Question: Owen Examples 8.2% is turned into 1) Mortgage Points: When taking out a mortgage loan, you may be offered points(also called discount points. This is

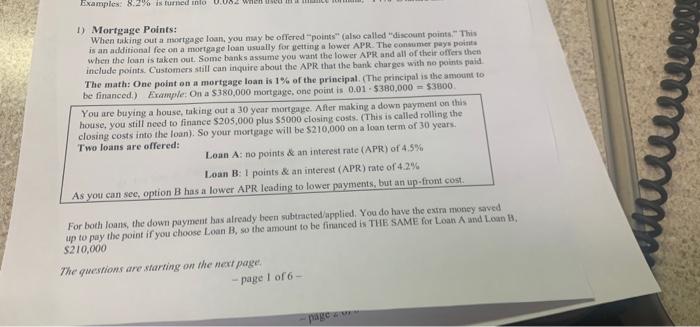

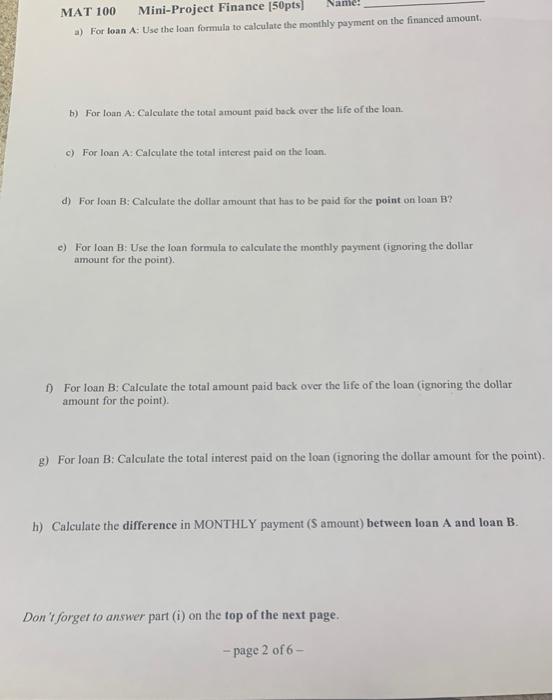

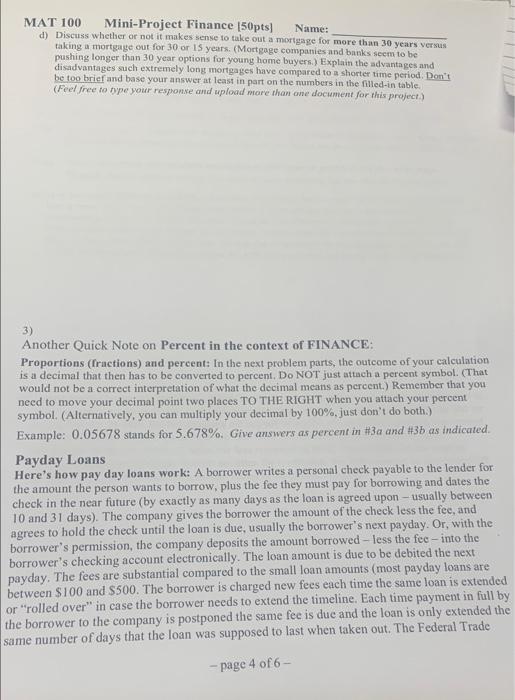

Owen Examples 8.2% is turned into 1) Mortgage Points: When taking out a mortgage loan, you may be offered "points"(also called "discount points. This is an additional fee on a mortgage loan usually for getting a lower APR. The consumer pays points when the loan is taken out. Some banks assume you want the lower APR and all of their offers then include points. Customers still can inquire about the APR that the bank charges with no points paid The math: One point on a mortgage loan is 1% of the principal. (The principal is the amount to be financed) Example: On a $380,000 mortgage, one point is 0.01 - 5380,000 = $3800 You are buying a house, taking out a 30 year mortgage. After making a down payment on this house, you still need to finance 5205,000 plus 55000 closing costs. (This is called rolling the closing costs into the loan). So your mortgage will be $210,000 on a loan term of 30 years, Two loans are offered: Loan A: no points & an interest rate (APR) of 4.5% Loan B: 1 points & an interest (APR) rate of 4.2% As you can see, option has a lower APR leading to lower payments, but an up-front cost mm For both loans, the down payment has already been subtracted/applied. You do have the extra money saved up to pay the point if you choose Loan B, so the amount to be financed is THE SAME for Loan A und L.can 18, $210,000 The questions are starting on the next page - page 1 of 6 - page MAT 100 Mini-Project Finance (50pts ) For loan A: Use the loan formula to calculate the monthly payment on the financed amount b) For loan A: Calculate the total amount paid back over the life of the loan. c) For loan A: Calculate the total interest paid on the loan. d) For loan B: Calculate the dollar amount that has to be paid for the point on loan B? c) For loan B: Use the Tonn formula to calculate the monthly payment (ignoring the dollar amount for the point) 1) For loan B: Calculate the total amount paid back over the life of the loan (ignoring the dollar amount for the point). g) For loan B: Calculate the total interest paid on the loan (ignoring the dollar amount for the point). h) Calculate the difference in MONTHLY payment (S amount) between loan A and loan B. Don't forget to answer part (i) on the top of the next page. - page 2 of 6 - MAT 100 Mini-Project Finance (50pts] Name: d) Discuss whether or not it makes sense to take out a mortgage for more than 30 years versus taking a mortgage out for 30 or 15 years. (Mortgage companies and banks seem to be pushing longer than 30 year options for young home buyers.) Explain the advantages and disadvantages such extremely long mortgages have compared to a shorter time period. Don't be too brief and base your answer at least in part on the numbers in the filled-in table (Feel free to type your response and upload more than one document for this project.) 3) Another Quick Note on Percent in the context of FINANCE: Proportions (fractions and percent: In the next problem parts, the outcome of your calculation is a decimal that then has to be converted to percent. Do NOT just attach a percent symbol. (That would not be a correct interpretation of what the decimal means as percent) Remember that you need to move your decimal point two places TO THE RIGHT when you attach your percent symbol. (Alternatively, you can multiply your decimal by 100%, just don't do both.) Example: 0.05678 stands for 5.678%. Give answers as percent in #3a and #3b as indicated. Payday Loans Here's how pay day loans work: A borrower writes a personal check payable to the lender for the amount the person wants to borrow, plus the fee they must pay for borrowing and dates the check in the near future (by exactly as many days as the loan is agreed upon - usually between 10 and 31 days). The company gives the borrower the amount of the check less the fee, and agrees to hold the check until the loan is due, usually the borrower's next payday. Or, with the borrower's permission, the company deposits the amount borrowed - less the foc - into the borrower's checking account electronically. The loan amount is due to be debited the next payday. The fees are substantial compared to the small loan amounts (most payday loans are between $100 and $500. The borrower is charged new fees each time the same loan is extended or "rolled over" in case the borrower needs to extend the timeline. Each time payment in full by the borrower to the company is postponed the same fee is due and the loan is only extended the same number of days that the loan was supposed to last when taken out. The Federal Trade - page 4 of 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts