Question: P 1 0 - 3 ( Algo ) Comparing Bonds Issued at Par, at a Discount, and at a Premium L 0 1 0 -

PAlgo Comparing Bonds Issued at Par, at a Discount, and at a Premium L

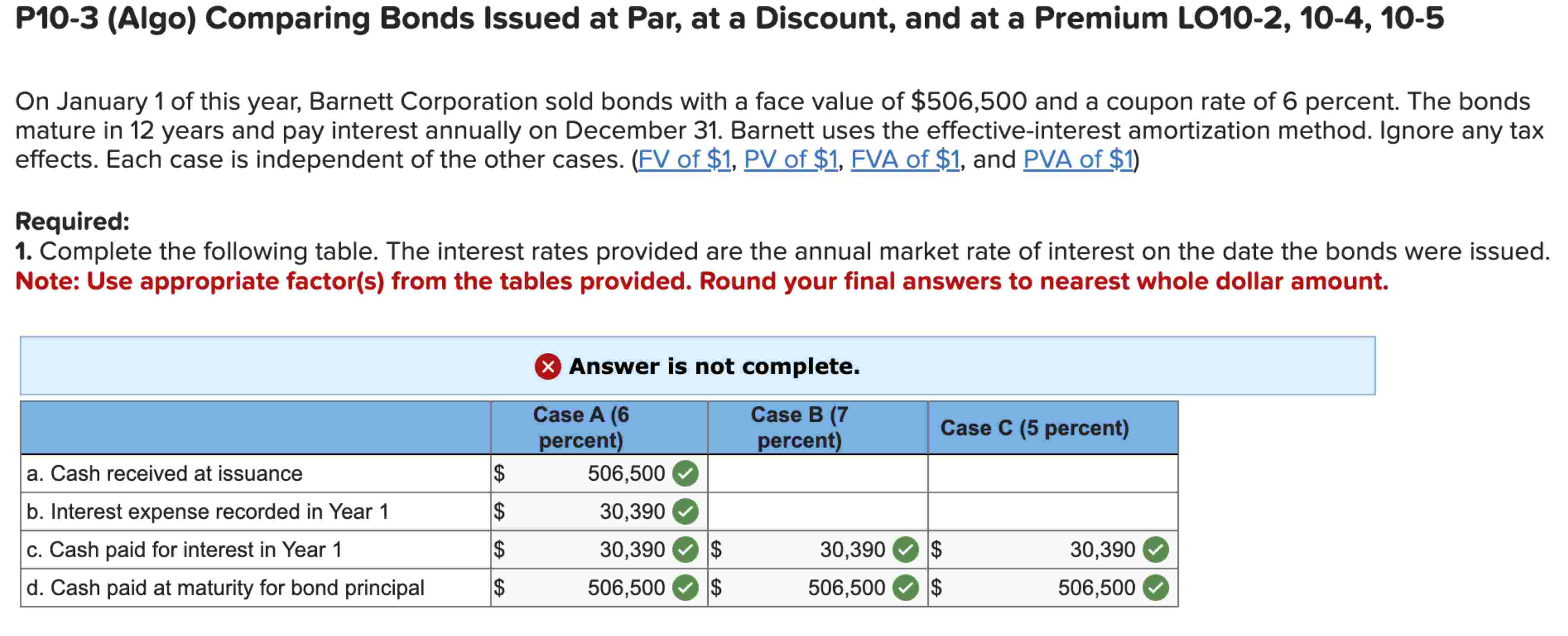

On January of this year, Barnett Corporation sold bonds with a face value of $ and a coupon rate of percent. The bonds

mature in years and pay interest annually on December Barnett uses the effectiveinterest amortization method. Ignore any tax

effects. Each case is independent of the other cases. FV of $ PV of $ FVA of $ and PVA of $

Required:

Complete the following table. The interest rates provided are the annual market rate of interest on the date the bonds were issued.

Note: Use appropriate factors from the tables provided. Round your final answers to nearest whole dollar amount.On January of this year, Barnett Corporation sold bonds with a face value of $ and a coupon rate of percent. The bonds

mature in years and pay interest annually on December Barnett uses the effectiveinterest amortization method. Ignore any tax

effects. Each case is independent of the other cases. FV of $ PV of $ FVA of $ and PVA of $

Required:

Complete the following table. The interest rates provided are the annual market rate of interest on the date the bonds were issued.

Note: Use appropriate factors from the tables provided. Round your final answers to nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock