Question: Overview: For your final project, the CEO has asked you, the new investment manager of XYZ Tech Company, to produce an investment analysis report describing

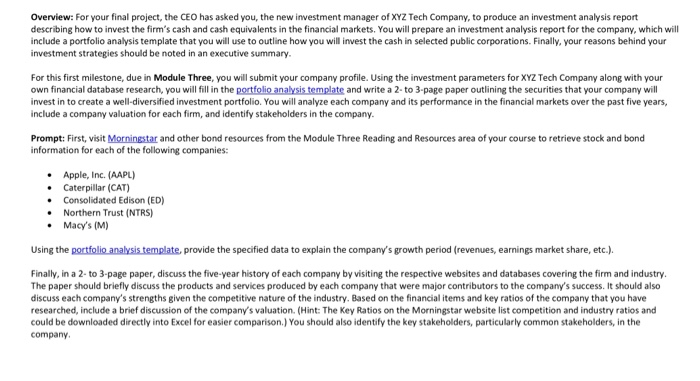

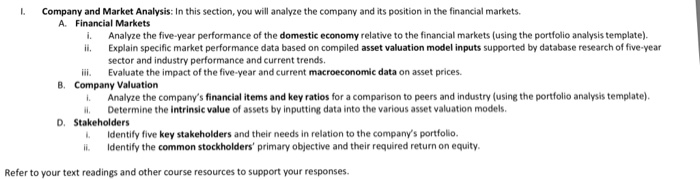

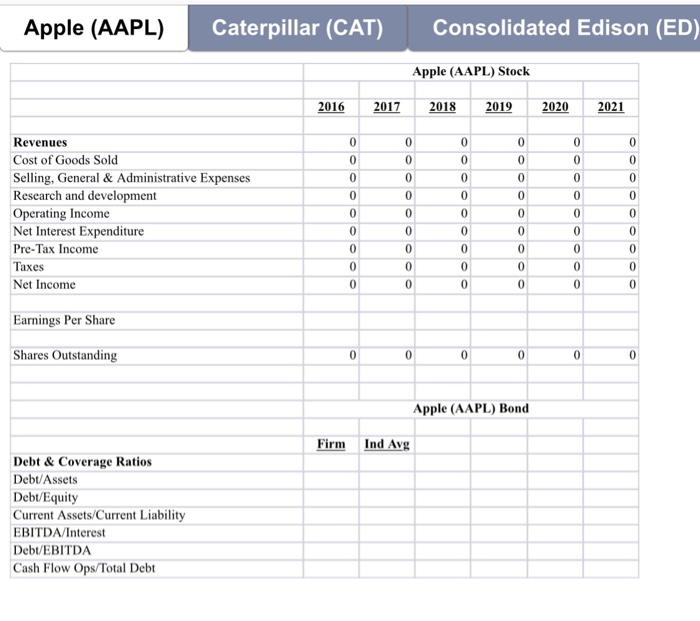

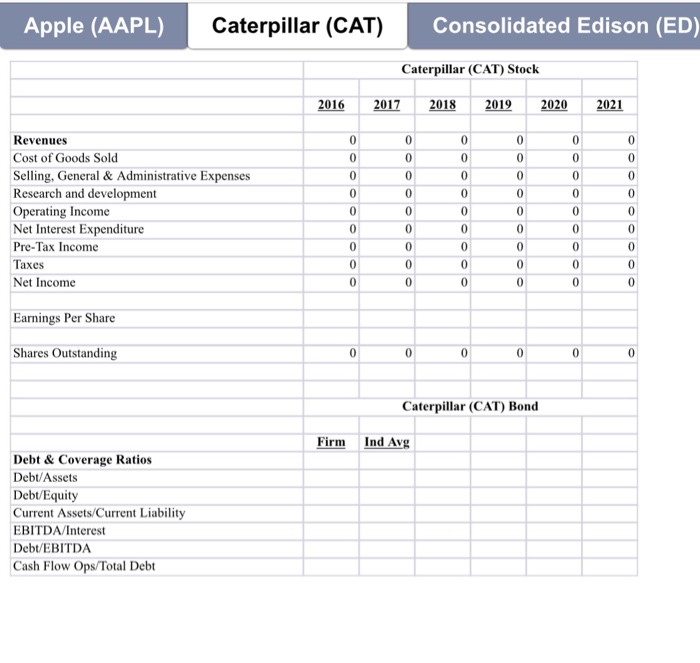

Overview: For your final project, the CEO has asked you, the new investment manager of XYZ Tech Company, to produce an investment analysis report describing how to invest the firm's cash and cash equivalents in the financial markets. You will prepare an investment analysis report for the company, which will include a portfolio analysis template that you will use to outline how you will invest the cash in selected public corporations. Finally, your reasons behind your investment strategies should be noted in an executive summary elin the postolo anabvsis tecmp For this first milestone, due in Module Three, you will submit your company profile. Using the investment parameters for XYZ Tech Company along with your own financial database research, you will fill in the portfolio analysis template and write a 2-to 3-page paper outlining the securities that your company will invest in to create a well-diversified investment portfolio. You will analyze each company and its performance in the financial markets over the past five years, include a company valuation for each firm, and identify stakeholders in the company adis performancein Prompt: First, visit Morningstar and other bond resources from the Module Three Reading and Resources area of your course to retrieve stock and bond information for each of the following companies: Apple, Inc. (AAPL) . Caterpillar (CAT) .Consolidated Edison (ED) Northern Trust (NTRS Macy's (M) Using the portfolio analysis template, provide the specified data to explain the company's growth period (revenues, earnings market share, etc.). Finally, in a 2- to 3-page paper, discuss the five-year history of each company by visiting the respective websites and databases covering the firm and industry The paper should briefly discuss the products and services produced by each company that were major contributors to the company's success. It should also discuss each company's strengths given the competitive nature of the industry. Based on the financial items and key ratios of the company that you have researched, include a brief discussion of the company's valuation. (Hint: The Key Ratios on the Morningstar website list competition and industry ratios and could be downloaded directly into Excel for easier comparison.) You should also identify the key stakeholders, particularly common stakeholders, in the company L Company and Market Analysis: In this section, you will analyze the company and its position in the financial markets. A. Financial Markets Analyze the five-year performance of the domestic economy relative to the financial markets (using the portfolio analysis template) Explain specific market performance data based on compiled asset valuation model inputs supported by database research of five-year sector and industry performance and current trends. i. ii. ii. Evaluate the impact of the five-year and current macroeconomic data on asset prices. i Determine the intrinsic value of assets by inputting data into the various asset valuation models 8. Company Valuation Analyze the company's financial items and key ratios for a comparison to peers and industry (using the portfolio analysis template) D. Stakeholders Identify five key stakeholders and their needs in relation to the company's portfolio ii. Identify the common stockholders' primary objective and their required return on equity. Refer to your text readings and other course resources to support your responses. Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED) Apple (AAPL) Stock 2016 2017 20182019 2020 2021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income Earnings Per Share Shares Outstanding Apple (AAPL) Bond Firm Ind Avg Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Debt/EBITDA Cash Flow Ops/Total Debt Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED) Caterpillar (CAT) Stock 2016 2017 2018201920202021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income Earnings Per Share Shares Outstanding Caterpillar (CAT) Bond Firm Ind Avg Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Debt/EBITDA Cash Flow Ops/Total Debt Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED) Consolidated Edison (ED) Stock 2016 2017 201822020 2021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income 0 0 Earnings Per Share Shares Outstanding Consolidated Edison (ED) Bond Firm Ind Av Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Debt/EBITDA Cash Flow Ops/Total Debt Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED Northern Trust (NTRS) Stock 2016 2017 2018 2019 2020 2021 0 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income 0 Earnings Per Share Shares Outstanding Northern Trust (NTRS) Bond Firm Ind Avg Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Deb/EBITDA Cash Flow Ops/Total Debt Apple (AAPL)Caterpillar (CAT) Consolidated Edison (ED) Macy's (M) Stock 2016 2012018 20120202021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income 0 0 Earnings Per Share Shares Outstanding Northern Trust (NTRS) Bond Firm Ind Avg Debt &Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Deb/EBITDA Cash Flow Ops/Total Debt Overview: For your final project, the CEO has asked you, the new investment manager of XYZ Tech Company, to produce an investment analysis report describing how to invest the firm's cash and cash equivalents in the financial markets. You will prepare an investment analysis report for the company, which will include a portfolio analysis template that you will use to outline how you will invest the cash in selected public corporations. Finally, your reasons behind your investment strategies should be noted in an executive summary elin the postolo anabvsis tecmp For this first milestone, due in Module Three, you will submit your company profile. Using the investment parameters for XYZ Tech Company along with your own financial database research, you will fill in the portfolio analysis template and write a 2-to 3-page paper outlining the securities that your company will invest in to create a well-diversified investment portfolio. You will analyze each company and its performance in the financial markets over the past five years, include a company valuation for each firm, and identify stakeholders in the company adis performancein Prompt: First, visit Morningstar and other bond resources from the Module Three Reading and Resources area of your course to retrieve stock and bond information for each of the following companies: Apple, Inc. (AAPL) . Caterpillar (CAT) .Consolidated Edison (ED) Northern Trust (NTRS Macy's (M) Using the portfolio analysis template, provide the specified data to explain the company's growth period (revenues, earnings market share, etc.). Finally, in a 2- to 3-page paper, discuss the five-year history of each company by visiting the respective websites and databases covering the firm and industry The paper should briefly discuss the products and services produced by each company that were major contributors to the company's success. It should also discuss each company's strengths given the competitive nature of the industry. Based on the financial items and key ratios of the company that you have researched, include a brief discussion of the company's valuation. (Hint: The Key Ratios on the Morningstar website list competition and industry ratios and could be downloaded directly into Excel for easier comparison.) You should also identify the key stakeholders, particularly common stakeholders, in the company L Company and Market Analysis: In this section, you will analyze the company and its position in the financial markets. A. Financial Markets Analyze the five-year performance of the domestic economy relative to the financial markets (using the portfolio analysis template) Explain specific market performance data based on compiled asset valuation model inputs supported by database research of five-year sector and industry performance and current trends. i. ii. ii. Evaluate the impact of the five-year and current macroeconomic data on asset prices. i Determine the intrinsic value of assets by inputting data into the various asset valuation models 8. Company Valuation Analyze the company's financial items and key ratios for a comparison to peers and industry (using the portfolio analysis template) D. Stakeholders Identify five key stakeholders and their needs in relation to the company's portfolio ii. Identify the common stockholders' primary objective and their required return on equity. Refer to your text readings and other course resources to support your responses. Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED) Apple (AAPL) Stock 2016 2017 20182019 2020 2021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income Earnings Per Share Shares Outstanding Apple (AAPL) Bond Firm Ind Avg Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Debt/EBITDA Cash Flow Ops/Total Debt Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED) Caterpillar (CAT) Stock 2016 2017 2018201920202021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income Earnings Per Share Shares Outstanding Caterpillar (CAT) Bond Firm Ind Avg Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Debt/EBITDA Cash Flow Ops/Total Debt Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED) Consolidated Edison (ED) Stock 2016 2017 201822020 2021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income 0 0 Earnings Per Share Shares Outstanding Consolidated Edison (ED) Bond Firm Ind Av Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Debt/EBITDA Cash Flow Ops/Total Debt Apple (AAPL) Caterpillar (CAT) Consolidated Edison (ED Northern Trust (NTRS) Stock 2016 2017 2018 2019 2020 2021 0 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income 0 Earnings Per Share Shares Outstanding Northern Trust (NTRS) Bond Firm Ind Avg Debt & Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Deb/EBITDA Cash Flow Ops/Total Debt Apple (AAPL)Caterpillar (CAT) Consolidated Edison (ED) Macy's (M) Stock 2016 2012018 20120202021 Revenues Cost of Goods Sold Selling, General & Administrative Expenses Research and development Operating Income Net Interest Expenditure Pre-Tax Income Taxes Net Income 0 0 Earnings Per Share Shares Outstanding Northern Trust (NTRS) Bond Firm Ind Avg Debt &Coverage Ratios Debt/Assets Debt/Equity Current Assets/Current Liability EBITDA/Interest Deb/EBITDA Cash Flow Ops/Total Debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts