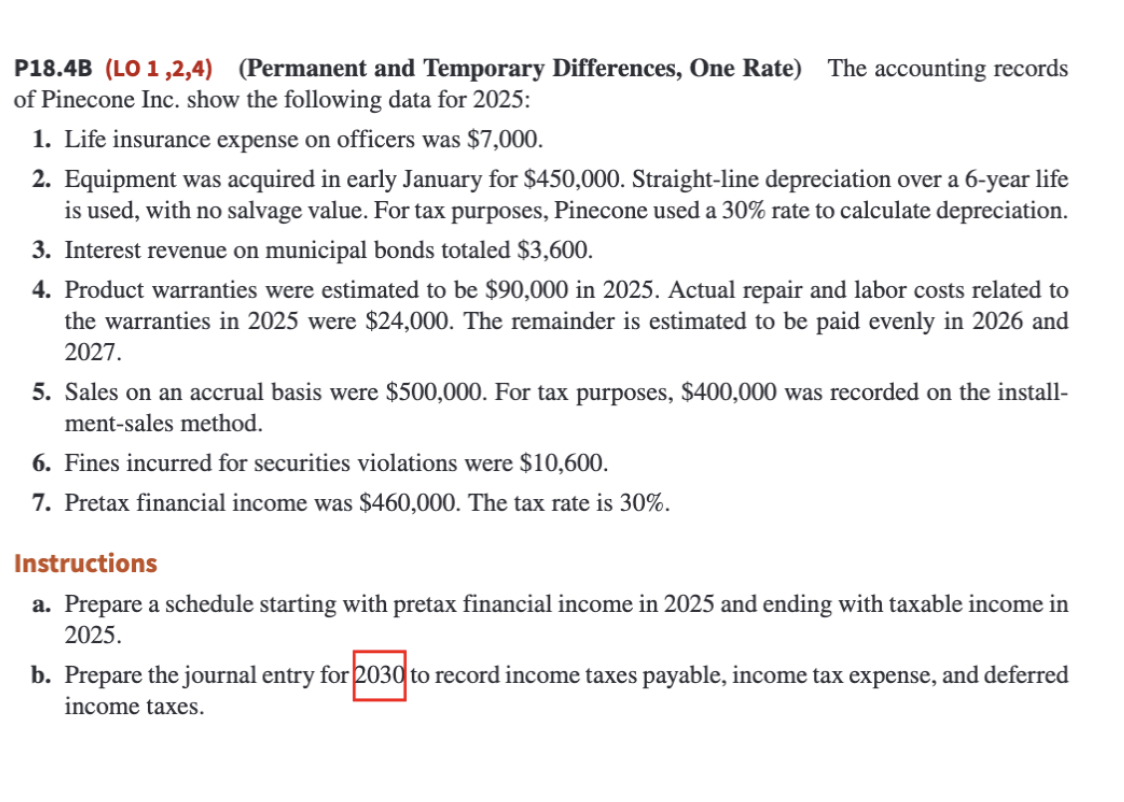

Question: P 1 8 . 4 B ( LO 1 , 2 , 4 ) ( Permanent and Temporary Differences, One Rate ) The accounting records

PB LO Permanent and Temporary Differences, One Rate The accounting records of Pinecone Inc. show the following data for :

Life insurance expense on officers was $

Equipment was acquired in early January for $ Straightline depreciation over a year life is used, with no salvage value. For tax purposes, Pinecone used a rate to calculate depreciation.

Interest revenue on municipal bonds totaled $

Product warranties were estimated to be $ in Actual repair and labor costs related to the warranties in were $ The remainder is estimated to be paid evenly in and

Sales on an accrual basis were $ For tax purposes, $ was recorded on the installmentsales method.

Fines incurred for securities violations were $

Pretax financial income was $ The tax rate is

Instructions

a Prepare a schedule starting with pretax financial income in and ending with taxable income in

b Prepare the journal entry for to record income taxes payable, income tax expense, and deferred income taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock