Question: Overview This project will be completed individually. You will evaluate the financial statements and related disclosures of Weyerhaeuser Company, a timberland company. You will use

Overview

This project will be completed individually. You will evaluate the financial statements and related disclosures of Weyerhaeuser Company, a timberland company. You will use the 2021 10-K as your first resource in answering most of the questions; however, some questions require historical data which you will need to obtain from older 10-Ks. You will also need to access the financial statements of some of Weyerhaeuser's competitor firms. You can access financial filings using the following steps.

- Go to https://www.sec.gov/edgar/searchedgar/companysearch.html. In the search box, enter the company's name or ticker symbol (i.e.., 'Weyerhaeuser Co.' or 'WY'). After selecting the right company, you can locate the latest 10-K filing under the heading "Latest Filings". For example, Weyerhaeuser's 2021 10-K was filed on February 18, 2022. Clicking on the link takes you to the 10-K.

- You can also find financial statements on a company's investor relations site (for Weyerhaeuser, this is here: https://investor.weyerhaeuser.com/quarterly-and-annual-results).

Materials submitted for the assignment should include a single pdf document, including the following parts:

- A descriptive heading or title.

- A one-paragraph introduction describing Weyerhaeuser as a company. Include a brief summary of the company's history, its products, major recent events, and its industry.

- A reproduction of each question prompt detailed in the next section (in bold font) followed by your response to the question (non-bold font).

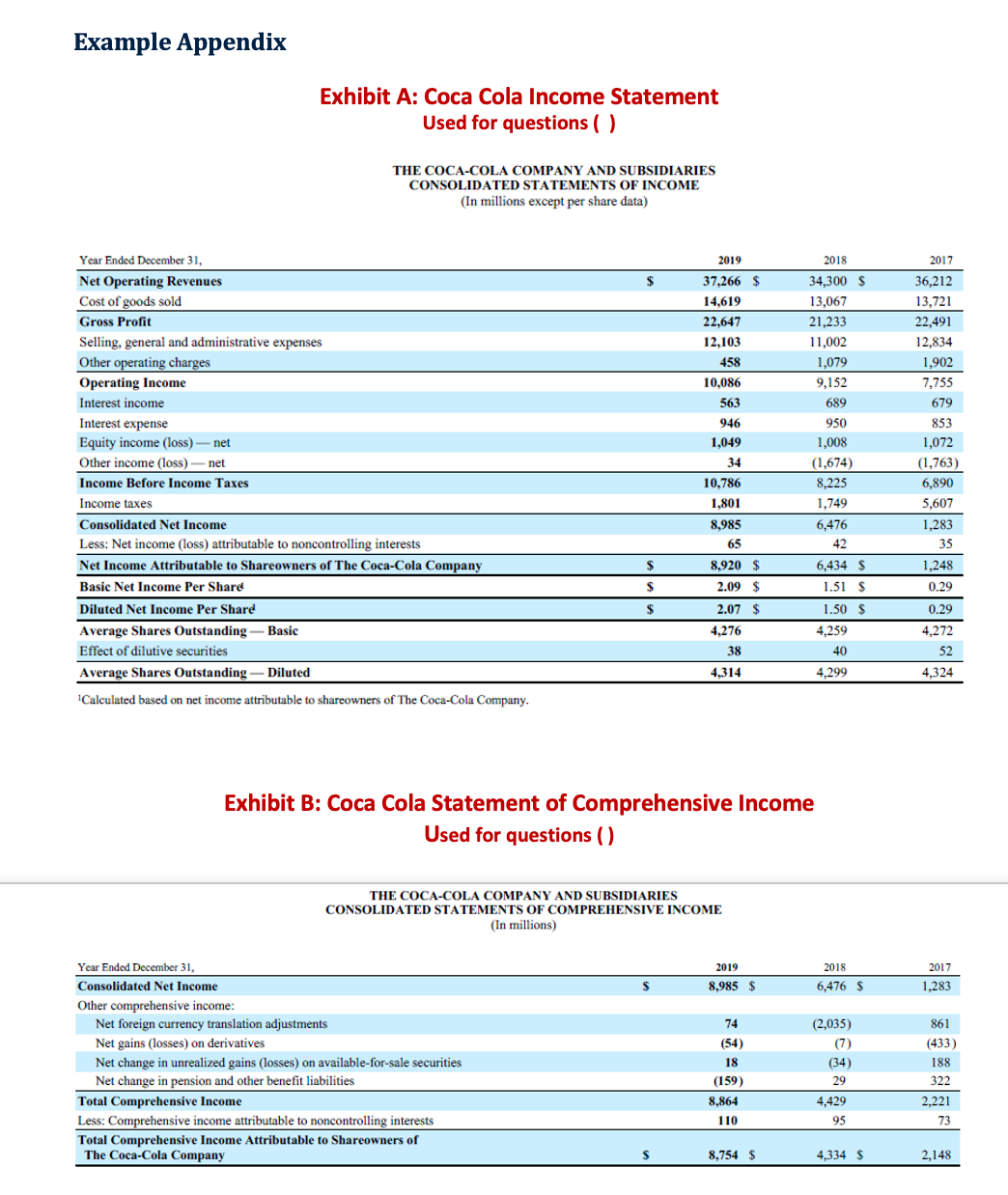

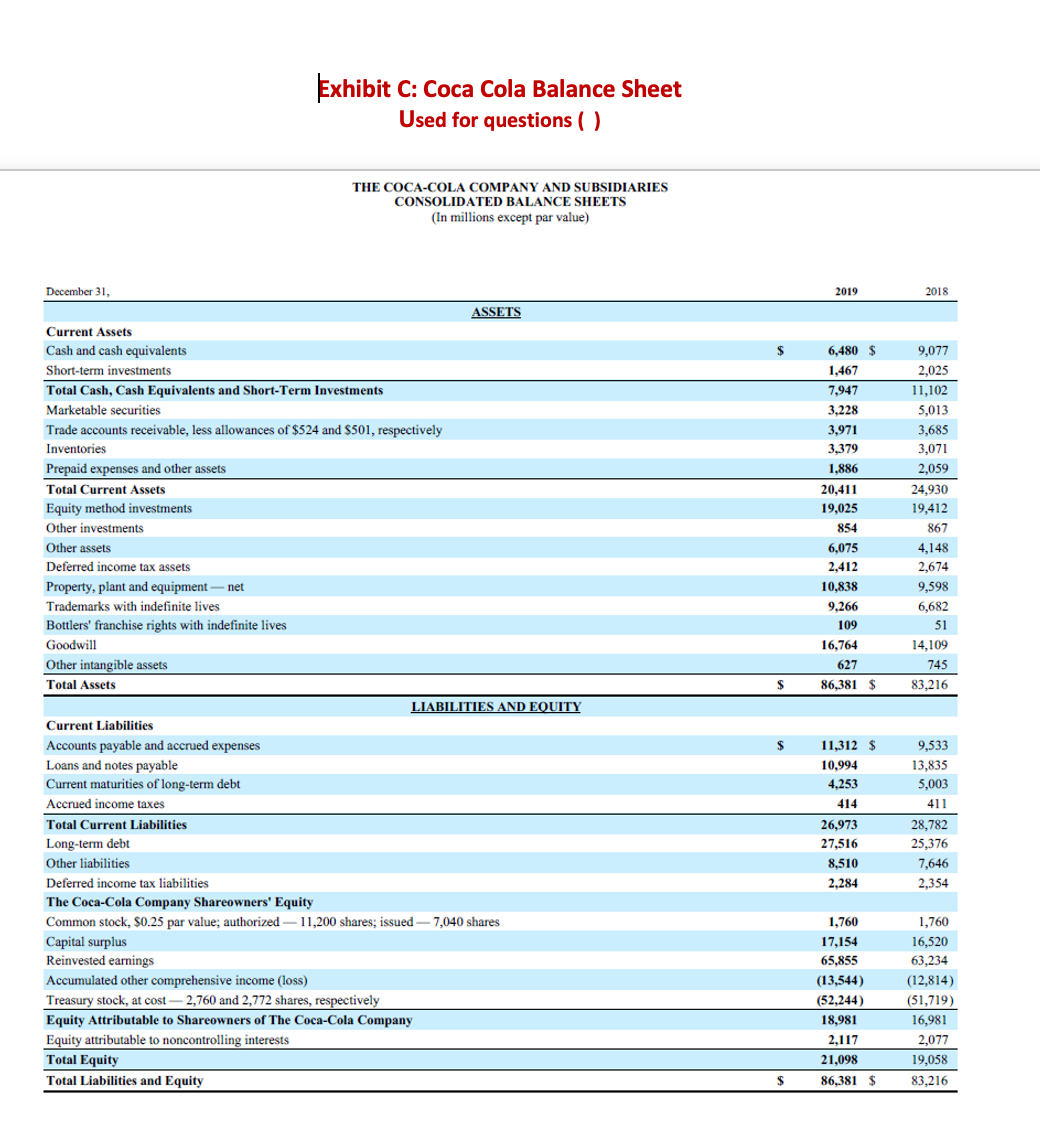

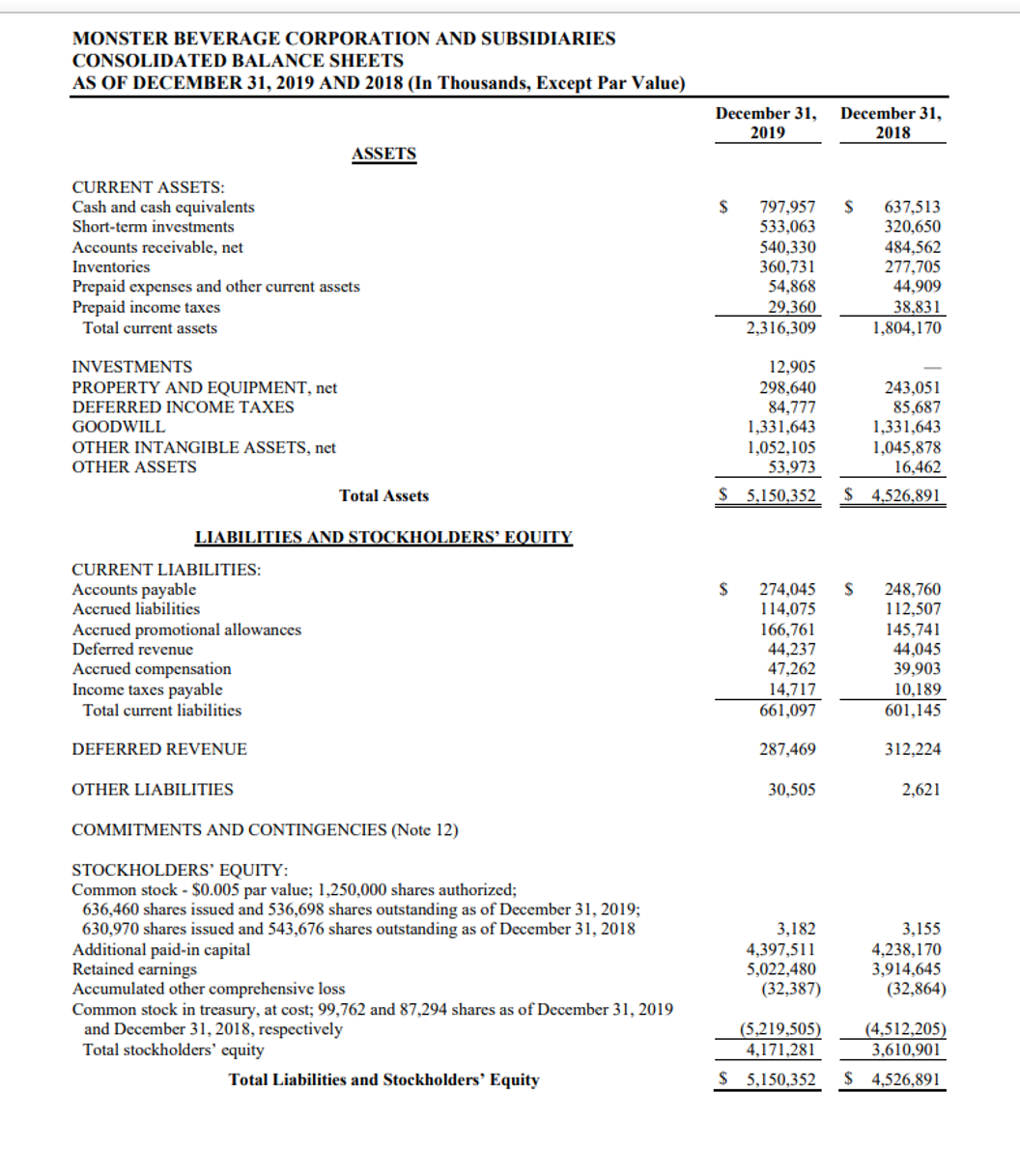

- An appendix with any tables you would like to provide to help you answer the questions fully. For example, questions that request horizontal or vertical analysis of financial statements cannot be fully addressed without providing quite a bit of data. You should fully discuss pertinent findings from your analysis in the text of your responses but include the full tables of data in the appendix (incorporating the tables by reference in your discussion). An example of this appendix is included at the end of this file.

Project Questions

- Describe the format of Weyerhaeuser's income statement (single-step, multi-step, hybrid) and explain why you describe it that way. Why do some companies use the multi-step format? What information does such a format highlight for investors?

- Evaluate the trend in revenue over the past five years for Weyerhaeuser. You'll need to refer to the company's financials from older 10-Ks to gather the historical data you need. Calculate the percentage change in revenue each year. Discuss what you believe is driving the change in sales considering what you can learn about the company, the industry, and overall economic conditions.

- Evaluate the trend in net income over the past five years. Calculate the percentage change in net income and perform vertical analysis (calculating each expense item as a percentage of revenue) on key items of the income statement to help with your analysis. Discuss the key drivers of the change in net income.

- Compute the gross profit percentage, profit margin, and return on assets for fiscal years 2017 through 2021. Analyze and discuss what these ratios tell you about the company. Consider your analysis from questions 2 and 3 in your discussion of the ratios. Describe the trend in these ratios for Weyerhaeuser. Also describe the inferences you can draw from comparisons with peer and competitor firms.

- Compute the current ratio and debt to equity ratio for fiscal years 2017 through 2021. Analyze and discuss what these ratios tell you about the company. Describe the trend in these ratios for Weyerhaeuser. Also describe the inferences you can draw from comparisons with peer and competitor firms.

- Compute Weyerhaeuser's Times-Interest-Earned ratio for 2021. Describe what this ratio tells you about the company.

- Assume that Weyerhaeuser capitalized 300 million of interest in 2021. (Put another way, assume the interest expense number Weyerhaeuser reports already reflects 300 million of capitalized interest. Note that this is an assumption since Weyerhaeuser does not disclose the amount of capitalized interest.) How would the calculation of Times_Interest_Earned be different if Weyerhaeuser did not capitalize any interest in 2021?

7. State whether Weyerhaeuser uses the direct or indirect method of reporting cash flows from operating activities in the statement of cash flows. Explain how you know this. Also, for the following line items describe why it is added or subtracted from net income in arriving at "Net cash from operations."

a. Depreciation, depletion and amortization: $477M is added back. Why?

b. Change in Receivables: $57M is subtracted. Why?

8 Read through the risk factors that Weyerhaeuser discloses in its 2021 annual report. In your opinion, what are the most significant risks faced by Weyerhaeuser and its investors? Why?

9 Summarize briefly the contents of the KPMG audit report that accompanies (precedes) the financial statements. Your summary should include, but not be limited to, [1] a discussion of how you know if the audit report is "unqualified", "unqualified with an explanatory paragraph", "modified", or "adverse", [2] a brief discussion of the Critical Audit Matter KPMG identifies (Why is this item highlighted and how should it impact an investor's reading of the financials?), and [3] the implications of the tenure of KPMG as Weyerhaeuser's auditor (What are the arguments for and against keeping the same auditor for 20 years?).

10 Weyerhaeuser is organized as a Real Estate Investment Trusts (REITs). Do some research into REITs and answer the following questions:

- Why do you think they made this choice? What are the advantages and disadvantages (to the company and/or its investors)?

- What must a company do to qualify as an REIT?

- How does REIT status impact the amount of dividends paid by the company?

- How does REIT status impact the amount of retained earnings on the balance sheet?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts