Question: Overview S corporations are often used as the entity type for many small businesses. However, there are certain requirements that must be met to be

Overview

S corporations are often used as the entity type for many small businesses. However, there are certain requirements that must be met to be an S corporation. This discussion explores one of these requirements.

Action Items

- CCS is an S corporation. Read the ethics problem in Chapter 22 in the textbook.

- Research the impact of using the RIA checkpoint.

- Answer the three questions in the ethics box. Provide support, with proper citations, for your response.

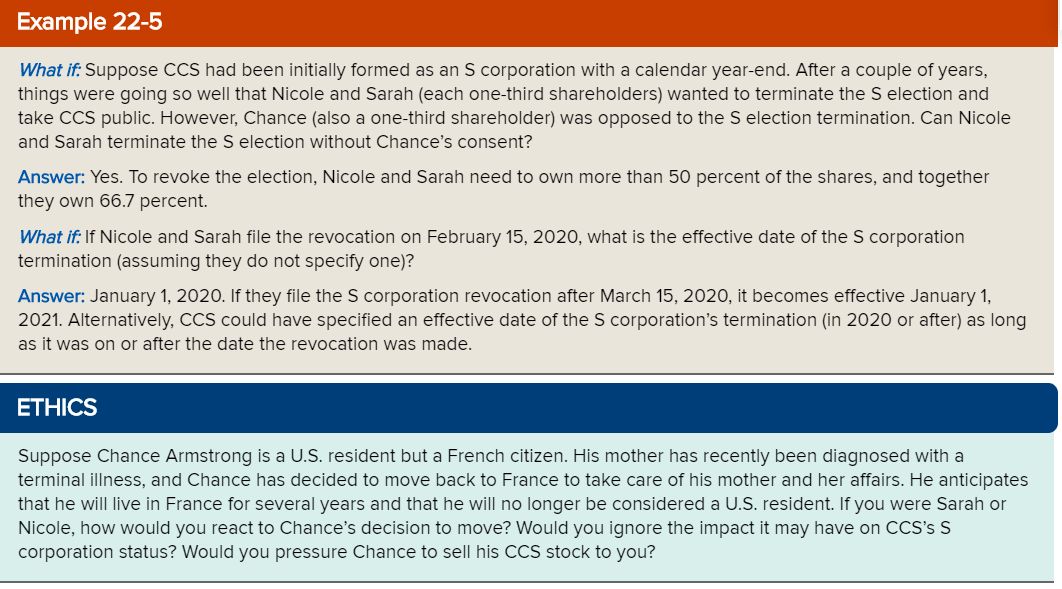

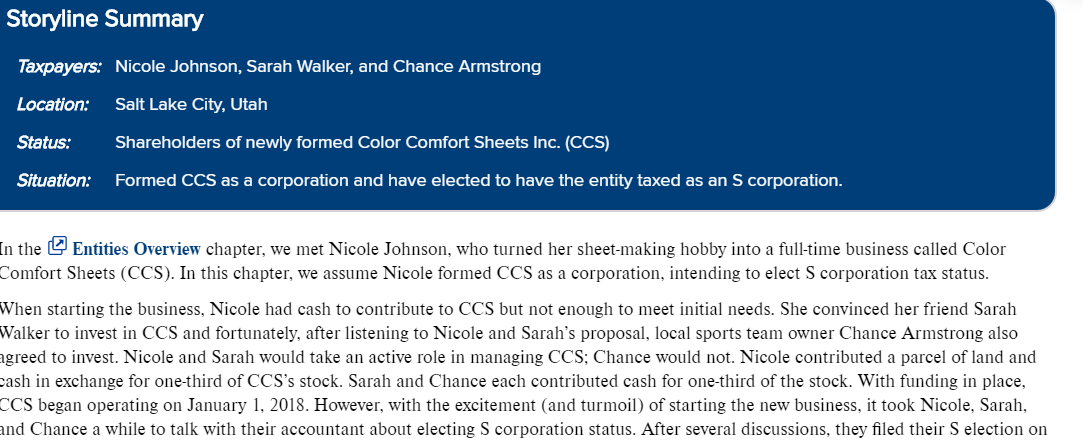

Example 22-5 What if: Suppose CCS had been initially formed as an S corporation with a calendar year-end. After a couple of years, things were going so well that Nicole and Sarah (each one-third shareholders) wanted to terminate the selection and take CCS public. However, Chance (also a one-third shareholder) was opposed to the selection termination. Can Nicole and Sarah terminate the selection without Chance's consent? Answer: Yes. To revoke the election, Nicole and Sarah need to own more than 50 percent of the shares, and together they own 66.7 percent. What if: If Nicole and Sarah file the revocation on February 15, 2020, what is the effective date of the S corporation termination (assuming they do not specify one)? Answer: January 1, 2020. If they file the S corporation revocation after March 15, 2020, it becomes effective January 1, 2021. Alternatively, CCS could have specified an effective date of the S corporation's termination (in 2020 or after) as long as it was on or after the date the revocation was made. ETHICS Suppose Chance Armstrong is a U.S. resident but a French citizen. His mother has recently been diagnosed with a terminal illness, and Chance has decided to move back to France to take care of his mother and her affairs. He anticipates that he will live in France for several years and that he will no longer be considered a U.S. resident. If you were Sarah or Nicole, how would you react to Chance's decision to move? Would you ignore the impact it may have on CCS's S corporation status? Would you pressure Chance to sell his CCS stock to you? Storyline Summary Taxpayers: Nicole Johnson, Sarah Walker, and Chance Armstrong Location: Salt Lake City, Utah Status: Shareholders of newly formed Color Comfort Sheets Inc. (CCS) Situation: Formed CCS as a corporation and have elected to have the entity taxed as an S corporation. In the Entities Overview chapter, we met Nicole Johnson, who turned her sheet-making hobby into a full-time business called Color Comfort Sheets (CCS). In this chapter, we assume Nicole formed CCS as a corporation, intending to elect S corporation tax status. When starting the business, Nicole had cash to contribute to CCS but not enough to meet initial needs. She convinced her friend Sarah Walker to invest in CCS and fortunately, after listening to Nicole and Sarah's proposal, local sports team owner Chance Armstrong also agreed to invest. Nicole and Sarah would take an active role in managing CCS; Chance would not. Nicole contributed a parcel of land and cash in exchange for one-third of CCS's stock. Sarah and Chance each contributed cash for one-third of the stock. With funding in place, CCS began operating on January 1, 2018. However, with the excitement (and turmoil) of starting the new business, it took Nicole, Sarah, and Chance a while to talk with their accountant about electing S corporation status. After several discussions, they filed their S election on Example 22-5 What if: Suppose CCS had been initially formed as an S corporation with a calendar year-end. After a couple of years, things were going so well that Nicole and Sarah (each one-third shareholders) wanted to terminate the selection and take CCS public. However, Chance (also a one-third shareholder) was opposed to the selection termination. Can Nicole and Sarah terminate the selection without Chance's consent? Answer: Yes. To revoke the election, Nicole and Sarah need to own more than 50 percent of the shares, and together they own 66.7 percent. What if: If Nicole and Sarah file the revocation on February 15, 2020, what is the effective date of the S corporation termination (assuming they do not specify one)? Answer: January 1, 2020. If they file the S corporation revocation after March 15, 2020, it becomes effective January 1, 2021. Alternatively, CCS could have specified an effective date of the S corporation's termination (in 2020 or after) as long as it was on or after the date the revocation was made. ETHICS Suppose Chance Armstrong is a U.S. resident but a French citizen. His mother has recently been diagnosed with a terminal illness, and Chance has decided to move back to France to take care of his mother and her affairs. He anticipates that he will live in France for several years and that he will no longer be considered a U.S. resident. If you were Sarah or Nicole, how would you react to Chance's decision to move? Would you ignore the impact it may have on CCS's S corporation status? Would you pressure Chance to sell his CCS stock to you? Storyline Summary Taxpayers: Nicole Johnson, Sarah Walker, and Chance Armstrong Location: Salt Lake City, Utah Status: Shareholders of newly formed Color Comfort Sheets Inc. (CCS) Situation: Formed CCS as a corporation and have elected to have the entity taxed as an S corporation. In the Entities Overview chapter, we met Nicole Johnson, who turned her sheet-making hobby into a full-time business called Color Comfort Sheets (CCS). In this chapter, we assume Nicole formed CCS as a corporation, intending to elect S corporation tax status. When starting the business, Nicole had cash to contribute to CCS but not enough to meet initial needs. She convinced her friend Sarah Walker to invest in CCS and fortunately, after listening to Nicole and Sarah's proposal, local sports team owner Chance Armstrong also agreed to invest. Nicole and Sarah would take an active role in managing CCS; Chance would not. Nicole contributed a parcel of land and cash in exchange for one-third of CCS's stock. Sarah and Chance each contributed cash for one-third of the stock. With funding in place, CCS began operating on January 1, 2018. However, with the excitement (and turmoil) of starting the new business, it took Nicole, Sarah, and Chance a while to talk with their accountant about electing S corporation status. After several discussions, they filed their S election on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts