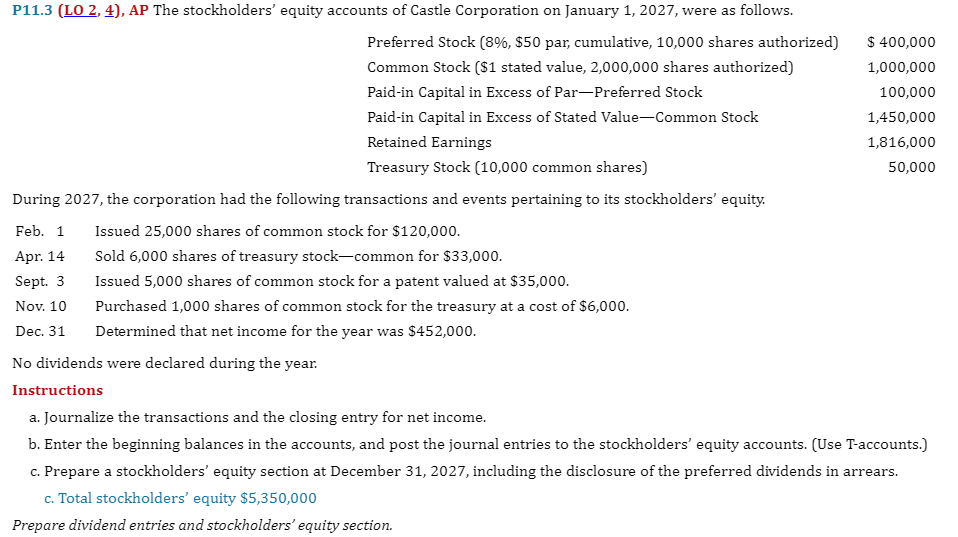

Question: P 1 1 . 3 ( LO 2 , 4 ) , AP The stockholders equity accounts of Castle Corporation on January 1 , 2

PLO AP The stockholders equity accounts of Castle Corporation on January were as follows.

Preferred Stock $ par, cumulative, shares authorized $

Common Stock $ stated value, shares authorized

Paidin Capital in Excess of ParPreferred Stock

Paidin Capital in Excess of Stated ValueCommon Stock

Retained Earnings

Treasury Stock common shares

During the corporation had the following transactions and events pertaining to its stockholders equity.

Feb. Issued shares of common stock for $

Apr. Sold shares of treasury stockcommon for $

Sept. Issued shares of common stock for a patent valued at $

Nov. Purchased shares of common stock for the treasury at a cost of $

Dec. Determined that net income for the year was $

No dividends were declared during the year.

Instructions:

Journalize the transactions and the closing entry for net income.

Enter the beginning balances in the accounts, and post the journal entries to the stockholders equity accounts. Use Taccounts.

Prepare a stockholders equity section at December including the disclosure of the preferred dividends in arrears.

Total stockholders equity $

Prepare dividend entries and stockholders equity section.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock