Question: Oz Credit Bank (OCB) is currently processing an application for a 3-year interest-only loan in the amount of $7.5 million from a customer in

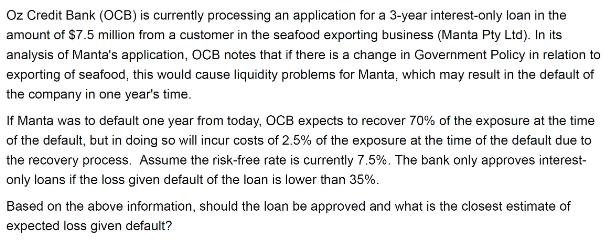

Oz Credit Bank (OCB) is currently processing an application for a 3-year interest-only loan in the amount of $7.5 million from a customer in the seafood exporting business (Manta Pty Ltd). In its analysis of Manta's application, OCB notes that if there is a change in Government Policy in relation to exporting of seafood, this would cause liquidity problems for Manta, which may result in the default of the company in one year's time. If Manta was to default one year from today, OCB expects to recover 70% of the exposure at the time of the default, but in doing so will incur costs of 2.5% of the exposure at the time of the default due to the recovery process. Assume the risk-free rate is currently 7.5%. The bank only approves interest- only loans if the loss given default of the loan is lower than 35%. Based on the above information, should the loan be approved and what is the closest estimate of expected loss given default?

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

To determine whether the loan should be approved and calculate the expected loss given default LGD w... View full answer

Get step-by-step solutions from verified subject matter experts