Question: OXF 3.97% B D E F G H - Select two bond types out of the five you graphed above (Treasuries, A, BBB, BB and

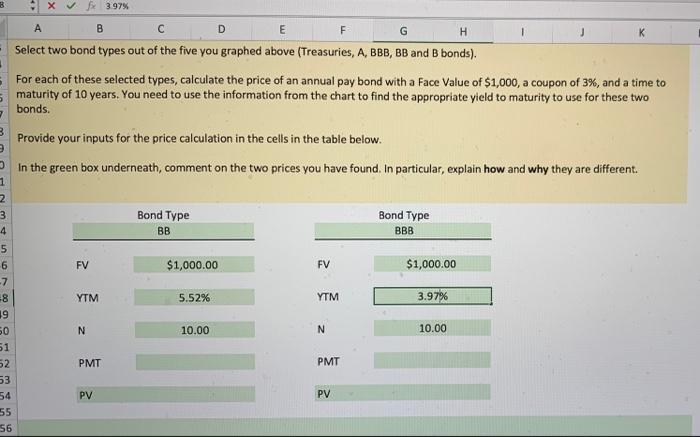

OXF 3.97% B D E F G H - Select two bond types out of the five you graphed above (Treasuries, A, BBB, BB and B bonds). For each of these selected types, calculate the price of an annual pay bond with a Face Value of $1,000, a coupon of 3%, and a time to maturity of 10 years. You need to use the information from the chart to find the appropriate yield to maturity to use for these two bonds. 3 Provide your inputs for the price calculation in the cells in the table below. In the green box underneath, comment on the two prices you have found in particular, explain how and why they are different. 7 1 2 3 4 Bond Type BB Bond Type BBB FV $1,000.00 FV $1,000.00 YTM 5.52% YTM 3.97% N 10.00 N 10.00 5 6 -7 -8 19 50 51 52 53 54 55 56 PMT PMT PV PV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts