Question: Overview In the .pdf file named ACCTG 6000 - Practice Problem for Module Five - CASE, I provide background information about the company named OJ

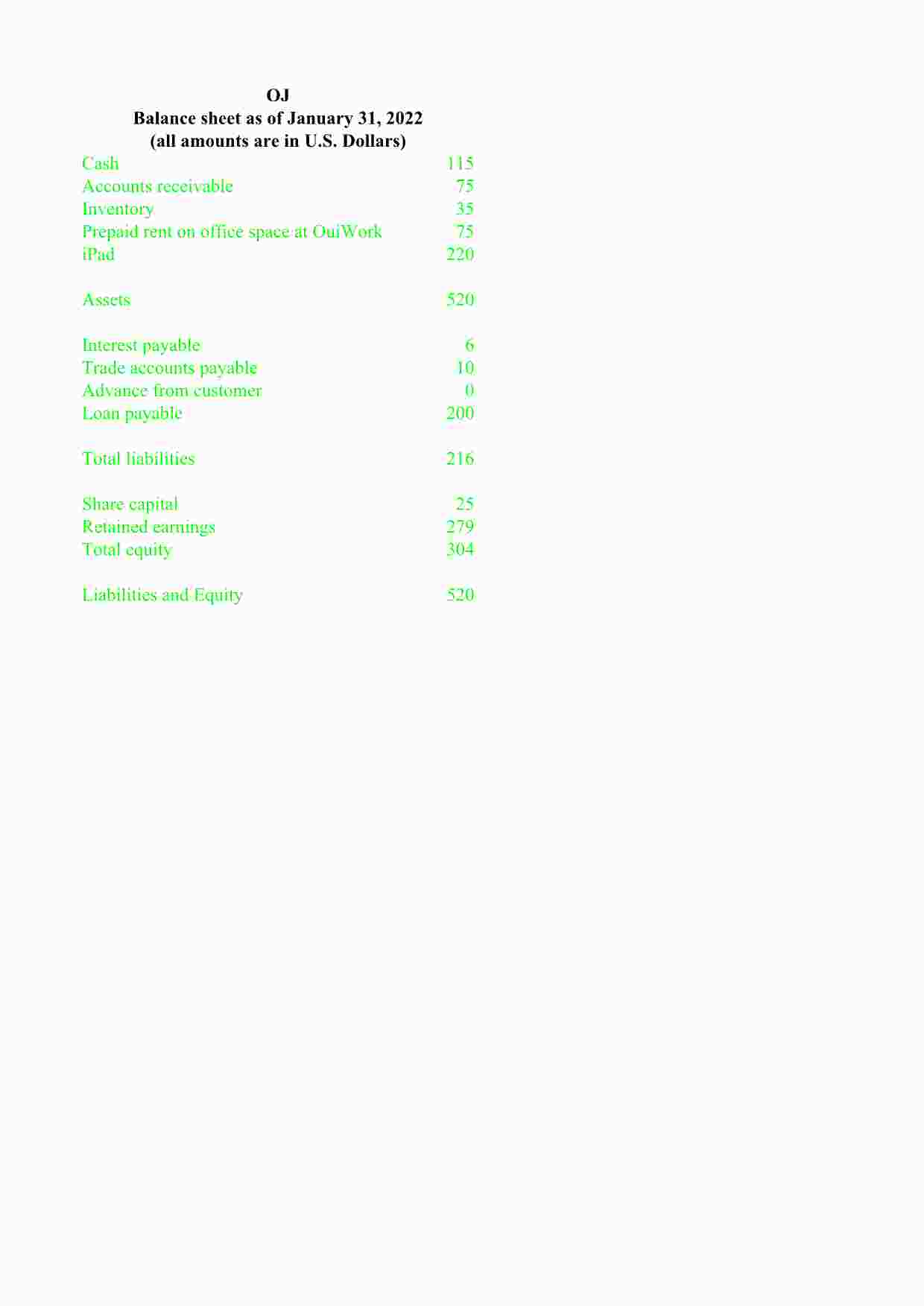

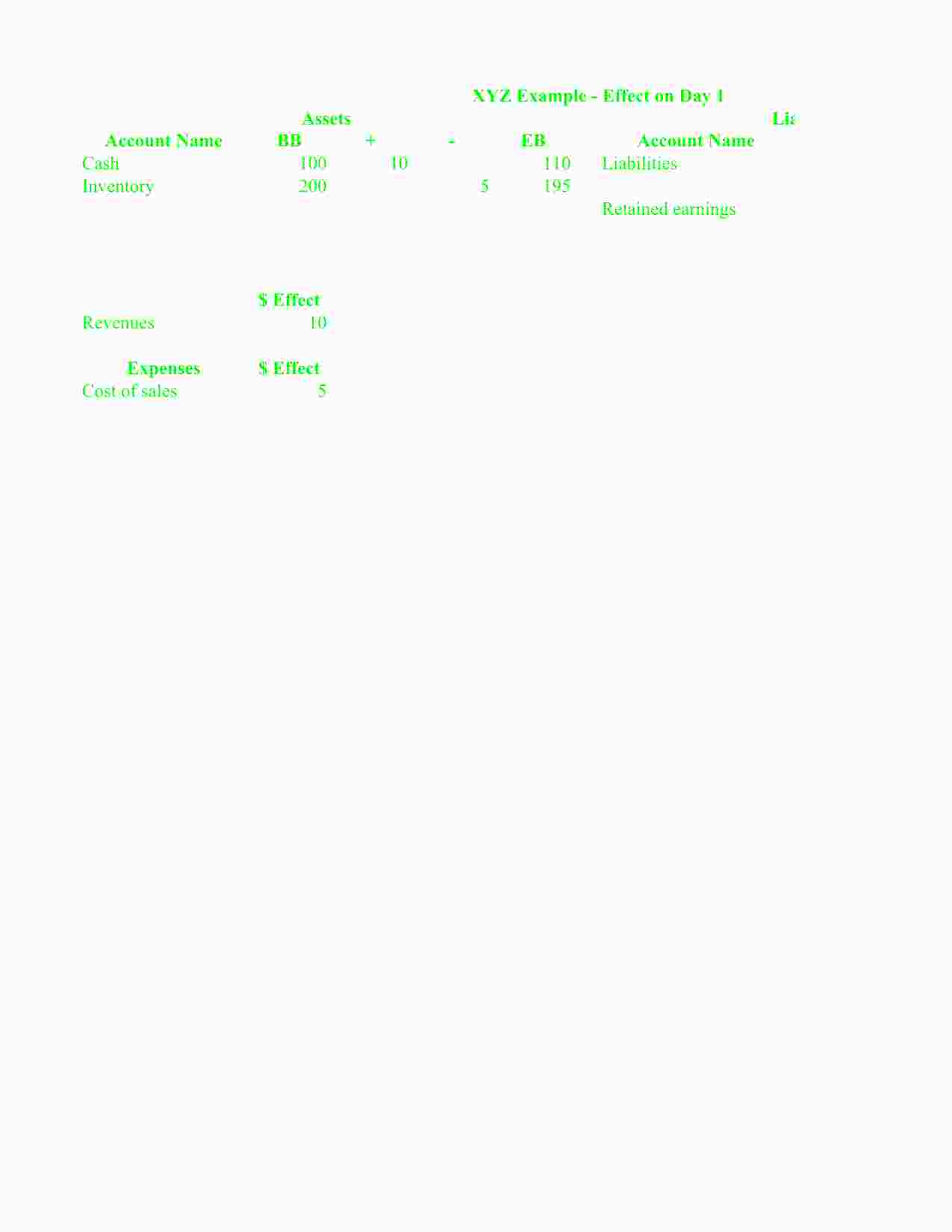

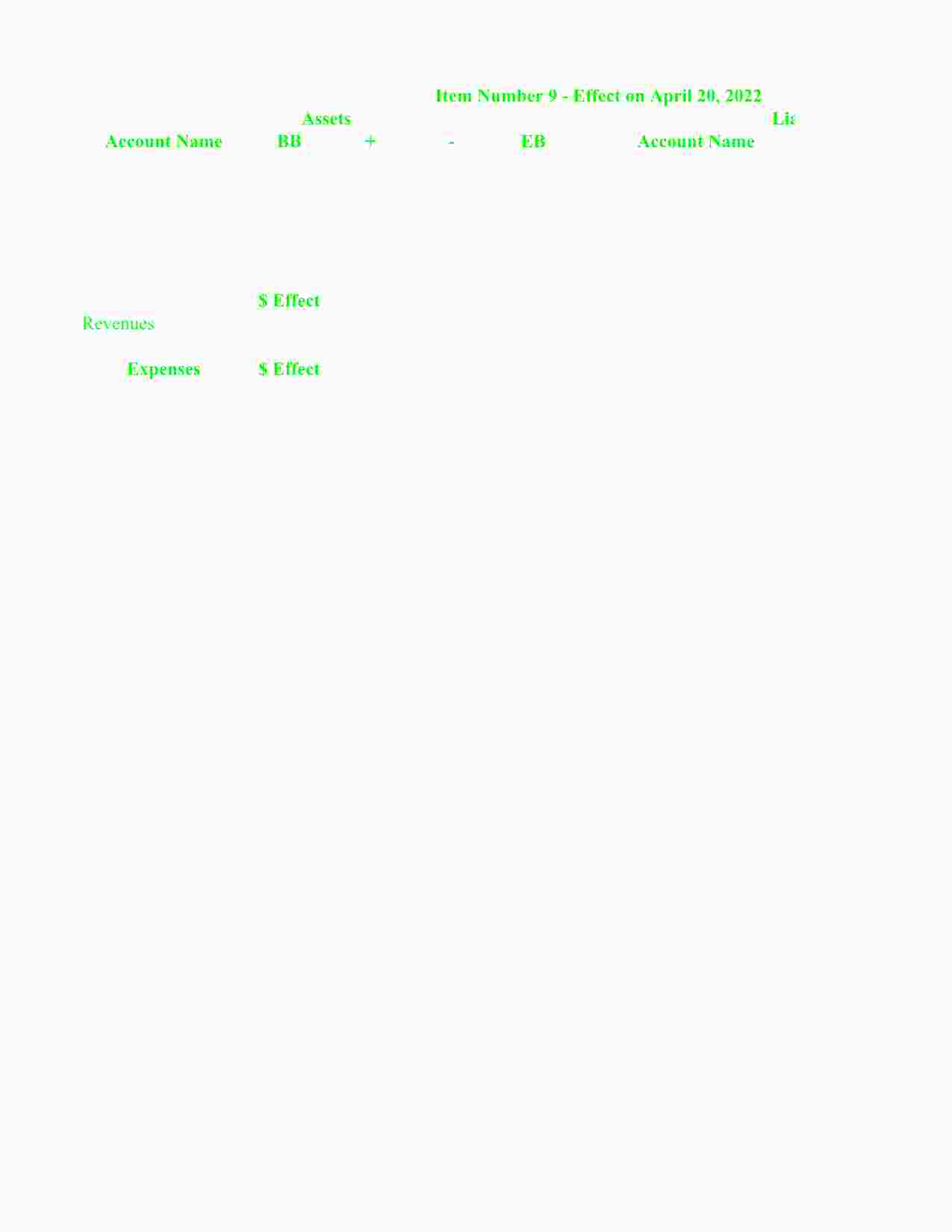

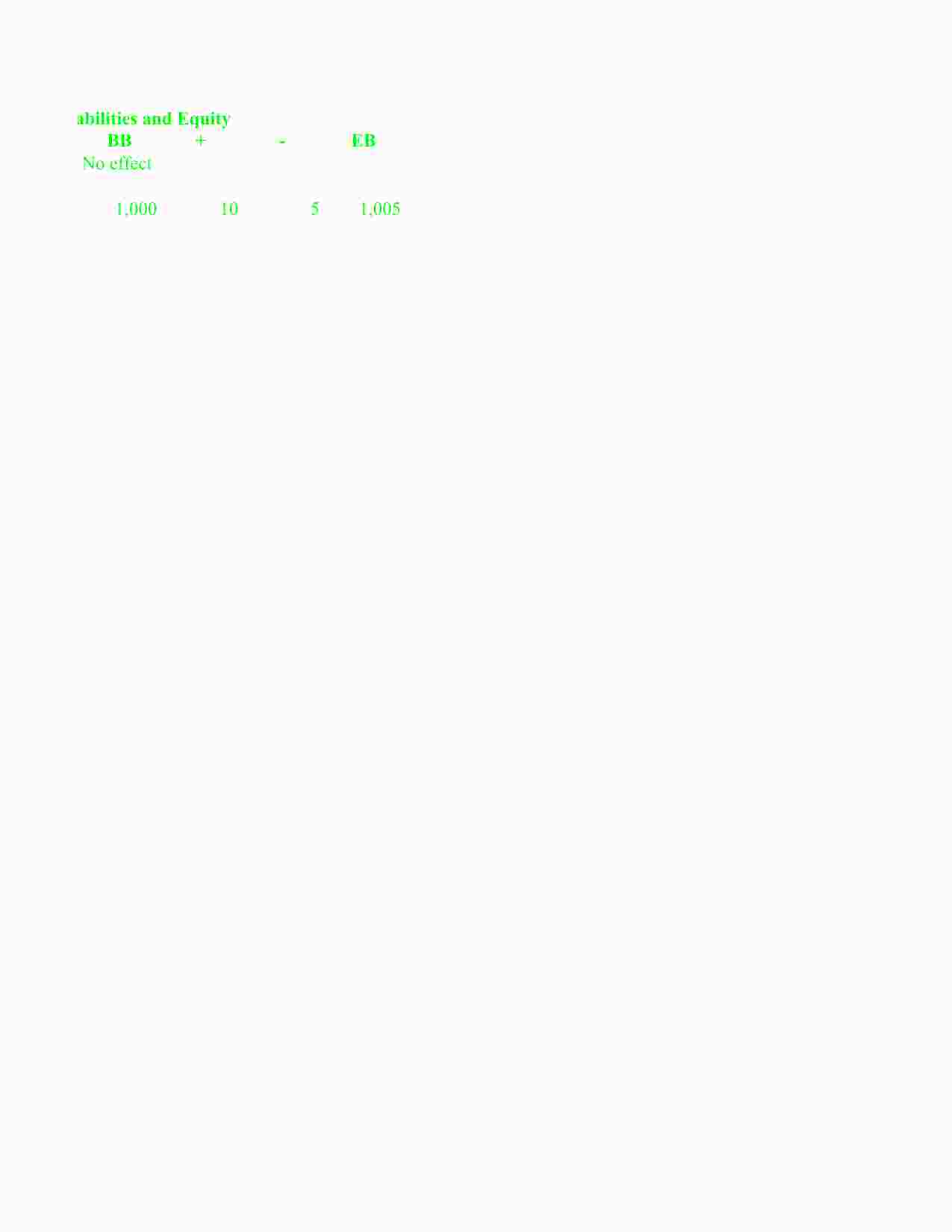

Overview In the .pdf file named ACCTG 6000 - Practice Problem for Module Five - CASE, I provide background information about the company named OJ and I describe all the relevant transactions and events carried out by OJ between February 1, 2022 and June 30, 2022. I refer to each transaction/event as an item, I've assigned each item a number, and there are 25 items. Required Part 1 For each item that relates to a transaction and/or event that occurred between February 1, 2022 and June 30, 2022, describe: 1. The effect that the transaction/event had on OJ's assets, liabilities, and equity on the day that the transaction/event occurred. a. You must list all the accounts that were affected. Do not list accounts that were not affected. b. For each account that was affected, you must state the: i. Beginning balance, i.e., the carrying value of the account before the transaction/event occurred. ii. The amount by which the carrying value of the account changed. iii. Ending balance, i.e., the carrying value of the account after the transaction/event occurred. 2. The effect that the transaction/event had on OJ's revenues for the day that the transaction/event occurred. a. You must list the dollar effect that the transaction/event had on revenues. b. If the transaction/event did not affect revenues, you should enter "No Effect." 3. The effect that the transaction/event had on OJ's expenses for the day that the transaction/event occurred. a. You must list each expense account that was affected and the dollar effect that the transaction/event had on this account. b. If, on the day it occurred, the transaction/event did not affect any expenses, you should enter "No Effect." Further instructions for Part 1 ? At the end of each month, you are to update all balance sheet accounts for the effects of accruing: (1) revenues that were earned during the month and (2) expenses that were incurred during the month. ? Regarding items 14, 15, 23, 24, and 25 which relate to transactions and events that occurred throughout a particular month, you should describe the related transactions and events as if they occurred on the last day of the month. ? In the Excel workbook there is a separate worksheet for each item and you should enter your answers in the worksheet that relates to the corresponding item. For example, if you are describing the effect of item 2, you would use the Excel worksheet named ITEM 2. ? To illustrate how to enter your answers in the Excel worksheet, let's consider an example involving XYZ. Suppose the following: At the beginning of Day 1, XYZ's (1) cash account had a balance of 100; (2) inventory account had a balance of 200; and (3) retained earnings account had a balance of 1,000. During Day 1, a transaction/event caused XYZ's (1) cash to increase by 10; (2) inventory to decrease by five; (3) revenues to increase by 10; and (4) cost of sales to increase by five. In the Excel worksheet named XYZ EXAMPLE, I show how to describe the effect of the transaction/event on XYZ's assets, liabilities, equity, revenues, and expenses. Note: BB and EB are the acronyms for beginning balance and ending balance. + and - denote positive and negative changes. I do not list all of the line items on XYZ's balance sheet and income statement. Rather, I only list the line items that were affected. The transaction did not affect any of XYZ's liabilities. Hence, I do not list any specific liabilities. Rather, I enter "Liabilities" in cell G4, and then I enter "No effect" in cell H4. Part 2 ? Prepare OJ's balance sheet as of June 30, 2022. ? Show your answer in the Excel worksheet named BALANCE SHEET JUNE-30-2022, which is contained in the Excel workbook. Show the name of each account in the space under the heading Account Name. Show the ending balance of each account in the space under the heading Carrying Value. Identify the location of your supporting calculations in the space under the heading Comments. ? Your answer to Part 2 might depend on some of your answers to Part 1. If so, in the space under the heading Comments. identify the relevant worksheet. For example, suppose the ending balance on June 30 of OJ's cash account can be found in the worksheet named ITEM X. Then, in the row pertaining to cash you would enter "see ITEM X" in the space below the heading Comments. ? Your answer to Part 2 might depend on additional calculations that you did not make when answering Part 1. If so, show these calculations in the worksheet named BALANCE SHEET JUNE-30-2022. And, in the space under the heading Comments, identify the cells where these calculations are located. For example, suppose the ending balance on June 30 of OJ's cash account is based on a set of calculations that you performed in cells A25 through A30. Then, in the row pertaining to cash you would enter "see cells A25 through A30" in the space below the heading Comments. Part 3 ? Prepare OJ's income statement for the five-month period ending on June 30, 2022. ? Show your answer in the Excel worksheet named INCOME STATEMENT JUNE-30-2022, which is contained in the Excel workbook. Show the name of each line item (e.g. Revenues) in the space under the heading Line Item. Show the amount of each line item in the space under the heading Amount.o Identify the location of your supporting calculations in the space under the heading Comments. ? Your answer to Part 3 might depend on some of your answers to Parts 1 and/or 2. If so, in the space under the heading Comments, identify the relevant worksheet. For example, suppose that OJ's revenues for the five-month period ending on June 30 can be found in the worksheet named ITEM Y. Then, in the row pertaining to revenues you would enter "see ITEM Y" in the space below the heading Comments. ? Your answer to Part 3 might depend on additional calculations that you did not make when answering Parts 1 and 2. If so, show these calculations in the worksheet named INCOME STATEMENT JUNE-30-2022. And, in the space under the heading Comments, identify the cells where these calculations are located. For example, suppose that OJ's revenues for the five-month period ending on June 30 are based on a set of calculations that you performed in cells A25 through A30. Then, in the row pertaining to revenues you would enter "see cells A25 through A30" in the space below the heading Comments. It is 1:00 PM on Tuesday, July 5, 2022 and you have just received an email from your good friend Octavia Jakunin. While opening the email, you reminisce about the last time that you saw Octavia, which was February 2, 2022. On that day you met with her and helped her put together a balance sheet and income statement for her company OJ. Per your recollection, OJ provides juice-making services to individuals who hold parties and other events. In addition, OJ sells juice-related novelty items Once you've opened the email, you begin reading and this is what you see. Hey, How's life? It's been a long time. I apologize for that but I've been very busy as OJ is starting to take off. Who would have thought that people would be so excited about juice?!?! Do you have time to meet? Business has become more complicated and I need help putting together some financial statements. Let me know if you can stop by my place sometime this afternoon. OJ After reading the message, you quickly respond and tell Octavia that you'll meet her later that day. She asks if you can come to her apartment around 3:30, and you agree. Later that day, you arrive at Octavia's apartment at 3:20, and you and Octavia exchange pleasantries. Then, Octavia mentions that she has not had time to update the balance sheet and income statement that you prepared for the month of January 2022. Hence, she'd like for you to prepare a set of financial statements for OJ. Although you're busy, you like Octavia and she is a good friend so you agree to help her at no charge. The two of you then begin working and Octavia provides you with the following: ? OJ's January 31, 2022 balance sheet. This balance sheet is contained in the Excel worksheet named OJ Balance Sheet 01-31-2022, which is contained in the Excel workbook named ACCTG 6000 - Practice Problem for Module Five - EXCEL FILE. ? Background information about key line items shown on the balance sheet for January 31, 2022 and a description of key accounting assumptions made by Octavia. This background information is provided below. ? A description of all of the relevant transactions and events that occurred between February 1, 2022 and June 30, 2022 inclusive. These descriptions are provided below. Background Information about Key Line Items Shown on the Balance Sheet for January 31, 2022 and Description of Key Accounting Assumptions Octavia reminds you of the following: ? The iPad was purchased on January 1, 2020. OJ paid $720 for it and it has a useful life of three years and zero salvage value. OJ's policy is to use straight line depreciation and zero salvage value. ? The loan payable relates to a loan that was originated on November 1, 2018. Per the loan contract, OJ is required to repay the principle of $200 on November 1, 2023. OJ is also required to make five annual interest payments. OJ made the first three interest payments on the dates they were due. The fourth interest payment is due on November 1, 2022. The annual interest rate is twelve (12) percent. In addition, Octavia notes that it is her accounting policy to accrue revenues and expenses on a monthly basis. Although she did not do this for the past five months, she wants you to do it when you prepare the financial statements. That is, at the end of each month starting with the month of February 2022 and ending with the month of June 2022, you should accrue revenues earned and expenses incurred during the month. Then, you should update the balances of all balance sheet accounts so that they reflect the effects of accruing revenues and expenses for the month. Description of All of the Relevant Transactions and Events that Occurred between February 1, 2022 and June 30, 2022 The following transactions and events occurred during February and March 2022. (Note, these were slow months as OJ did not provide any services, etc. However, it did make some collections, payments, and decisions.) ITEM 1: On February 5, OJ collected all amounts owed to it by customers who received goods and/or services from OJ prior to February 2022. ITEM 2: On February 15, OJ paid all of the amounts it owed to its suppliers. ITEM 3: On the last day of February (i.e., February 28), Octavia took some time off to reflect on her business. She was quite disheartened. She seriously considered dissolving OJ but she decided to give it two more months. She also decided that OJ would not: ? Pay her a salary for the month of February or for the foreseeable future. ? Renew its lease with OuiWork. That is, Octavia decided that after OJ's current rental agreement with OuiWork expires on the last day of March, she will work from home. ? Pay dividends for the foreseeable future. ITEM 4: On the first day of March 2022 (i.e., March 1), OJ made a rental payment of $75 to OuiWork. This is the prepayment of the rent for the month of March 2022. The following transactions and events occurred in April 2022. ITEM 5: On April 7, a local accounting firm, R&H Circle, signed a contract with OJ. ? Per the contract, OJ agreed to provide juice-making services from 6:00 AM to 6:00 PM on April 15 in exchange for $750. ? On April 7, R&H Circle prepaid half of the amount owed. ITEM 6: On April 15 (while on site at R&H Circle), OJ sold all of the novelty items in its inventory to employees of R&H Circle. These employees paid OJ a combined total of $60. ITEM 7: On April 15, Octavia delivered an invoice for $375 to the receptionist at the front desk of R&H Circle. This invoice was for the amount that R&H Circle owed for services rendered by OJ on April 15. On April 20, Octavia received a call from Jane Jiang. Jane is the founding and managing partner of R&H Circle. She asked Octavia if she could come by the office of R&H Circle to collect the amount owed to her and discuss a business proposition. Octavia agreed and she met Jane at 3:30 that afternoon. The highlights of the meeting are: ? ITEM 8: Jane paid, on behalf of R&H Circle, the amount owed by R&H Circle to OJ. ? ITEM 9: Jane made an offer to Octavia, Octavia accepted, and they signed a contract. Per the contract: Octavia agreed that, starting in May 2022, OJ will provide juice-making services at R&H Circle from 6:30 AM to 9:00 AM on the first and last Friday of every month. R&H Circle agreed to pay OJ $500 for each month of service. The contract terminates after one year. During the year, R&H Circle will make four quarterly payments of $1,500. The first payment is due on or before May 1, 2022; the second payment is due on or before August 1, 2022; the third payment is due on or before November 1, 2022; and the final payment is due on or before February 1, 2022. ITEM 10: On April 22, Octavia received a call from Darrah Stater. Darrah is a client of R&H Circle and she happened to visit their offices on April 15 where she drank several of the juices made by OJ. She was impressed and during the phone conversation with Octavia, she proposed that OJ provide her with personal juice-making services. Specifically, on the first and last Thursday of every month, Darrah hosts several friends at her home gym and she would like to make juice available while they exercise. ? Octavia agreed that, starting in May 2022, OJ will provide juice-making services at Darrah's house from 10:00 AM to 11:30 AM on the first and last Thursday of every month. ? Darrah agreed to pay OJ $300 per month of service. ? The contract terminates after one year. ? During the year, Darrah will make four quarterly payments of $900. The first payment is due on or before June 15, 2022; the second payment is due on or before September 15, 2022; the third payment is due on or before December 15, 2022; and the final payment is due on or before March 15, 2022. ITEM 11: On April 25, 2022, OJ signed a new lease with OuiWork. ? The lease term begins on May 1, 2022 and ends on April 30, 2023. ? The monthly rental payment is $80. ? On the day that the lease was signed (i.e. April 25, 2022), OuiWork demanded that OJ prepay the first two monthly rental payments. OJ made the payment on the same day. ? The payment for each of the remaining 10 months is due on the first day of the corresponding month. ? OJ does not account for this agreement as a lease. The following transactions and events occurred in May 2022. ITEM 12: On May 1, OJ received the first payment of $1,500 from R&H Circle. ITEM 13: On May 1, OJ purchased inventory with an invoice price of $100. OJ paid the supplier $60 and agreed to pay the remaining $40 by June 30, 2022. ITEM 14: During May, OJ provided juice-making services per its agreements with R&H Circle and Darrah Stater. Both R&H Circle and Darrah were very happy with the service. ITEM 15: During May, OJ sold novelty items with a cost of $75 for $125. All of these sales were for cash. The following transactions and events occurred in June 2022. ITEM 16: On June 1, OJ sold the iPad for $60 cash. ITEM 17: On June 1, OJ paid cash of $400 for a new MacBook Air. ? Later, when she talked with you, Octavia decided that this computer has a useful life of two years and a salvage value of 40. ITEM 18: On June 15, OJ received the first payment of $900 from Darrah Stater. ITEM 19: On June 15, OJ signed an employment contract with Succo d'Arancia. ? Succo will receive $100 per month and this amount will be paid in advance. Consequently, on June 15, OJ paid Succo $100 and Succo's employment contract began that day. ? The contract has an indefinite term. ITEM 20: On June 15, Octavia decided that, starting in July 1, she would pay herself a monthly salary of $250. The salary will be paid at the end of each month. ITEM 21: On June 28, OJ paid the amount it owed to the supplier of novelty items. ITEM 22: On June 28, OJ sold 10 shares to a private investor in exchange for $510. ? These ten shares are equivalent to 25 percent of the total outstanding shares, i.e., after the sale, Octavia owned 75 percent of the shares and the private investor owned the remaining 25 percent. ITEM 23: During June, OJ provided juice-making services per its agreements with R&H Circle and Darrah Stater. ITEM 24: During June, OJ did not sell any novelty items to "regular" customers. Hence, Octavia decided to discontinue selling novelty items. With this in mind, on the last day of June, she sold all of OJ's inventory to a local thrift shop. The thrift shop paid $10 cash. ITEM 25: During June, OJ had discussions with a number of potential clients who are interested in hiring OJ to serve juices at their local businesses and/or homes.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts