Question: ow/connect.html Help Save & Exlt Submit Required information 10A) Recording the Effects of a Discount Bond Issue and First Interest E10-14 (Supplement Payment and Preparing

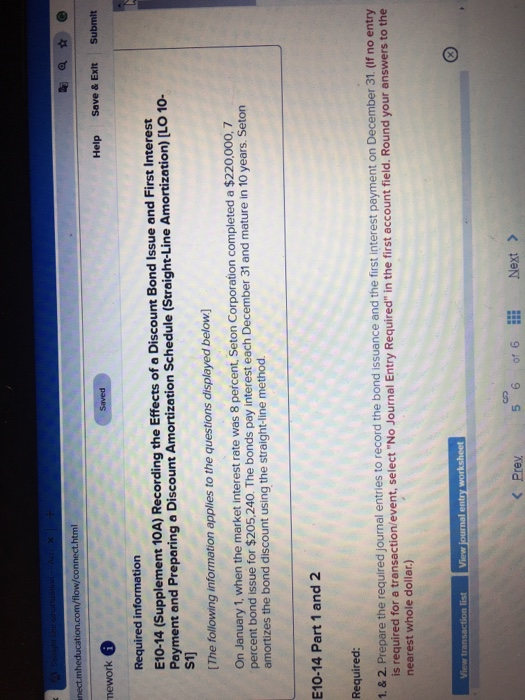

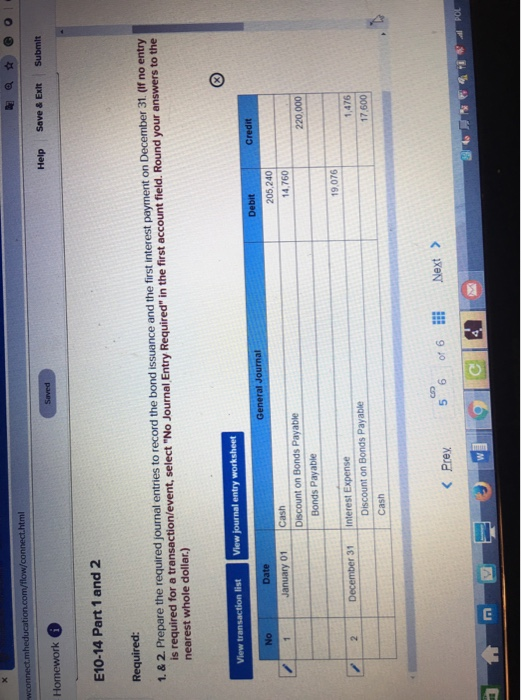

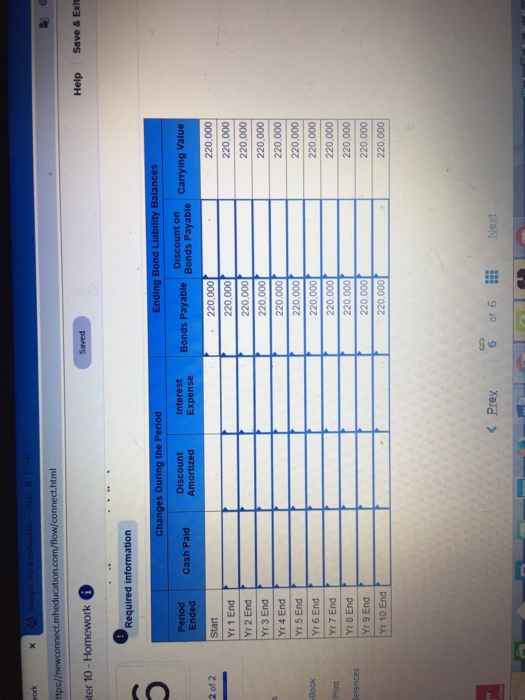

ow/connect.html Help Save & Exlt Submit Required information 10A) Recording the Effects of a Discount Bond Issue and First Interest E10-14 (Supplement Payment and Preparing a Discount Amortizetion Schedule (Streight- Line Amortization) [LO 10- s1 The following information applies to the questions displayed below] On January 1, when the market interest rate was 8 percent, Seton Corporation completed a $220,000, 7 percent bond issue for $205,240. The bonds pay interest each December 31 and mature in 10 years amortizes the bond discount using the straight-line method. . Seton E10-14 Part 1 and 2 Required: e the required journal entries to record the bond issuance and the first interest payment on December 31. (If no entry t, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar.) list E Next K Prev Help Save&Exit Submit E10-14 Part 1 and 2 Required: 1. & 2. Prepare the required journal entries to record the bond issuance and the first interest payment on December 31. (If no enty is required for a transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar.) Debit Credit Date 205,240 14,760 ry01 Cash 220,000 19,076 r31 Interest Expense Discount on Bonds Payable 17.600 Cash 6 61 123-456789-10 0 (O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts