Question: ow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=... Q * Print Item Assume the beginning inventory as of January 1 consisted of 500 units that were purchased for $8.25 each.

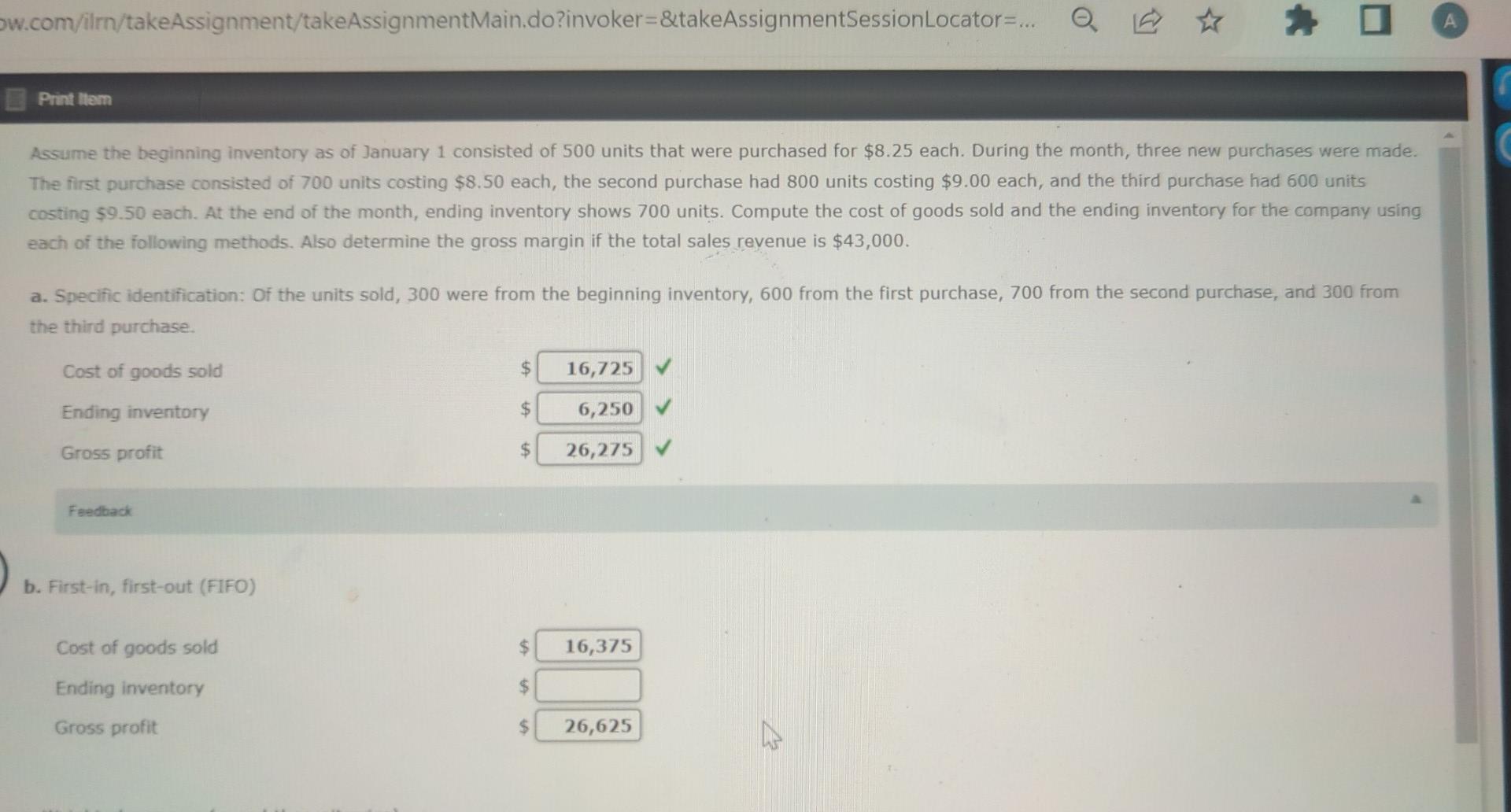

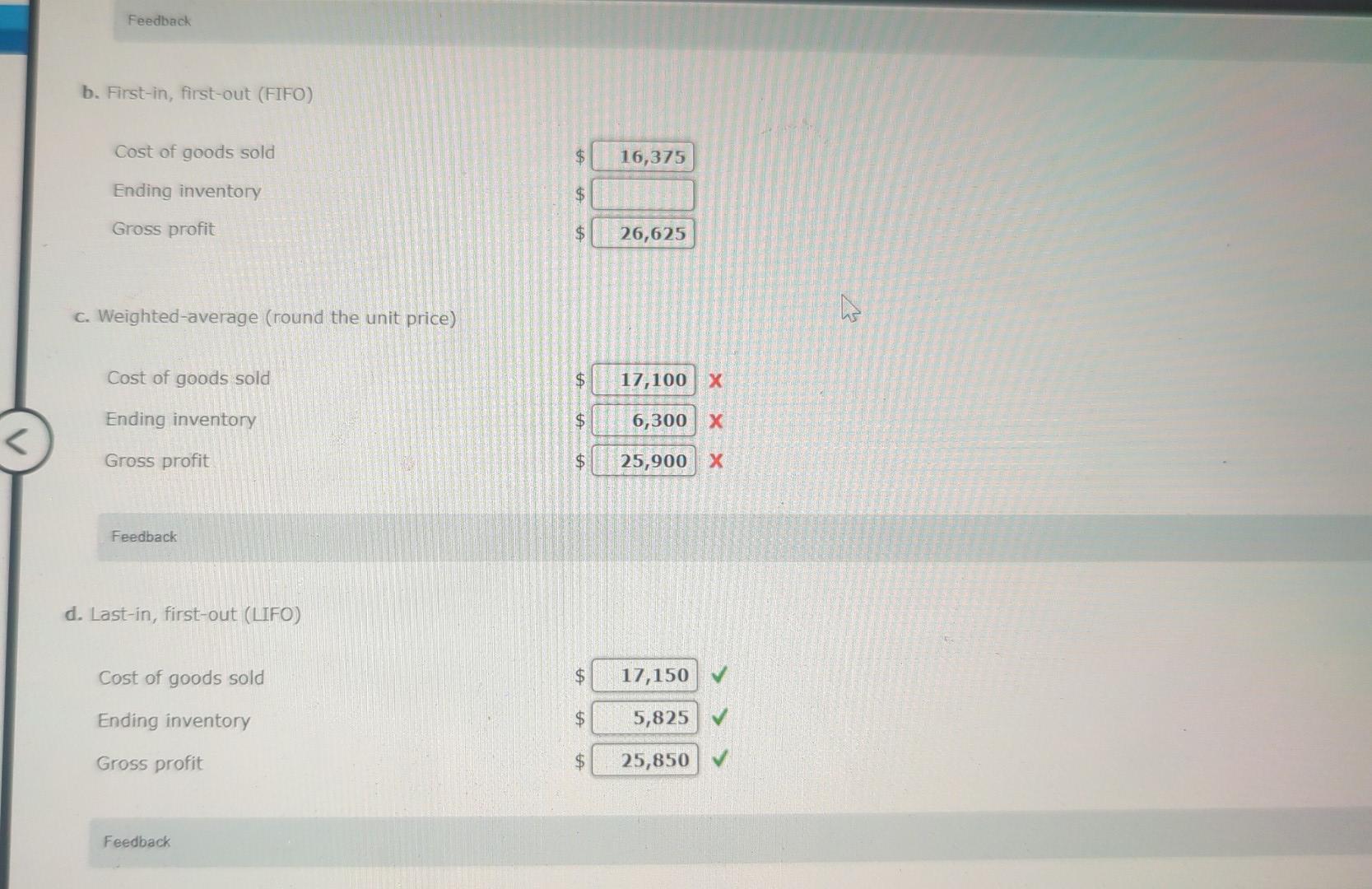

ow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=... Q * Print Item Assume the beginning inventory as of January 1 consisted of 500 units that were purchased for $8.25 each. During the month, three new purchases were made. The first purchase consisted of 700 units costing $8.50 each, the second purchase had 800 units costing $9.00 each, and the third purchase had 600 units costing $9.50 each. At the end of the month, ending inventory shows 700 units. Compute the cost of goods sold and the ending inventory for the company using each of the following methods. Also determine the gross margin if the total sales revenue is $43,000. a. Specific identification: Of the units sold, 300 were from the beginning inventory, 600 from the first purchase, 700 from the second purchase, and 300 from the third purchase. Cost of goods sold Ending inventory Gross profit Feedback b. First-in, first-out (FIFO) Cost of goods sold Ending inventory Gross profit $ 16,725 $ 6,250 $ 26,275 $ +A 16,375 $ $ 26,625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts