Question: P 1 7 . 7 ( L 0 1 , ( underline { mathbf { 2 } } , underline {

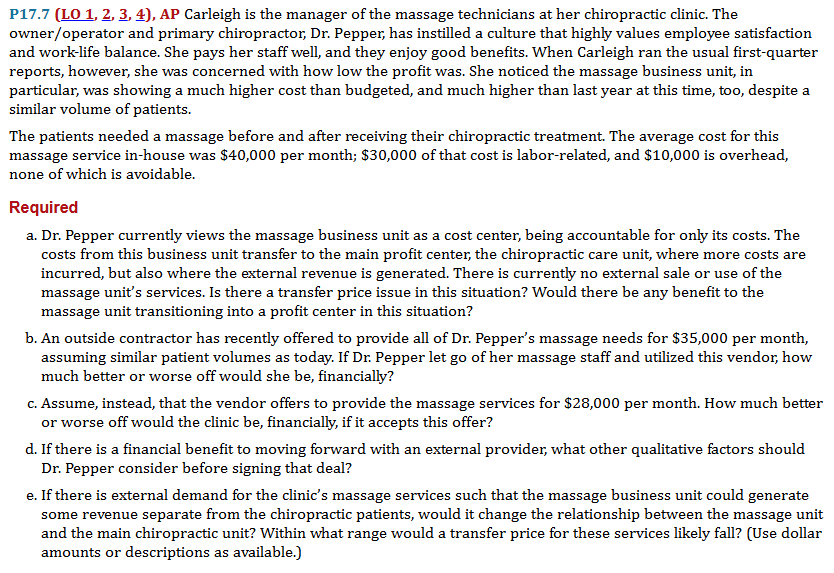

PLunderlinemathbfunderline AP Carleigh is the manager of the massage technicians at her chiropractic clinic. The owneroperator and primary chiropractor, Dr Pepper, has instilled a culture that highly values employee satisfaction and worklife balance. She pays her staff well, and they enjoy good benefits. When Carleigh ran the usual firstquarter reports, however, she was concerned with how low the profit was. She noticed the massage business unit, in particular, was showing a much higher cost than budgeted, and much higher than last year at this time, too, despite a similar volume of patients. The patients needed a massage before and after receiving their chiropractic treatment. The average cost for this massage service inhouse was $ per month; $ of that cost is laborrelated, and $ is overhead, none of which is avoidable. Required a Dr Pepper currently views the massage business unit as a cost center, being accountable for only its costs. The costs from this business unit transfer to the main profit center, the chiropractic care unit, where more costs are incurred, but also where the external revenue is generated. There is currently no external sale or use of the massage unit's services. Is there a transfer price issue in this situation? Would there be any benefit to the massage unit transitioning into a profit center in this situation? b An outside contractor has recently offered to provide all of Dr Pepper's massage needs for $ per month, assuming similar patient volumes as today. If Dr Pepper let go of her massage staff and utilized this vendor, how much better or worse off would she be financially? c Assume, instead, that the vendor offers to provide the massage services for $ per month. How much better or worse off would the clinic be financially, if it accepts this offer? d If there is a financial benefit to moving forward with an external provider, what other qualitative factors should Dr Pepper consider before signing that deal? e If there is external demand for the clinic's massage services such that the massage business unit could generate some revenue separate from the chiropractic patients, would it change the relationship between the massage unit and the main chiropractic unit? Within what range would a transfer price for these services likely fall? Use dollar amounts or descriptions as available.

Only need help with part b and c

For part b I know the company would be worse off, but Im not sure by how much.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock