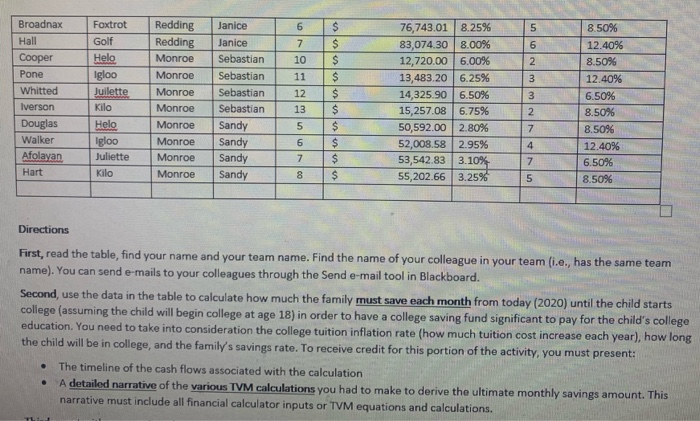

Overview For this assignment you will be working with one of your colleagues (2 in total). Each student will submit their own response using the course file naming convention (2 points) For this graded activity, we will be revisiting the Reddings, and the Monroes with some slight adjustments, You have each been assigned a Redding or Monroe child (Scott, Janice, Sebastian, or Sandy). You are tasked with calculating how much their family will need to save in order to pay for the child's college education. Assume that the family will begin saving today (on a monthly basis). The other details you need to complete this multi-level calculation as well as who you will be working with is in the table below. I Student Team Family name Child name Current Average annual college College Age tuition, room and board, inflation tencbook cost, etc. in rate 2020 Years Family Savings expected rate to be college 4 Scott Scott 4 Scott 4 4 Baily Coleman Battle-Hall Perry Strayhorn Bule Hager-Baker Smith Etheridge James Morehead Roy 4 5 Alpha Beta Charlie Delta Echo Foxtrot Golf Alpha Beta Charlie Delta Echo Redding Redding Redding Redding Redding Redding Redding Redding Reddiog Redding Redding Redding 5 6 7 8 9 19 $ $ $ $ $ $ $ $ $ $ $ $ 34,740.00 8.00% 37,519.20 8.25% 40,614.53 8.50% 44,066.778.75% 47,922.619.00% 52,235.65 9.25% 57,067 44 9.50% 49,879.00 9.50% 54,617.51 9.25% 59,669.629.00% 65,039.89 8.75% 70,730.88 8.50% Scott Scott Scott Scott Janice Janice Janice Janice Janice 5 8.50% 12.40% 6.50N 8.50% 12.40% 6.50% 8 50% 12.40% 6.50% 8.50% 12.40% 6.50% 5 1 2 5 4 4 4 5 5 5 6 5 6 7 10 11 Broadnax Hall Cooper Pone Whitted Iverson Douglas Walker Afolayan Hart 12 Foxtrot Golf Helo Igloo Juilette Kilo Helo Igloo Juliette Kilo Redding Redding Monroe Monroe Monroe Monroe Monroe Monroe Monroe Monroe Janice Janice Sebastian Sebastian Sebastian Sebastian Sandy Sandy Sandy Sandy $ $ $ $ $ $ $ $ $ $ 76,743.01 8.25% 83,074.30 8.00% 12,720.00 6.00% 13,483.20 6.25% 14,325.90 6.50% 15,257.08 6.75% 50,592.00 2.80% 52,008.58 2.95% 53,542.83 3.10% 55,202.66 3.25% 2 3 3 2 7 8.50% 12.40% 8.50% 12.40% 6.50% 8.50% 8.5096 12.40% 6.50% 8.50% 13 5 6 4 7 7 5 8 Directions First, read the table, find your name and your team name. Find the name of your colleague in your team (i.e., has the same team name). You can send e-mails to your colleagues through the Send e-mail tool in Blackboard. Second, use the data in the table to calculate how much the family must save each month from today (2020) until the child starts college (assuming the child will begin college at age 18) in order to have a college saving fund significant to pay for the child's college education. You need to take into consideration the college tuition inflation rate (how much tuition cost increase each year), how long the child will be in college, and the family's savings rate. To receive credit for this portion of the activity, you must present: The timeline of the cash flows associated with the calculation A detailed narrative of the various TVM calculations you had to make to derive the ultimate monthly savings amount. This narrative must include all financial calculator inputs or TVM equations and calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts