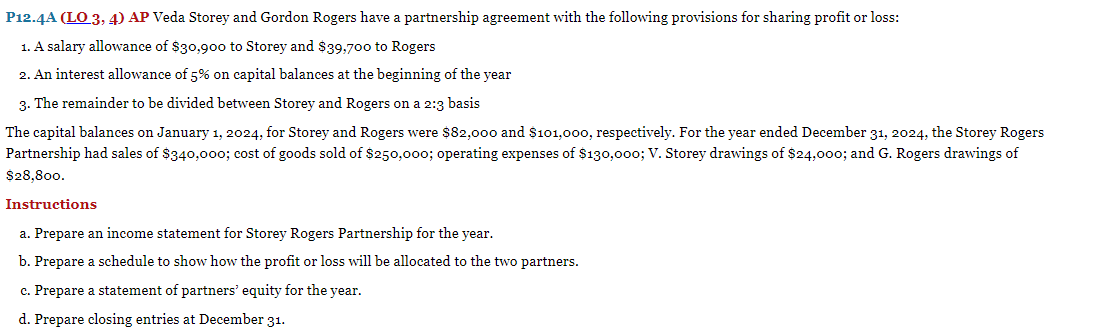

Question: P 1 2 . 4 A ( LO 3 , 4 ) AP Veda Storey and Gordon Rogers have a partnership agreement with the following

PA LO AP Veda Storey and Gordon Rogers have a partnership agreement with the following provisions for sharing profit or loss:

A salary allowance of $ to Storey and $ to Rogers

An interest allowance of on capital balances at the beginning of the year

The remainder to be divided between Storey and Rogers on a : basis

The capital balances on January for Storey and Rogers were $ and $ respectively. For the year ended December the Storey Rogers

Partnership had sales of $; cost of goods sold of $; operating expenses of $; V Storey drawings of $; and G Rogers drawings of

$o

Instructions

a Prepare an income statement for Storey Rogers Partnership for the year.

b Prepare a schedule to show how the profit or loss will be allocated to the two partners.

c Prepare a statement of partners' equity for the year.

d Prepare closing entries at December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock