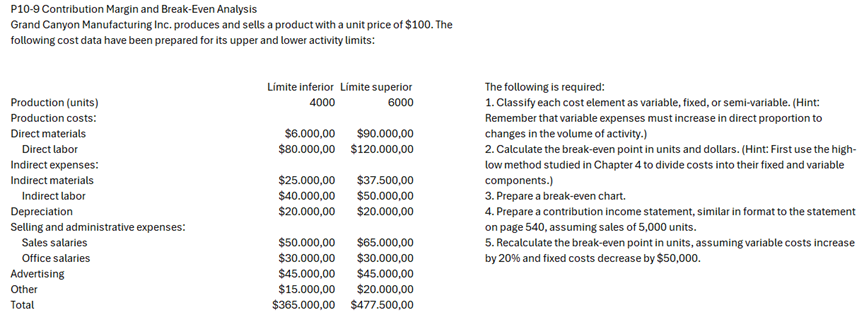

Question: P 1 0 - 9 Contribution Margin and Break - Even Analysis Grand Canyon Manufacturing Inc. produces and sells a product with a unit price

P Contribution Margin and BreakEven Analysis Grand Canyon Manufacturing Inc. produces and sells a product with a unit price of $ The following cost data have been prepared for its upper and lower activity limits: Lmite inferior Lmite superior Production units Production costs: Direct materials $ $ Direct labor $ $ Indirect expenses: Indirect materials $ $ Indirect labor $ $ Depreciation $ $ Selling and administrative expenses: Sales salaries $ $ Office salaries $ $ Advertising $ $ Other $ $ Total $ $ The following is required: Classify each cost element as variable, fixed, or semivariable. Hint: Remember that variable expenses must increase in direct proportion to changes in the volume of activity. Calculate the breakeven point in units and dollars. Hint: First use the highlow method studied in Chapter to divide costs into their fixed and variable components. Prepare a breakeven chart. Prepare a contribution income statement, similar in format to the statement on page assuming sales of units. Recalculate the breakeven point in units, assuming variable costs increase by and fixed costs decrease by $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock